US Trade Deficit Stabilizes as Post-Tariff ‘Front-Loading’ Fades

US trade deficit rebounded to USD 56.8 billion in November after recording a USD 29.2 billion shortfall, the smallest monthly since 2009, in the previous month, the US Census Bureau reported Thursday.

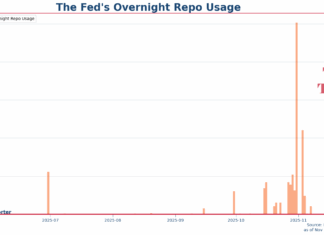

Why the Fed’s Standing Repo Facility Isn’t for Daily Use: An Explainer

"The [Standing Repo Facility (SRF)] rate is set at the top of the FOMC’s target range for the federal funds rate. This combination of an ample supply of reserves and an SRF rate at the top of the target range reduces the day-to-day reliance on the facility except during periods of significant upward pressure on rates resulting from strong liquidity demand or market stress," said John Williams

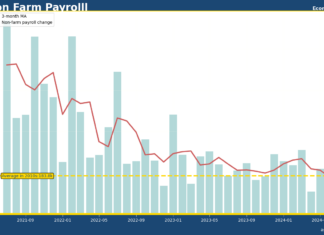

US payroll growth in Jan beats expectations

US nonfarm payroll increased 353,000 and Unemployment rate as 3.7% in January

The Most Important Question Jay Powell Need to Answer – Where is the Saturated...

The most important question for the 30th Jan Fed meeting balance sheet policy, because it is also most underrated by the market.

Why FOMC mulling to cut ON RRP rate by 5 bps?

A relatively unexpected discussion among Federal Reserve officials during November FOMC meeting was that "some" committee members suggested a future consideration of lowering the ON RRP facility rate by 5 basis points. Why are they talking about that?

OECD governments borrowing expected to hit record $11tn

Gross borrowing of OECD governments from the markets is set to surpass $11tn this year. This would be a new record, above the current record of $10.9 trillion set in 2010.

Japan exports (Dec 2018) recorded largest fall in two year

Japanese exports record a year-on-year drop of 3.8% in December 2018, the most substantial shrinkage since October 2016.

US nonfarm payroll beats expectations in June amid signs of cooling off

US nonfarm payroll increased by 206,000 in June, beating market expectation of 190,000, amid signs that job growth in cooling off as the the Bureau of Labor Statistics revised down the May and April by a combined 111,000 in its report released Friday.

Most of China’s Foreign Currency Credit are in USD

According to the data from BIS global liquidity indicators, as of September 2018, most foreign currency credits to China is still denominated with US dollar.

Fed to let Bank Term Funding Program expires on March 11

The US central bank also made an adjustment of the program's terms, setting minimum interest rate level at the interest of reserve balance, effective immediately, to block an arbitrage opportunity that banks have been taking advantage of.