ECB has published the December 2018 SESFOD (survey on credit terms and conditions in euro-denominated securities financing and OTC derivatives markets) results.

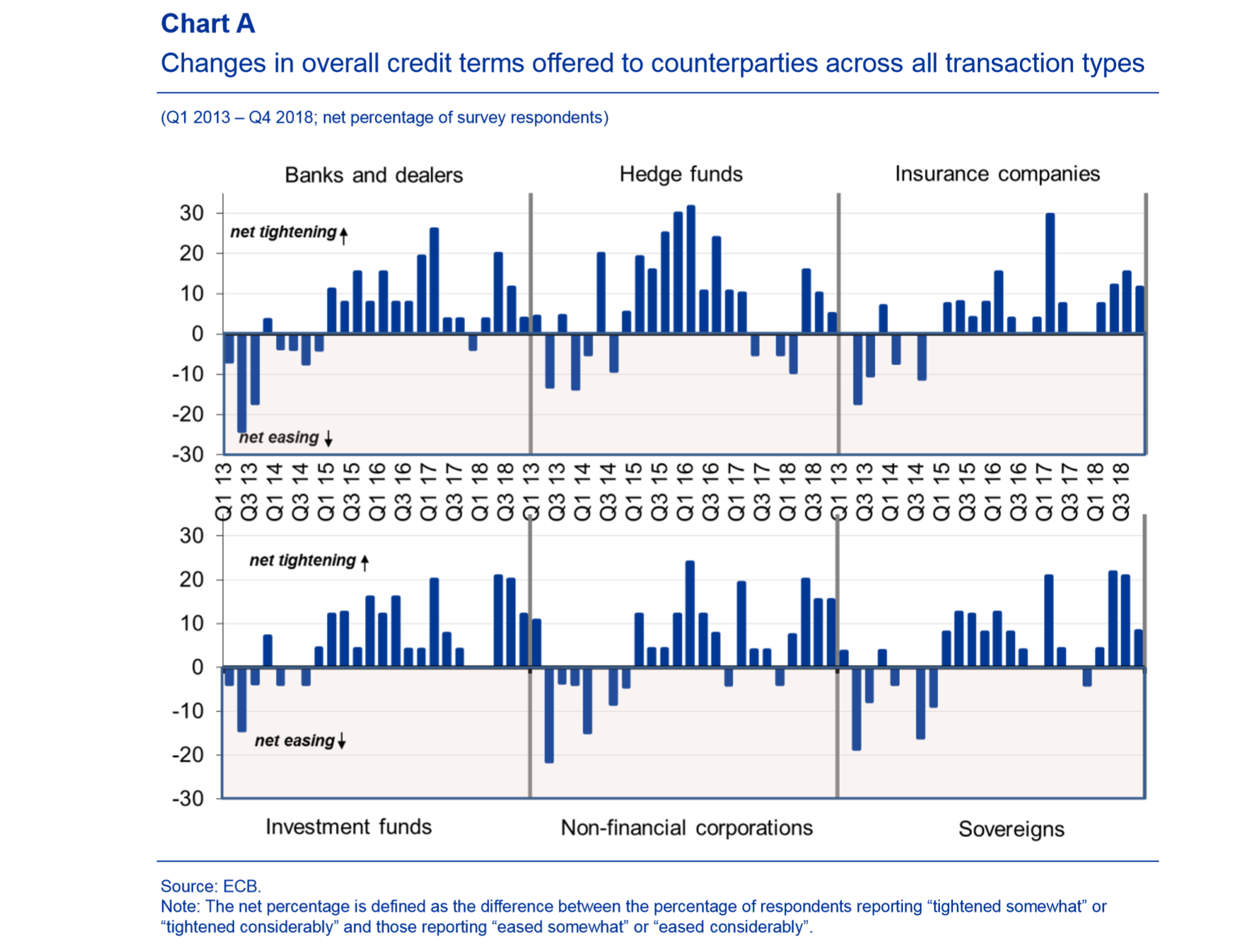

The latest SESFOD shows that the credit terms offered to counterparties for both securities financing and OTC derivative transactions is further tightened.

Deterioration in general market liquidity and functioning, competition from other institutions, and the availability of balance sheet capacity were the factors most frequently cited by respondents who reported a tightening in credit terms and conditions.

Other factors mentioned were a willingness to take risks and the change in internal treasury charges. Changes in central counterparties’ (CCPs) practices, including margining and haircuts, contributed to a further tightening of conditions for both securities financing and OTC derivative markets, according to 12% of respondents.