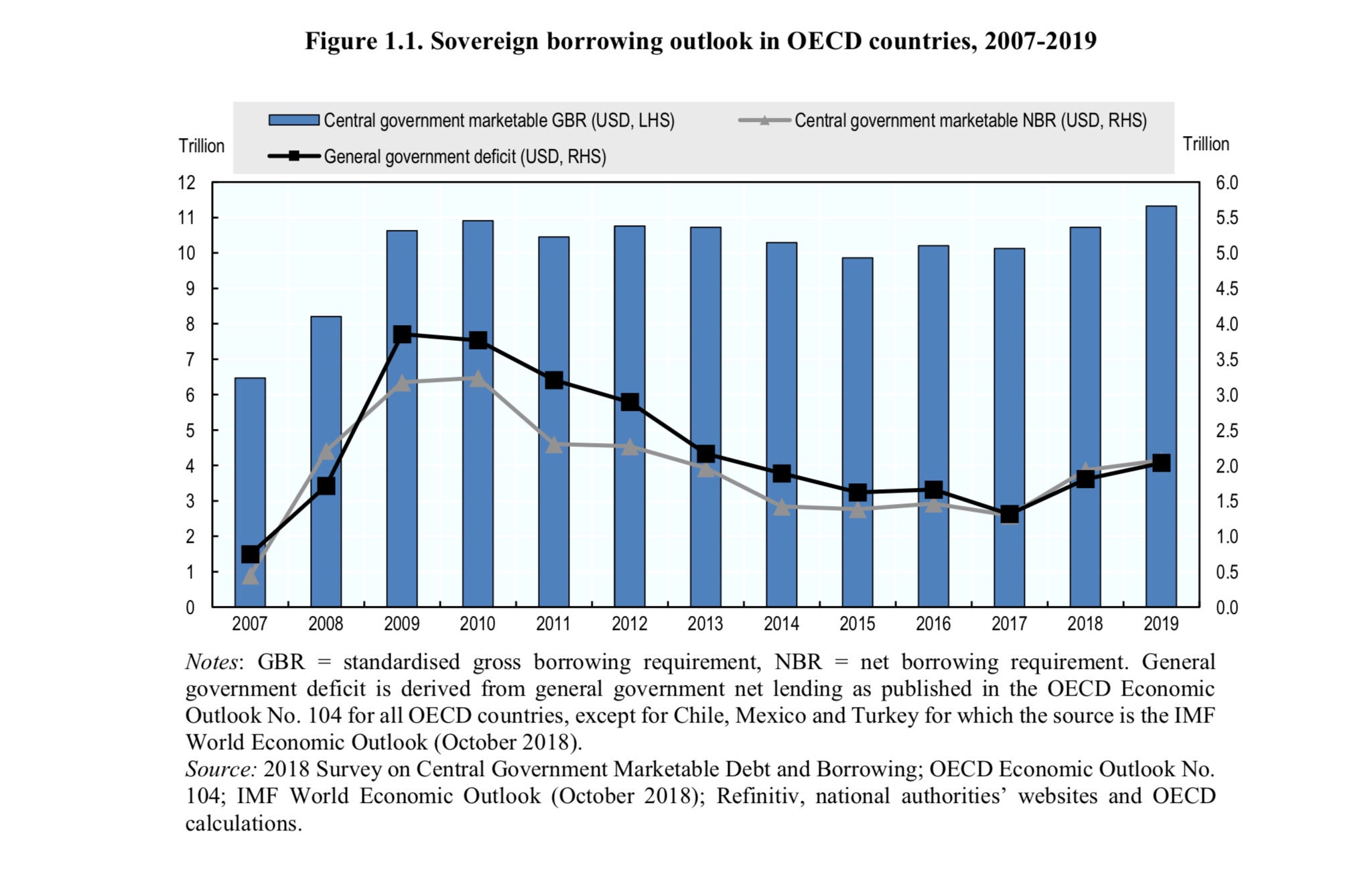

Gross borrowing of OECD governments from the markets is set to surpass $11tn this year. This would be a new record, above the current record of $10.9 trillion set in 2010.

Gross borrowing includes not only new bonds issued on capital market, but also the existing debt that is being rolled over.

According to the OECD Sovereign Borrowing Outlook, outstanding government debt for the 34 members of the OECD doubled between 2007 and 2018, also the debt-to-GDP ratio rose from 49.5 % to 72.6% during the period.

New debt issuance of OECD governments rose to $1.9 trillion last year, up from $1.3 trillion in 2017, the lowest level since the financial crisis. The new issuance is projected to rise further to exceed $2 trillion this year, the OECD said.

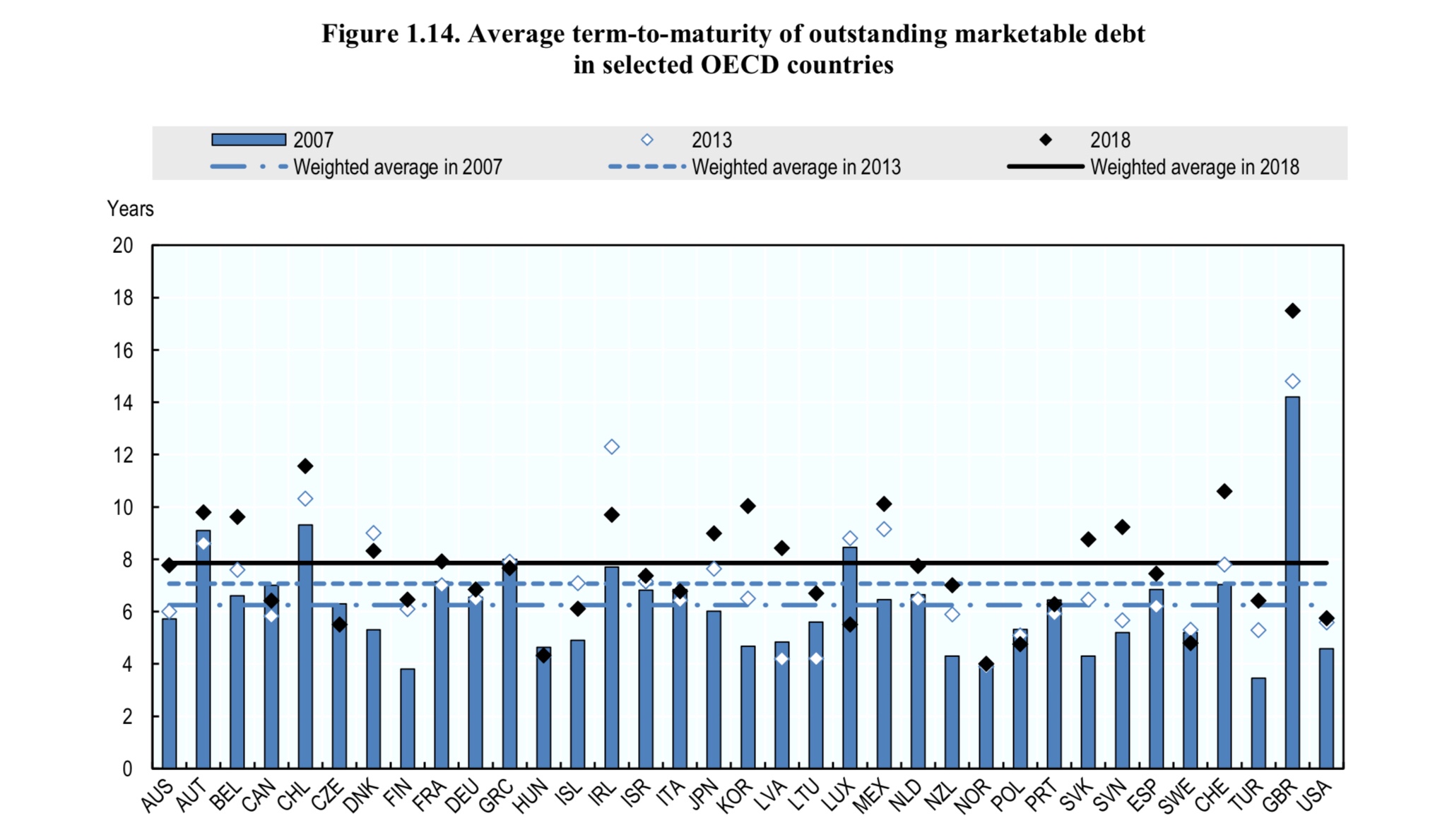

Although the government borrowing is increasing, the report mentioned that over the past decade, the composition of government financing in the OECD area has tilted towards long-term fixed rate financing instruments.

The average-term-to-maturity of outstanding marketable debt has increased considerably and reached almost 8 years in 2018, which implies a slower pass-through of changes in market interest rates to government interest costs. It has resulted in more resilient debt portfolios.

You can find the OECD Report here.