Last Updated:

This is the latest installment of our interview series “Where is the General Theory of the 21st Century?”. “Where is the General Theory of the 21st Century?” is an interview series that explore the evolution of macroeconomics academia since the Great Recession. Do we have some revolutionary changes in the macroeconomics after 2008, just like we have had the “Keynesian Revolution” after the Great Recession? Why haven’t economists come up with a new General Theory after the Great Recession? We ask influential economists for their answers on these questions.

The honorable guest for this installment is Atif Mian, Theodore A. Wells ’29 Professor of Economics and Public Affairs at Princeton University, and Director of the Julis-Rabinowitz Center for Public Policy and Finance at the Woodrow Wilson School. Professor Mian has done a lot of excellent works on the connections between finance and the macroeconomy.

One of his most important work is the critically acclaimed book, House of Debt, which he coauthored with Professor Amir Sufi. In the book, and a series of research prior to the book, they explain why debt continues to threaten the global economy, and what needs to be done to fix the financial system. In our opinion, it is fair to say this series of research embarked certain major changes in macroeconomics since the Great Recession.

In this interview, Professor Mian will first discuss if there are any “revolutionary” changes happened in macroeconomic academia since the Great Recession. In the second part of the interview (to be published soon), we will further discuss his recent research paper “Household Debt and Business Cycles World Wide”, and the important implications of that paper.

(The interview is edited for clarity. All mistakes are ours.)

Q: Econreporter M: Atif Mian

Q: Do you think there are any “revolutionary” changes in Macroeconomics after the Great Recession, like the Keynesian Revolution in the 1930s?

M: Yes, I think there has been a major shift in macroeconomics thinking which is largely driven by the events of the 2008 financial crisis in the US and elsewhere. I would like to think of this shift as essentially a realization that credits and financial markets, in general, are a lot more important for understanding the huge macroeconomic destructions that we saw in 2008 and the global business cycles situation.

Let’s dive into that a bit more. I think it’s useful to remember that post-1980s, there were certain secular macroeconomic trends. These trends are relevant for what I am going to discuss later.

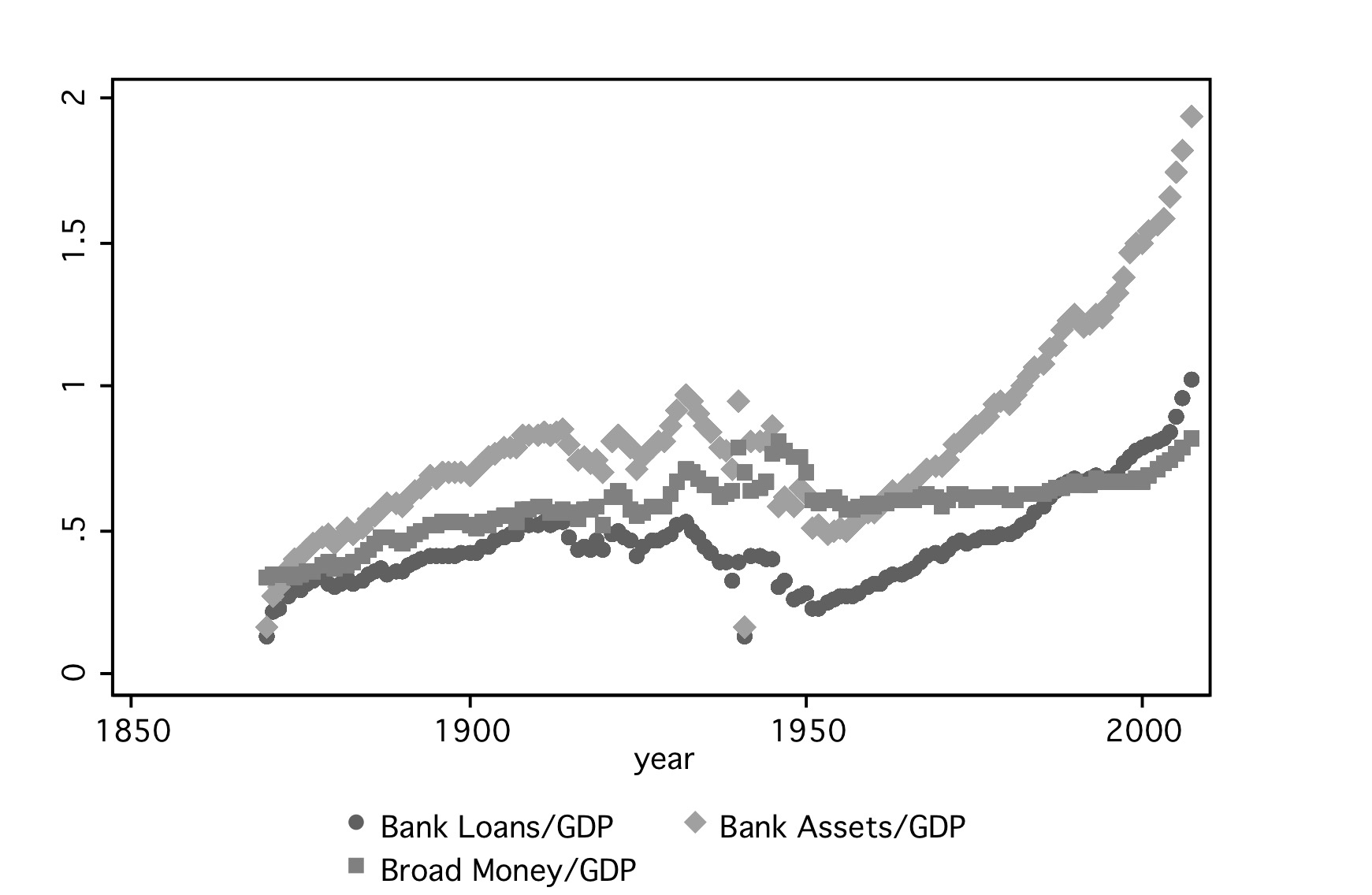

The first one is the rapid increase in the size of the financial sector globally. Another way to say the same thing is that there has been a large increase in Credit-to-GDP ratio, by historical standard. A very nice work by Oscar Jorda, Moritz Schularick, and Alan M. Taylor [When Credit Bites Back: Leverage, Business Cycles, and Crises] which shows that when using a long time series, there has been a large increase in Credit-to-GDP, especially post-1980s. It is not just a US phenomena but it has happened globally.

The second related thing that they’ve pointed out is that the increase in Credit-to-GDP is disproportionately driven by the household and the housing sector. Typically, when we think of the models of credit market, we think of the case that savers are putting money in the banks, and the banks are lending that money out to firms, then the firm use that capital for business expansion. What their work basically shows, on a broad level, is that that view is not really an accurate description of what banks have actually been doing in the last 3-4 decades. What explains the large increase in credit is the fact that they have been lending to the household sector. A large part of that is driven by lending for home buying, which is mortgage lending essentially. That is one important fact in the background.

Another useful fact to keep in mind also starts from the 1980s. There has been the continual decline in the long-term interest rate. They continue to go down from 1980 onward, until they kind of hit zero in the Great Recession. Then we had this sort of the zero lower bound monetary policy constraint, then quantitative easing and all that. These are the two big trends which are useful to keep in mind and I will try to come back to them.

So, how has the macroeconomics shifted since 2008? In one important way which macroeconomics has shifted is the realization that there is a close connection between credits and the real economy. However, to a large extent, that realization was always there. For example, very influential and seminal works by Ben Bernanke, Mark Gertler, and Simon Gilchrist [The Financial Accelerator in a Quantitative Business Cycle Framework], or Nobu Kiyotaki and John Moore [Credit Cycles], among others.

All of this influential literature were already building the connections. However, the focus of all of these linkages has largely been on connecting credit to the macroeconomy on the firm side. Credits are important for investment, firms need to borrow and that the borrowing channel can potentially be constrained at times, that is kind of what give us the boom-and-bust-cycle — through the credit channel. That’s how that literature kind of developed during the 80s, 90s and so on.

Since 2008 there is an additional realization that household credits are actually very important for understanding the modern business cycle. The channels to which household credits impact the real economy are actually quite distinct from the channel to which credits to firms might impact the business cycle. At the crude level, you can think of that as the credit to household affecting the macroeconomy through the demand-side of the economy. Because the credit goes to the households who would then use it to buy the house that they couldn’t buy before; or a new automobile, new TV; or using the credit card to buy household items. The way household credits impact the economy is essentially on the demand-side. It shifts the aggregate demand curve in macroeconomics lingo. In the more traditional way of thinking about credit in the macroeconomy, the “credit to the firm” story, credits are typically used for investment and building capital. The key distinction is that the capital is affecting the macroeconomy on the aggregate supply side. So that is a really different view of how credits impact the real economy.

Coming back to what I think is the big shift in macroeconomics thinking, it is, again, the realization that credit is very important in influencing the business cycle through its effect on the demand-side. Now let me dive into it a little deeper by pointing out the theoretical and empirical works that have made this connection.

On the empirical side, the works that I have done with Amir Sufi on the Great Recession in the US kind of highlighted this particular channel. The leveraging up in the household sector is actually a very important factor in understanding why the recession was as deep as it was in the US. There are also some other works on the Europe that have shown a very similar pattern there.

For example, if you compare the so-called peripheral countries in Europe, for example, Spain, Greece, and Ireland among others, versus the core countries, Germany and France in particular, you find the important difference that the peripheral economies went through this kind of boom-and-bust-cycle. A lot of the credit was used to fund the household sector and housing sector. It’s a very good predictor of this boom-bust-cycle that we observed in peripheral countries.

In the second half of this interview, I will come to the new paper which we have kind of shows that this pattern is absolutely not only limited to the 2008 crisis globally. It’s actually a more pervasive phenomenon that we have been observing globally since the 1930s onwards.

The second development is on the theoretical side. There have been very nice theoretical insights that have been developed, showing that this kind of household credit cycle. I think the first paper that came out, very early on during the crisis, was by Gauti Eggertsson and Paul Krugman [Debt, Deleveraging, and the Liquidity Trap], where they highlighted how the high level of household debt can drive a demand-driven recession in an environment where policymakers are constrained. In particular, when the monetary policy is constraining how much you can react to the recessionary events. In their model, it is essentially the zero lower bound constraint, that we can’t reduce the interest rate below a certain level. This monetary policy constraint or fiction drives the economy into recession in the presence of high level of debt because the households who have borrowed previously are forced to cut back on their spending or consumptions. That lowers the aggregated demand. You can’t compensate for that reduction in demand by lowering the interest rate by making monetary policy boost demand, so the economy dips into a recession.

That was the initial Eggertsson and Krugman insight but there has been a series of papers since then that have expanded on that. There is the work by Emmanuel Farhi and Ivan Werning [A theory of macroprudential policies in the presence of nominal rigidities], and another work by Martin Uribe and Stephanie Schmitt-Grohe [Downward Nominal Wage Rigidity, Currency Pegs, and Involuntary Unemployment], as well as others. They have sort of taken these arguments and push them forward.

One important additional insight in these works is that there is an important aggregate demand externality in the area of household credit. In particular, when people are deciding how much to borrow in “normal period”, i.e. during the credit booms, they will tend to ignore the aggregated demand externality. As a result, they over-stretch themselves in a macroprudential perspective.

The aggregated demand externality is driven by the feature of the economy that I’ve described earlier. There is the monetary policy fiction or other kinds of fictions like downward wage rigidity. The individual agents don’t properly take into account fictions of that sort when they are deciding how much to borrow during the boom of the credit cycle. As a result, from a macro-prudential perspective, they have the tendency to over-stretch themselves. That necessitated the macro-prudential policy. That’s one important insight that has come along in this literature.

Along with this insight, there are a couple of others related channels that also tends to amplify the macroeconomic impact of the credit cycle. The first one is the more traditional Pecuniary Externalities, the amount that people can borrow is linked to, for example, the price of the house or some assets. The same boom-bust-cycle is actually driven by, according to the Kiyotaki and Moore’s intuition, the feedback between the asset prices and borrowing. That exemplified the kind of household credit demand-side driven boom-bust cycle that I’ve talked about.

A very related channel is more on the behavioral side. Research papers by Andrei Shleifer and others have argued that there can be certain behavioral limitations of the agents. For example, they might be subjected to extrapolative expectations. When you have those kinds of, say, “error” in your expectation formation, that can further amplify this kind of cycle.

To summarize, these have been an important major shift in macroeconomics thinking, which is credits is a lot more important to understanding the business cycle and in particular household credit influences the business cycle through its impact on the demand side.

The other important longer-run theme that I’ve talked about was the longer-run decline in the interest rate since the 1980s. I think now we have a better understanding of the theoretical link between household credit and the economy. One can also start to see a potential link between this growth in household credits and the decline in long-term interest rate since the 1980s.

One way to rationalize that link is that the global economy has had the demand gaps. Policymakers in all the economies, in general, has the tendency to correct it by lowering the interest rate and try to boost aggregate demand. The way that channel has operated over time is essentially through the credit market or the financial sector. However, that particular global cycle came to a halt in 2008 because the interest rate could not go any lower. This kind of put a lid on how much household credits could grow.

Q: In the series of research leading to your book “House of Debt”, you and Prof. Amir Sufi adopted several innovative empirical methods, for example, Zip Code data analysis and heterogeneous agents. We also see that these methods are more widely used after the Great Recession. Do you agree that macroeconomics should be more empirics-based, especially focusing on micro-level data you have used?

M: Yes. Through the argument of revealed preference, you already told my answers. [Laughter]

In my own works, I have extensively used the more micro-level data to tackle some of the more traditional macroeconomic questions. I think it is very important in general. It led us to some very useful insights that are otherwise hard to obtain through the more traditional aggregate theories and analyses within macroeconomics.

Since we have talked about the shifts in macroeconomics thinking in general, I think that’s another shift that has taken place since 2008. On the methodological side, these are the realization that these more granular micro-level data is very useful in addressing the harder macroeconomic questions that we have had difficulty addressing in the past. Let me just push that agenda a little bit further by giving you one example of how these works have made the impact.

The effective monetary policy on the real economy is an age old, yet very important question in macroeconomics. There have been different ways to looking at that. For example, the VAR methodology, using time-series data to attack this particular question. That work has been important in distilling and different ideas.

But it faces a natural limit because when we are just using the aggregate time-series data, one has difficulties in thinking through the cause and effect issues. For example, the Fed might very well be changing its policy in anticipation of events that it sees on the horizon in the near term. Because of that potential feedback between monetary policy today and its short-term expectations of where the economy is going, it fundamentally becomes a very difficult exercise to tease apart how the Fed influences the real economy directly.

However, if one uses more heterogeneous data in the cross-section, you can start getting a better understanding of how the monetary policy impacts the economy. Recently, there has been a bunch of work that has done that. That’s a very exciting development in macroeconomics in general.

For example, there is a paper by Amir Kirmani, M.Di Maggio, B.J.Keys, T.Piskorski, R. Ramcharan, A.Seru, and V.Yao, coming out in the American Economic Review [Monetary Policy Pass-Through: Mortgage Rates, Household Consumption and Voluntary Deleveraging] [note](Conditionally accepted by the American Economic Review)[/note], it uses the variations in the cross-section in the interest rates that different individuals faced. In particular, they explore the variations in the mortgages which people have.

Some people have the 5-year adjustable rate mortgages (ARMs), others have the 7-year ARMs. Let’s say that the mortgages started in 2005. When 2010 comes, in the middle of the slowdown, those with the 5-year ARMs would get the interest rate reduction because the mortgages reset to a lower rate automatically. They get this reduction in the interest rate that the Fed was trying to pass through to the individual households. But those individuals who have a 7-year ARMs still have to wait for 2 additional years before they get a lower interest rate.

By taking advantage of this kind of variation in the cross-section, they can actually show the impact of the reduction in interest rate for the 5-year ARMs owners, by comparing them to the 7-years ARMs owners who didn’t receive the same reduction in interest rate just because they have a different kind of financial contract. What they’ve shown with this kind of analysis is that a reduction interest rate is actually beneficial. It actually allows the lenders to boost their spending and improves local economic outcome, in term of employment and aggregate demand. That’s just one example that actually shows monetary policy can be effective.

At the same time, that same work also shows why the monetary policy was ineffective. If you think about it, you need to be able to pass through the action of the Fed to the ultimate households. However, if people are struck in the 30-year fixed rate mortgages, they would not be able to take advantage of this lower interest rate environment. As a result, monetary policy is not able to pass through to the ultimate households. It is going to be constrained in the effectiveness. That’s a very important insight that has come about because of this kind of work that I emphasized. That’s a very interesting and useful development.

If people have borrowing capacity and willing to borrow, the same monetary policy shock can have more impact on the real economy. When you lower interest rate, for people who are prone to borrow more, they can borrow aggressively against a lower interest rate and that boosts the economy.

But if the same individuals have already borrowed a lot in the down-cycle, you can lower the interest rate but those individuals are underwater. They can’t borrow any more. Then the same reduction in interest rate is not going to have much of an impact on the macroeconomy. This kind of logic also suggests that monetary policy itself is going to be insufficient in dealing with the downturn. You need to focus on something that Sufi and I have to try to emphasize in our book.

You need to focus on other tools. In particular, the design of these mortgage contracts. We need to put in place certain contingency where the contracts can automatically adjust to, just as in the adjustable rate example that I gave you.

These automatic modifications of the mortgage contracts become very important in the event of major disruptions. We do believe that for all the reasons that I have tried to explain in this conversation, from a macroprudential perspective, it’s important that we take seriously about the financial contracts. We should have these built-in contingencies where they have the tendency to self-adjust in the event of a downturn. It is very important to pass through the monetary policy shocks to the indebted homeowners in the event of a downturn.

Atif Mian explains How Household Debt affect the Global Business Cycles | #WITGT21 Interview Series |

This is the latest installment of our interview series ” Where is the General Theory of the 21st Century?”. “Where is the General Theory of the 21st Century?” is an interview series that explore the evolution of macroeconomics academia since the Great Recession.

Part II of the interview, where Professor Mian will further discuss his recent research paper “Household Debt and Business Cycles World Wide”.

Photo Credit: World Economic Forum

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡