Cloud Y

Trump appointees will get Fed board majority when Powell is gone – and it...

Trump-appointed Fed governors will hold a board majority by the time Powell steps down as a governor. And that could matter a lot.

Hong Kong soaks up HKD 30 billion from interbank market to defend currency peg

Hong Kong Monetary Authority (HKMA) intervened twice in the foreign exchange market on Thursday (July 3) to soak up a total of HKD 29.6 billion from the city's interbank liquidity market, as HKD exchange rate fell toward the weak end of its official trading band.

‘Unusually low’ Hong Kong interest rate is a policy choice*

A careful study of Hong Kong's currency peg that explain why the current low-interest rate environment can be interpreted as a result of the Hong Kong Monetary Authority's policy choice.

Shadow Fed Chair — and Powell’s nuclear option to counter it

President Trump's plan to install a "Shadow Chair" months before Jerome Powell's term ends will definitely reshape US monetary policy — but it could face a surprising challenge from Powell himself.

Why is the Hong Kong-US interest rate spread so persistent? — Currency peg in...

A spread of over 3.5 percentage points between US and Hong Kong Interest rate persisted for close to two months and so far arbitrage has failed to close the gap, leading to discussion of whether Hong Kong's Linked Exchange System is failing. This article, however, will explore some technical factors behind this interesting interest rate gap.

Hong Kong dollar amid ‘Asian Financial Crisis in reverse’ — basic explainer

An explainer on how Hong Kong Linked Exchange Rate System works, what Aggregate Balance is, and how interest rate arbitrage help maintains Linked Exchange Rate System.

Where are the endpoints of QT? Ample Reserve System vs Demand-driven Floor System

Quantitative tightening (QT)—a process central banks use to reverse years of liquidity creation from quantitative easing (QE)—is concluding in many advanced economies. The central banks are growing confident that reserve levels in their financial systems are nearing their endpoints.

Where are the endpoints of QT and what come next?

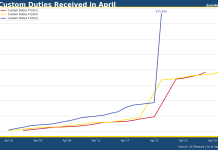

First sighting of Trump II tariff revenue surge

The US government on April 22 received USD 11.7 billion from customer duties in a single day, the first time we can observe a substantial increase in import duties revenue resulted from the new of tariff from the second Trump administration.

Should Federal Reserve use scenario analysis to handle trade war uncertainty?

The Fed is currently in a "wait and see" mode in deciding what is the reaction to Trump's trade policy. But is it possible for the Fed to be a bit more proactive than merely saying "we will be able to update you further when we know more details"?

Enters scenario analysis.

No, PPI is not a measure of wholesale inflation

A standard perception of PPI is that it is a measure of "wholesale inflation", but the BLS told EconReporter that this interpretation of PPI is not at all correct.