Cloud Y

Canadian’s average carried over credit card balances highest in 14 years, Equifax reports

The average carried over credit card balances for Canadian consumers topped CAD 4,300 in Q2, reaching the highest level since 2007, Equifax Canada said in its latest Market Pulse Consumer Credit Trends and Insights Report.

Canada inflation slows further to 2.5% in July

Inflation in Canada decreased to 2.53% at an annual basis in July according to Statistics Canada's latest report

Fed’s Daly, Kashkari support rate cut talks in September meeting

San Francisco Fed President Mary Daly and Minneapolis Fed President Neel Kashkari are both open to discussions about cutting Fed Fund Rate target at the up coming Federal Reserve meeting

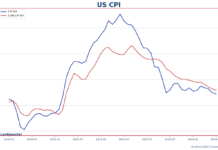

US CPI down to 2.9% in July as disinflation continues

US headline CPI down to 2.9% in July, lowest since March 2021

UK sees both unemployment rate, wage growth drop in June

Unemployment rate in the UK decreased to 4.2% at the three months to June, against a market expectation of rising from the May reading of 4.4% to 4.5%, the Office for National Statistics reported Tuesday.

Fed’s Bowman still sees ‘upside risks’ to US inflation

Federal Reserve governor Michelle Bowman is worried about reacceleration in cost of living, saying that she 'still see some upside risks to inflation'

Bank of Canada names ex-central bankers, University of Calgary professor as external experts for...

Ex-Bank of Spain Governor Pablo Hernández de Cos, ex-BoE official Kristin Forbes and Trevor Tombe, professor at the University of Calgary, will for an external expert team to conduct independent assessment on Bank of Canada's review on Covid-era exceptional actions

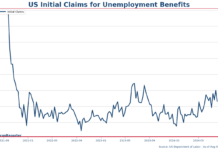

US initial jobless claims falls to 233,000, lower than expected

The number of people filed their initial claim for unemployment insurance benefits in the US fell to 233,000 in the week ending August 3.

Bank of Canada July meeting minutes reveal growing concerns on slowing labor market, consumption

Bank of Canada officials were increasingly concerned about potential risk of consumption slowdown amid growing slack in the labor market and excess supply in the economy when they cut interest rate during July 24 meeting, according to the central bank's summary of deliberations.

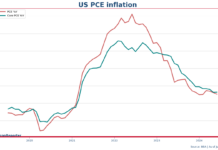

US PCE inflation drops to 2.5% as disinflationary trend continues

Inflation in the US cooled off further to 2.5% over the year to the end of June, according to the latest reading of US Bureau of Economic Analysis's PCE price index.