Cloud Y

Dallas Fed’s Logan cites neutral rate uncertainty as reason to ‘proceed cautiously’ on rate...

Lorie Logan, president of Dallas Fed, expressed worry about uncertainty surrounding the exact level of neutral rate of interest and hinted at the risk that the Federal Reserve's policy rate might already near the point which further rate may starts to fuel inflation again

Some Bank of Canada officials worried half point cut might signal economic trouble

Some Bank of Canada officials expressed worries during the last policy meeting that an "unusual" 50-basis-point might be "interpreted as a sign of economic trouble" and led to expectations of further outsized cuts, the meeting deliberations summary shows.

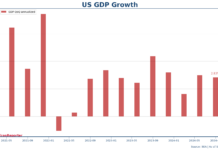

US consumers continues to drive strong GDP growth

US GDP increased by more than 2.8% at an annualized rate in Q3, supported by continued acceleration the growth of personal consumption expenditures.

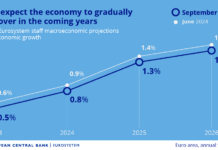

Eurozone economy shows resilience with 0.4% GDP increase in Q3

Eurozone GDP quarterly growth rate sped up to 0.4% in Q3, an upside surprise compared to an expectation of 0.2% increase, countering widespread worries that the currency bloc is sliding into economic stagnation.

Bank of Canada not sure about exact level of neutral rate, Macklem says

Bank of Canada isn't entirely sure what the country's natural rate of interest is and the central bank will have to discover it over time, said Governor Tiff Macklem.

Federal Reserve has never been this ‘confused’ about neutral rate

Federal Reserve decided to cut rate by an supersized 0.5 percentage point. The decision finally ended the weeks-long market debate of whether the central bank would cut 25 or 50 basis points. One important thing, though, didn't reach the headline: The Fed has never been this "confused" about where the natural rate should be.

Fed projects plan for front-loaded monetary easing, kicks off with 50 bps cut

The Federal Reserve lowered its fed fund rate target by 50 basis points to the range of 4.75 - 5%, with governor Michelle Bowman dissented the decision in favor of a smaller a quarter percentage point cut.

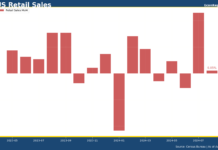

US Retail sales up just 0.1%, still beats expectations

Retail sales in the US increased just 0.05% on a monthly basis in August, down from the outsized 1.15% growth in July but still beats market expectation of -0.2%

Why Canada’s unemployment rate is rising so rapidly?

Canada's labor market has cooled down rapidly this year. Unemployment rate rose to 6.6% in August. The major issue is that the not enough job are created to digest the explosive population growth over the last few years and this integration problem is growing larger every month.

ECB cuts rate to 3.5% as it scales down growth forecast

The European Central Bank reduced the deposit facility rate, its policy interest rate anchor, by a quarter of a percentage point to 3.5%, as the central bank slightly lowered its economic growth forecast.