Canada inflation drops back to 2.7% in June

Annual inflation rate in Canada eased back to less than 2.7% in June after a upshot in the previous month, according to Statistics Canada's CPI report.

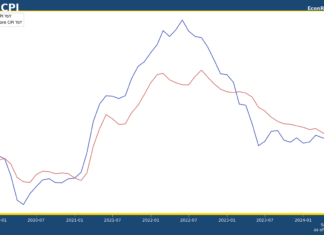

US PCE inflation holds at 2.7% in April as market expected

US PCE inflation held at 2.7% YoY in April 2024 while core inflation maintained its pace at 2.8% for the third months,

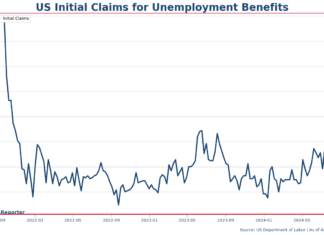

US initial jobless claims falls to 233,000, lower than expected

The number of people filed their initial claim for unemployment insurance benefits in the US fell to 233,000 in the week ending August 3.

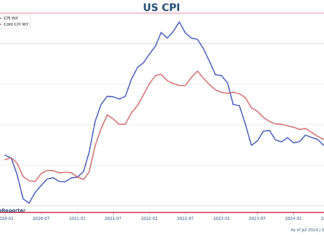

US CPI shows zero inflation in May

US CPI grew 0% in May as the yearly growth rate dropped to 3.27%; core inflation, which stripped out food and energy prices, rose 0.2% and the yearly rate decreased to 3.42%

Will QT finish before Powell’s chairman term ends?

Quantitative tightening (QT) may reach its end point "in the coming months," said Federal Reserve Chairman Jerome Powell in a speech last week.

What does it mean? Will QT finish before Powell's chairman term ends?

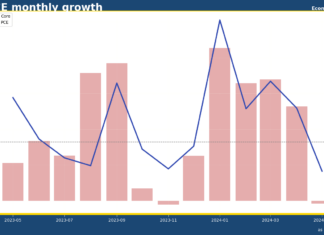

US PCE price index shows zero monthly inflation in May

US PCE price index showed 0% monthly inflation in May, bolstering market narrative that consumption sentiment has weakened in Q2 and helped easing inflationary pressure in the US economy.

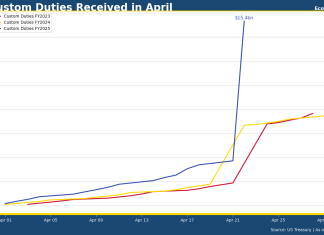

First sighting of Trump II tariff revenue surge

The US government on April 22 received USD 11.7 billion from customer duties in a single day, the first time we can observe a substantial increase in import duties revenue resulted from the new of tariff from the second Trump administration.

Canada inflation rebounds to 2.9% in May

CPI inflation in Canada rebounded to 2.9% YoY and 0.31% MoM in May 2024

US CPI down to 2.9% in July as disinflation continues

US headline CPI down to 2.9% in July, lowest since March 2021

Canada GDP shrinks 0.4% in Q2, is it all gloomy?

Canada's GDP contracted by 0.4% (or 1.6% annualized) over the second quarter, amid a 7.5% (26.7% annualized) drop in exports as the impact of US-imposed tariffs started to bite.