US gains 339,000 jobs while unemployment rate rises to 3.7%

Employers in the US added 339,000 jobs in May, but at the same time 440,000 more people reported they were unemployed

Eurozone inflation drops to 6.1% in May, lower than expected

Annual consumer prices in the Eurozone rose by 6.1% YoY in May, down from 7% in April.

UK inflation holds at 4% in January

CPI: 4.0% YoY (Dec: 4.0%); Core CPI: 5.1% YoY (Dec: 5.1%)

UK retail sales drops 1.2% in June due to poor weather, election uncertainty

Monthly growth rate of UK retail sales volume fell 1.2% in June, after a 2.9% increase in the previous month.

Germany’s GDP Data might have been Distorted by Questionable Data

Germany's GDP data for 2018 might have been distorted by some questionable data provided by the pharmaceutical manufacturing industry.

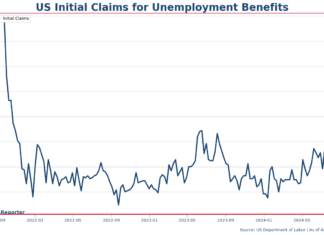

US initial jobless claims falls to 233,000, lower than expected

The number of people filed their initial claim for unemployment insurance benefits in the US fell to 233,000 in the week ending August 3.

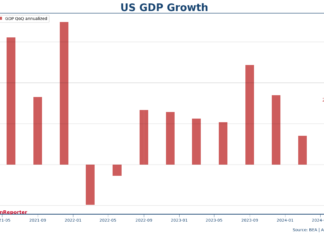

US GDP grows at 2.8% in Q2 as consumer spending remains strong

US GDP grew at a 2.8% annualized rate in Q2, supported by acceleration in consumer spending, increase in nonresidential fixed investment as well as an upturn in private inventory investment

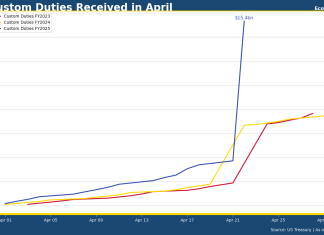

First sighting of Trump II tariff revenue surge

The US government on April 22 received USD 11.7 billion from customer duties in a single day, the first time we can observe a substantial increase in import duties revenue resulted from the new of tariff from the second Trump administration.

UK inflation remains above 10% as food prices continues rapid rise

The UK CPI rose 10.1% in the year to March, still remain in double digits even though analysts expected the annual rate to fall to 9.8%

Bank of England raises interest rate by 0.5%—notes on the Bank’s decision

Bank of England on Thursday decided to raise its benchmark interest rate by 0.5% to 5%, larger than the market expectation of a 0.25% increase. The decision followed Office of Nation Statistics' publication of a 8.7% CPI inflation reading for the year to May on Wednesday.