US payroll growth in Jan beats expectations

US nonfarm payroll increased 353,000 and Unemployment rate as 3.7% in January

UK retail sales drops 1.2% in June due to poor weather, election uncertainty

Monthly growth rate of UK retail sales volume fell 1.2% in June, after a 2.9% increase in the previous month.

UK inflation cools to 3.4% amid service inflation slowdown

Core inflation also slowed to 4.5%, compared to a year earlier.

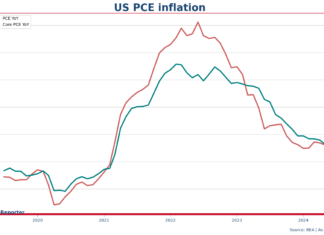

US PCE inflation drops to 2.5% as disinflationary trend continues

Inflation in the US cooled off further to 2.5% over the year to the end of June, according to the latest reading of US Bureau of Economic Analysis's PCE price index.

Canada inflation rebounds to 2.9% in May

CPI inflation in Canada rebounded to 2.9% YoY and 0.31% MoM in May 2024

The sizes of Sept rate hike to be decided on upcoming data, Fed officials...

Ahead of Jay Powell's keynote speech in Jackson Hole on Friday, two Fed officials said more rate hikes are still warranted, but they said it's too early to decide on the size rate increase yet.

BoE holds rate at 5.25% with ‘some’ officials signal eagerness to cut

Bank of England held its policy interest rate at 5.25% with a 7-2 vote amongst officials at its Monetary Policy Committee.

The Most Important Question Jay Powell Need to Answer – Where is the Saturated...

The most important question for the 30th Jan Fed meeting balance sheet policy, because it is also most underrated by the market.

Japan’s Inflation Rate is still Far From BOJ’s 2 Percent Target

Japan's core inflation rate was on 0.7 percent in February, remaining distant from the Bank of Japan's 2 percent target.

BoE to run system-wide evaluation on financial system including non-banks

Bank of England will conduct a system-wide exploratory scenario (SWES) exercise on the UK financial markets to see how well both banks and non-bank financial institutions can handle stress market conditions.