The Bank of Canada lowered its target for overnight rate by 0.25 ppts to 4.75%, making it one of the advanced economy central banks to cut rates before Federal Reserve does.

Governor Tiff Macklem in his opening statement for the post meeting press conference said that more rate cuts may follow.

“If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate. But we are taking our interest rate decisions one meeting at a time.”

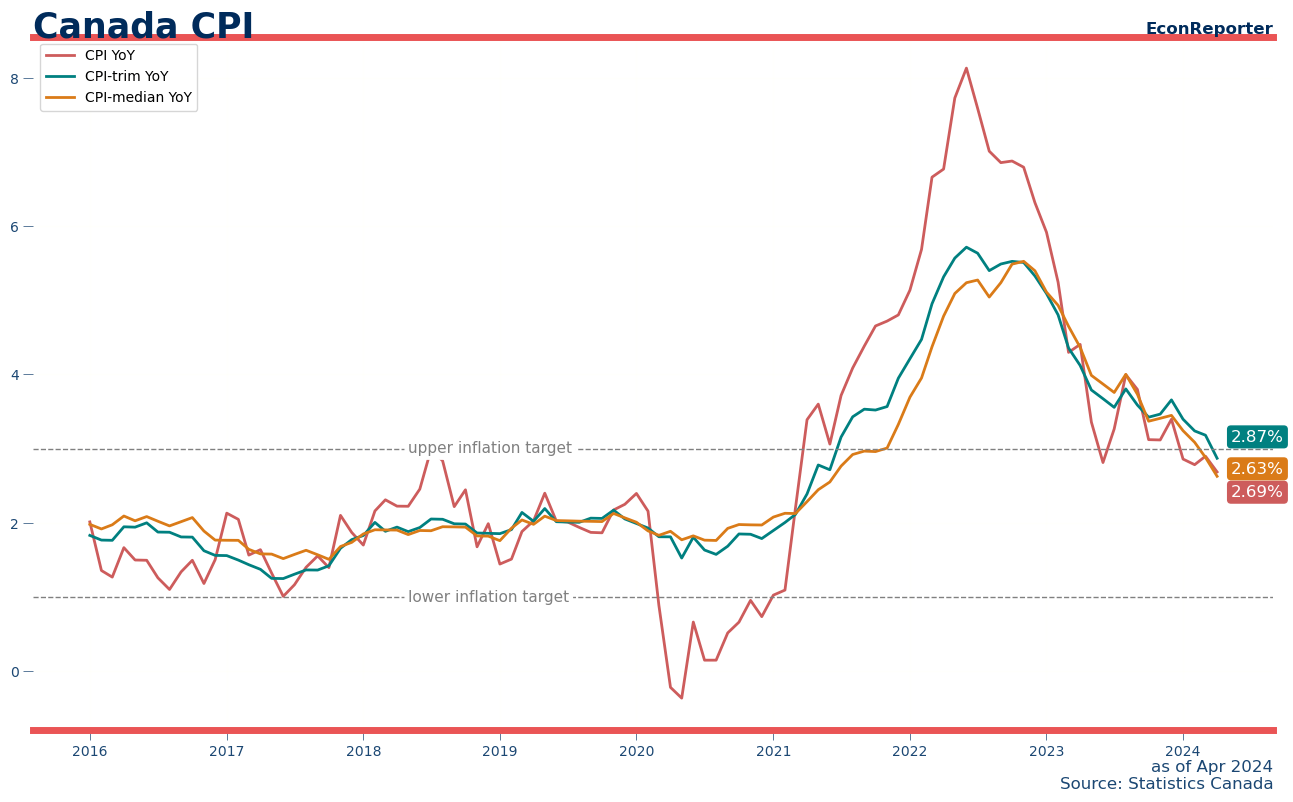

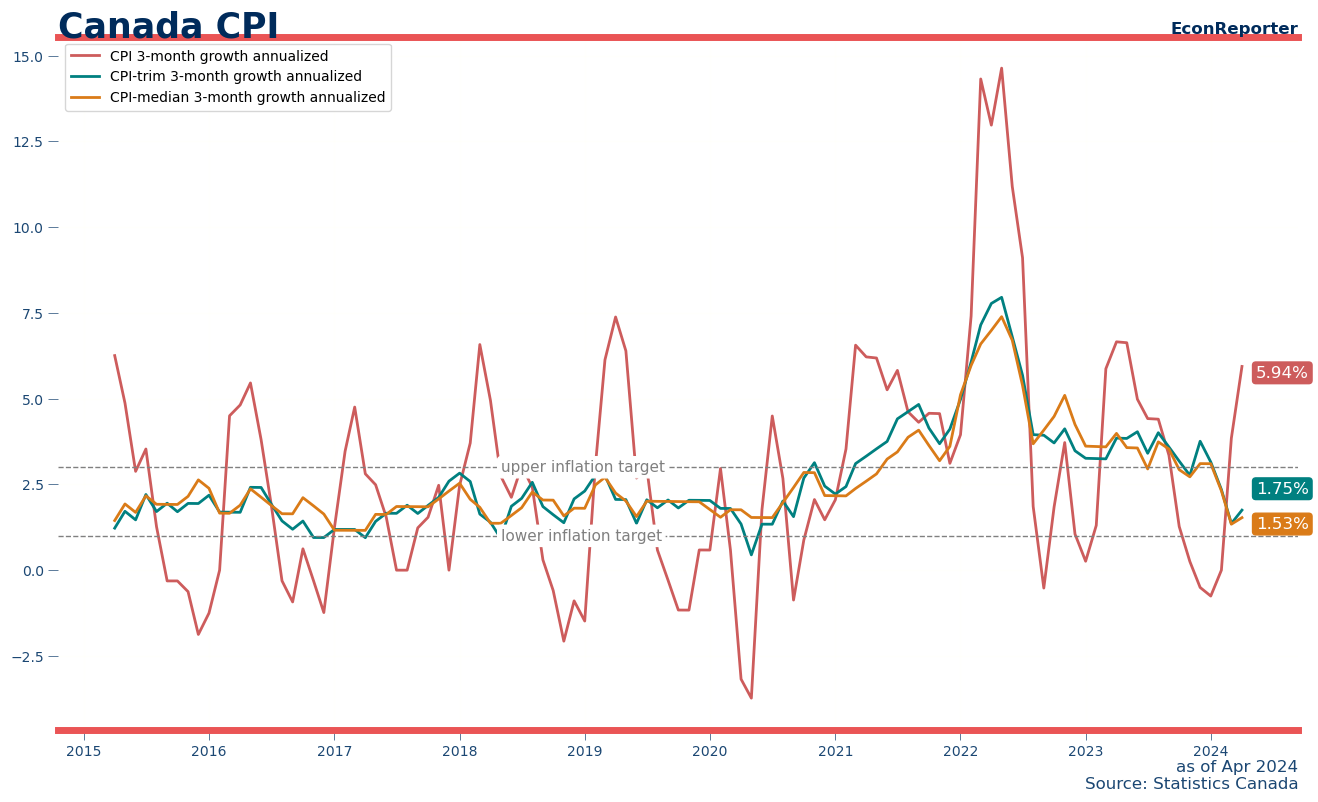

Macklem said CPI-trim and CPI-median, Bank of Canada’s preferred measures of core inflation, have both dropped to around 2.75% and that the 3-month rates of core inflation slowed to below 2% in March and April are reasons to support the rate cut.

The portion of CPI components that record higher than 3% price increases is also down to its historical average, which Macklem said is further evidence that “price increases are no longer unusually broad-based.”