Tag: Monetary Policy

Why FOMC mulling to cut ON RRP rate by 5 bps?

A relatively unexpected discussion among Federal Reserve officials during November FOMC meeting was that "some" committee members suggested a future consideration of lowering the ON RRP facility rate by 5 basis points. Why are they talking about that?

Some Bank of Canada officials worried half point cut might signal economic trouble

Some Bank of Canada officials expressed worries during the last policy meeting that an "unusual" 50-basis-point might be "interpreted as a sign of economic trouble" and led to expectations of further outsized cuts, the meeting deliberations summary shows.

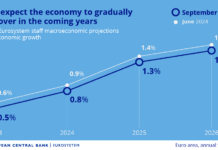

ECB cuts rate to 3.5% as it scales down growth forecast

The European Central Bank reduced the deposit facility rate, its policy interest rate anchor, by a quarter of a percentage point to 3.5%, as the central bank slightly lowered its economic growth forecast.

Bank of Canada cuts rate by 0.25 ppts to 4.75%

The Bank of Canada lowered its target for overnight rate by 0.25 ppts to 4.75%, making it one of the advanced economy central banks to cut rates before Federal Reserve does.

Bank of Canada continues to hold rate at 5% as underlying inflation still shows...

Governor Macklem said the "Governing Council’s discussion of monetary policy is shifting from whether our policy rate is restrictive enough to restore price stability, to how long it needs to stay at the current level"

Bank of Canada holds rate at 5% after September meeting

Bank of Canada maintained its benchmark interest rate at 5% but warned about persistent underlying inflationary pressure.

Bank of England raises interest rate by 0.5%—notes on the Bank’s decision

Bank of England on Thursday decided to raise its benchmark interest rate by 0.5% to 5%, larger than the market expectation of a 0.25% increase. The decision followed Office of Nation Statistics' publication of a 8.7% CPI inflation reading for the year to May on Wednesday.

Why Fed projects to cut rates next year even it expects failure to reach...

Inflation projections by Fed officials show that PCE inflation will not reach 2% by the end of 2025. Why the Fed expects to cut rate next year then?

Market sees Bank of England to raise rate to 4% by May

The financial market expecting the UK policy interest rate UK will break 4% by May, more than double the current level of 1.75%. Financial Times reported.

ECB on impact of Coronavirus (March 2)

Luis de Guindos, vice president of the European Central Bank, depicted the coronavirus as an additional " layer of uncertainty to global and euro area growth prospects,"