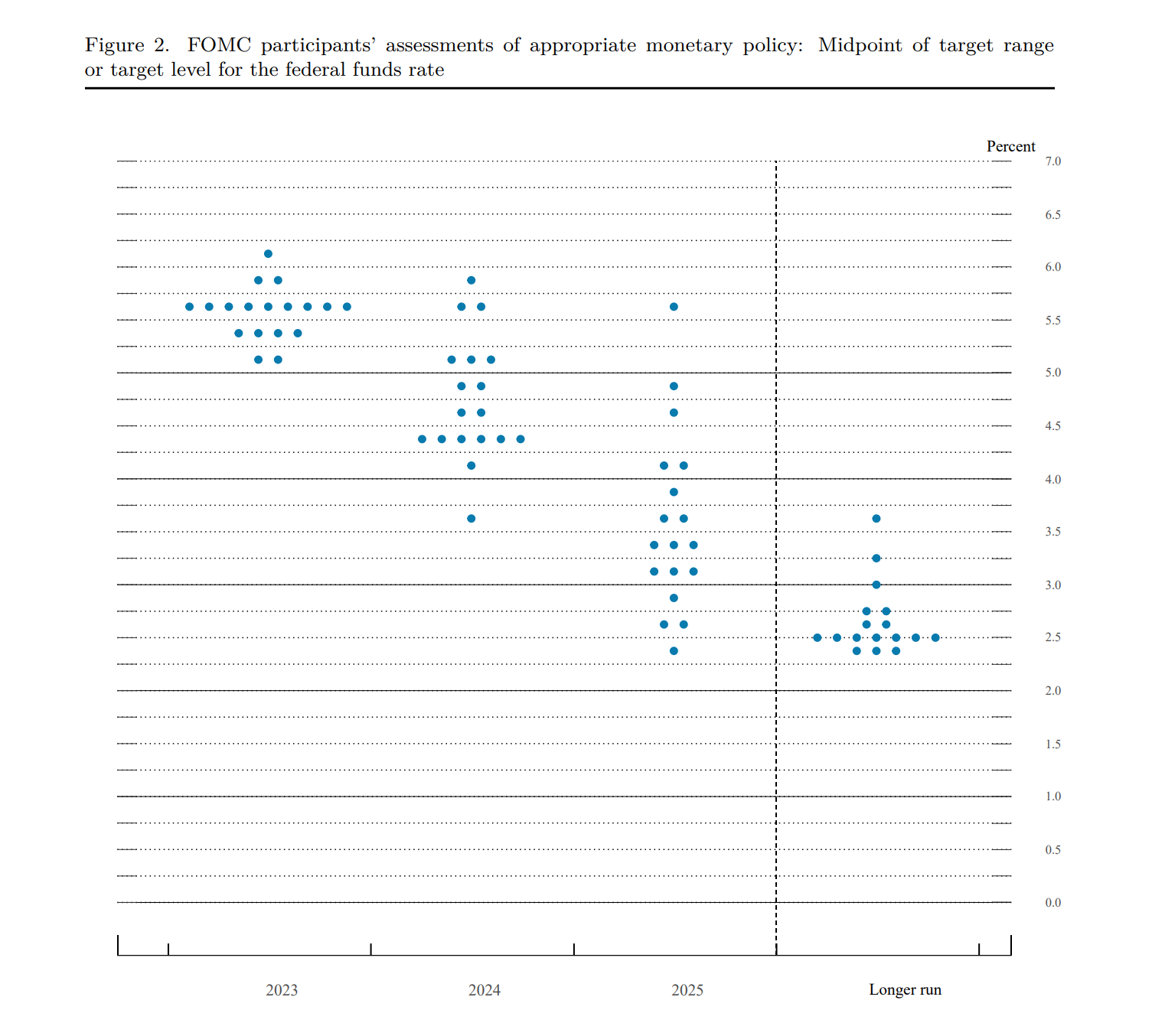

Federal Reserve officials signaled in the June Summary Economic Projections that the Federal fund rate will potentially reach 5.6% by the end of this year but drop back to 4.6% by the end of 2024 and will be cut to 3.4% by the end of 2025, according to the median projections by Fed board members and Federal Reserve Bank presidents.

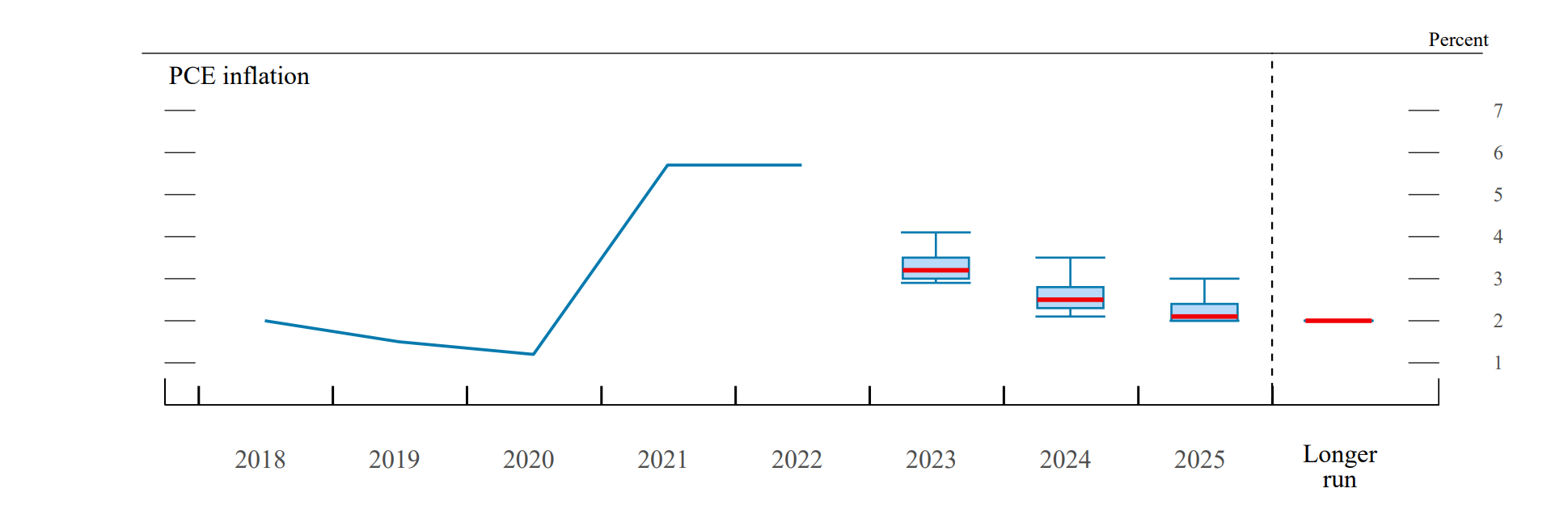

At the June 14 press conference, a journalist asked Fed Chair Jerome Powell why the Fed will start to cut rates even when its 2% inflation target is not projected to reach in the next couple of years.

To keep the real rate from rising

Powell explained that as inflation falls, real rate increases if the nominal interest rate remains unchanged. So, as the inflation is projected to ease further, even though it hasn’t reached the Fed’s 2% target, the central bank should cut rate to “maintain the real rate level” to avoid ratcheting up the monetary tightening.

The median projections by Fed officials suggest that they expect PCE inflation to remain elevated at 3.2% by the year-end, then falls to 2.5% in 2024 and 2.1% in 2025, meaning the Fed will likely not reach its 2% inflation target in the next two and a half year.