The Fed’s announcement means that BTFP will be expired as its original one-year finishes.

Adjusts BTFP terms to stop banks from gaining risk-free profit

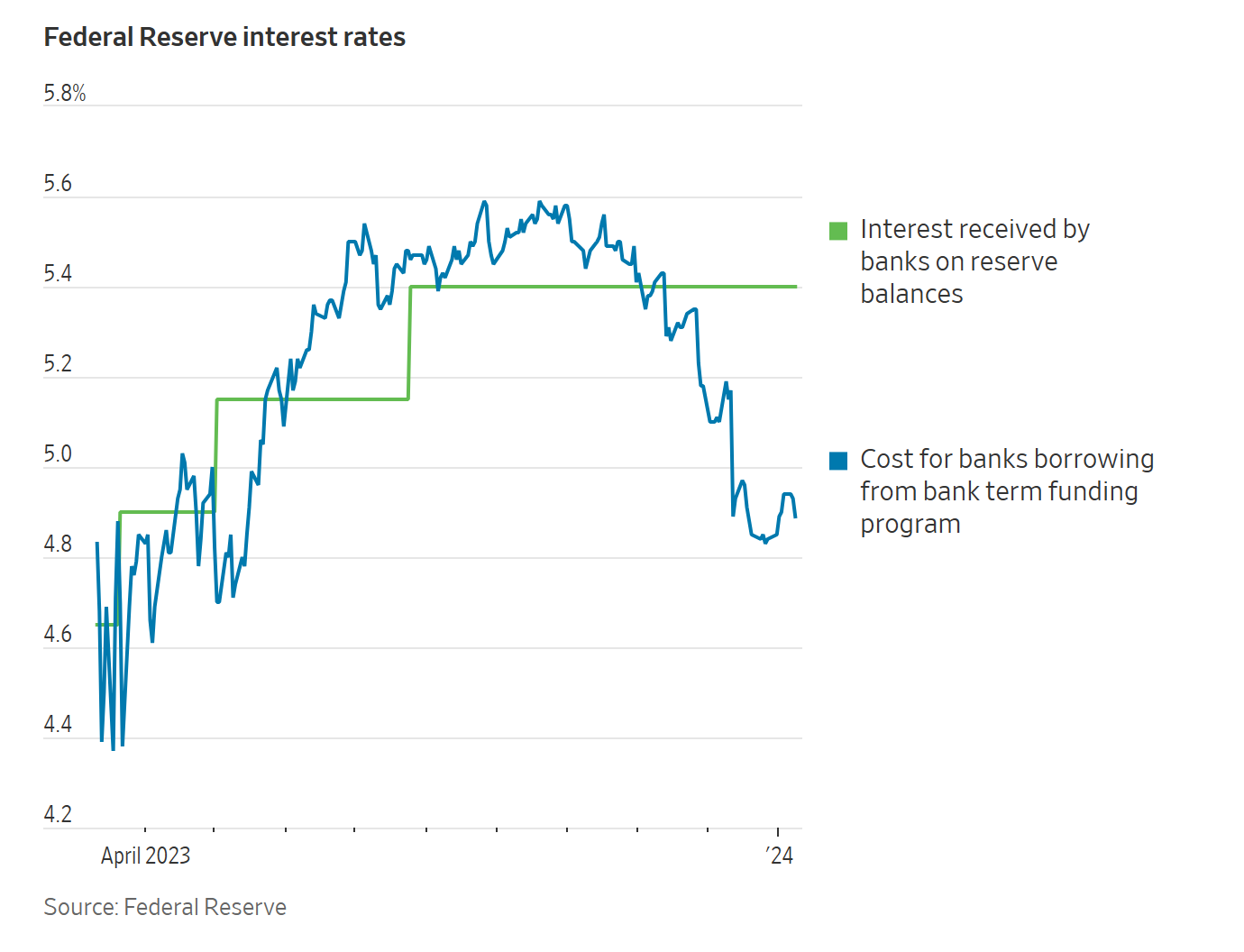

The US central bank also made an adjustment to the program’s terms, setting minimum interest rate level at the interest of reserve balance, effective immediately, to block an arbitrage opportunity that banks have been taking advantage of.

Recently, banks can gain risk free profit by borrowing from the BTFP, at the rate of one-year overnight index swap rate plus 10 bps, and then deposit the capital as reserve in the account with the Fed.

As the markets’ rate cut expectations have in recent months driven the one-year OIS below IOR, the banks can pocket a risk-free profit that is the spread between IOR and BTFP’s borrowing rate.

--- Follow us on Bluesky and Google News for our latest updates. ---