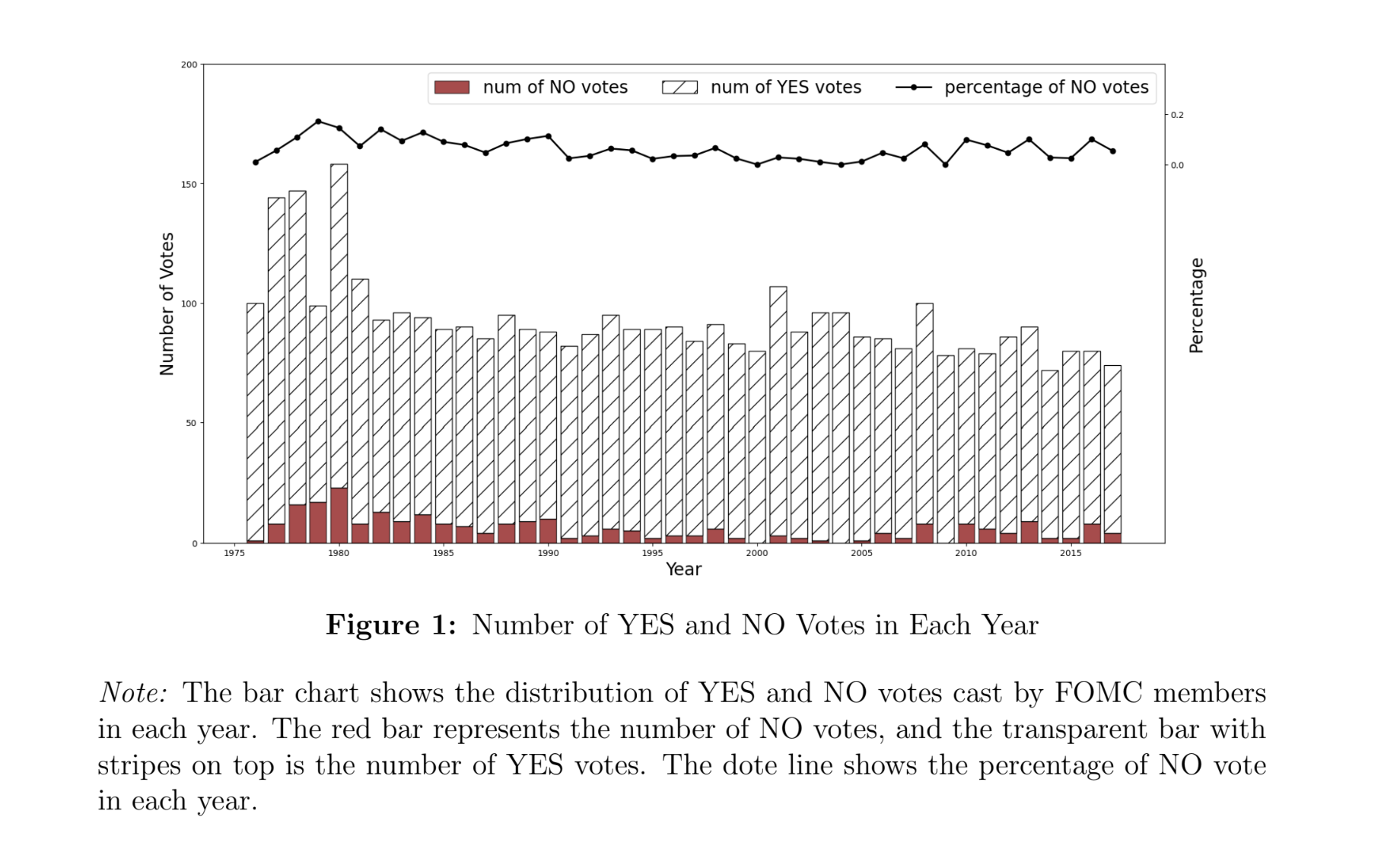

The FOMC is known to be good at reaching consensus in their meetings.

- Dissent votes are rare, accounting for only 6.37% of the votes between 1976 and 2017.

- Nonetheless, opting to vote with the FOMC consensus doesn’t necessarily mean committee members don’t “disagree” with it.

In a new working paper, two economists use machine learning to analyze the transcripts of Fed meetings, trying to decrypt the level of disagreement Fed officials expressed during the meetings.

Fed members vote yes even when they disagree

Tsang Kwok Ping of Virginia Tech and Yang Zichao of Zhongnan University of Economics and Law use machine learning to read the Fed’s meeting transcripts and to quantify the level of disagreement the officials expressed during the meetings.

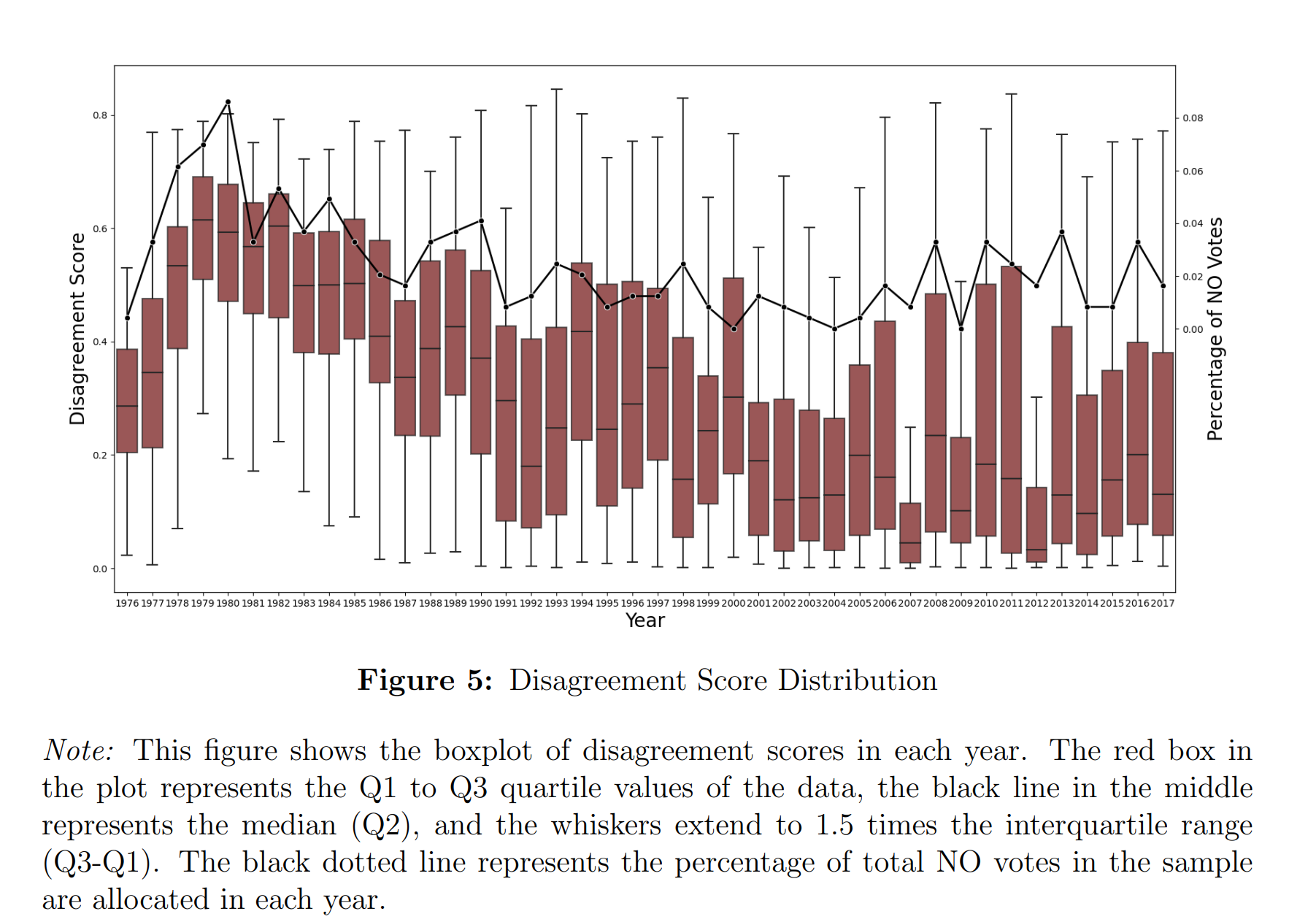

- A disagreement score between 0 and 1 is calculated, with 1 meaning the Fed member was entirely different from consensus.

- consensus, in the study, is proxied by the tone of the chairman’s transcript for the meetings

As shown in the graph, disagreement are quite common during Fed meetings, as one can expect.

- The disagreement scores were relatively higher before the 1990s, with the yearly average even topped 0.5 in the late 70s and early 80s.

- The drop in the score roughly shadows the evolution of dissent vote pattern.

- The lower disagreement score can also be related to the fact that Alan Greenspan in Oct 1993 suddenly revealed the existence of old Fed meeting transcripts, a fact which caught most FOMC members by surprise and potentially made the Fed officials more aware of how to express themselves during the meetings.

So…what can explain the disagreements?

The Fed’s quarterly Summary of Economic Projections?

- Alongside the famous dot plot, which anonymously discloses FOMC members’ projection for interest rates, the Fed officials also submit their forecasts for unemployment rate, GDP growth and inflation in the SEP.

- However, only the divergence on FOMC members’ unemployment projections is statistically correlated with the disagreement gauge.

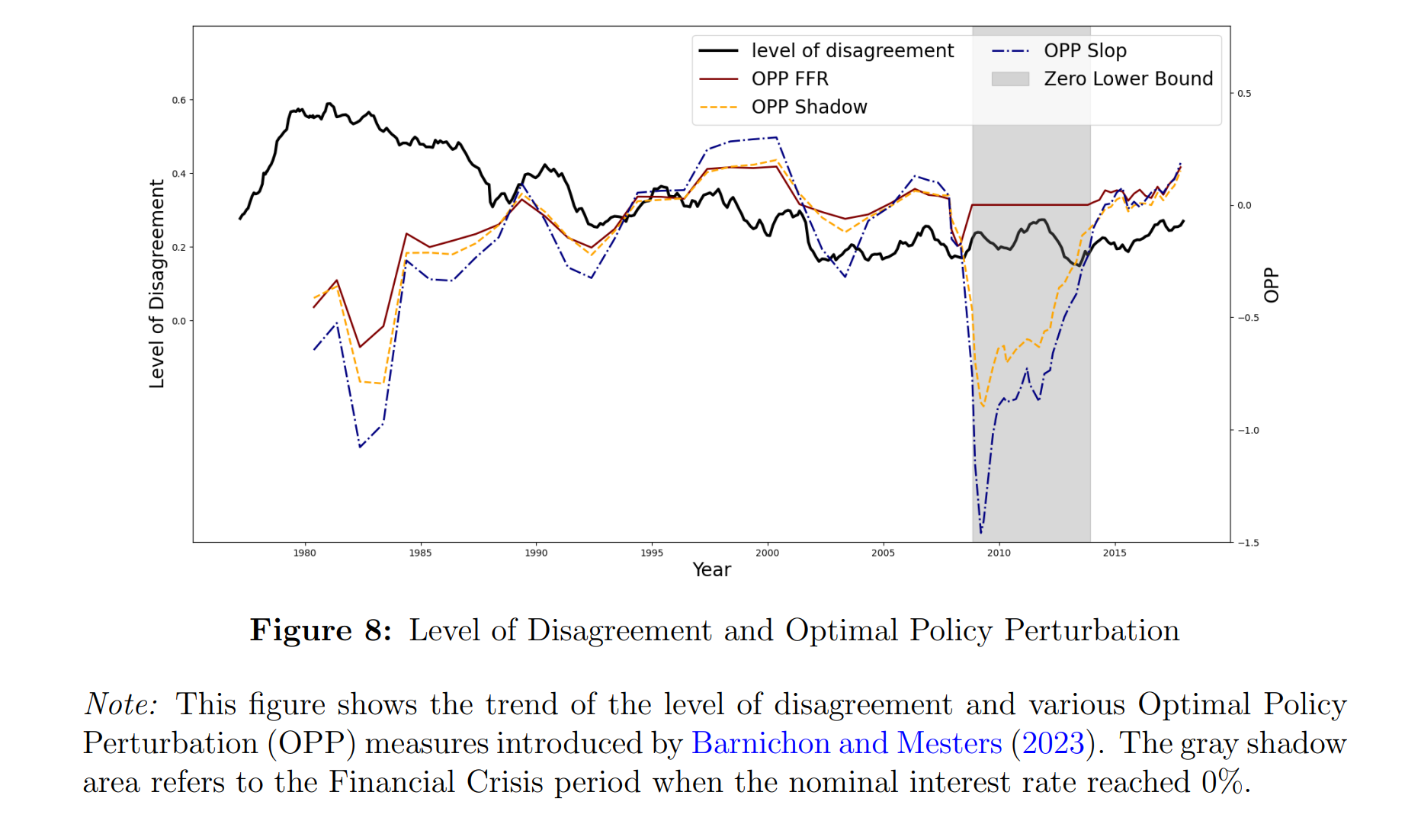

Deviation from optimal monetary policy?

- Using the so-called optimal policy perturbation method to measure the Fed’s deviation from optimal policy path, the researchers show that the overly tight monetary policy (represented by a negative OPP reading) in the 70s and 80s may potentially explains why official secretly disagree with the chair.

- OPP FFR, Shadow and Slop represent the optimal policy deviation in terms of federal funds rate, the shadow rate and the slope of the yield curve.

- Dropping the observations during the zero lower bound period, which generated extreme deviations in terms of shadow rate and the slope of the yield curve, all three OPP readings are significant negative correlation with the disagreement score.

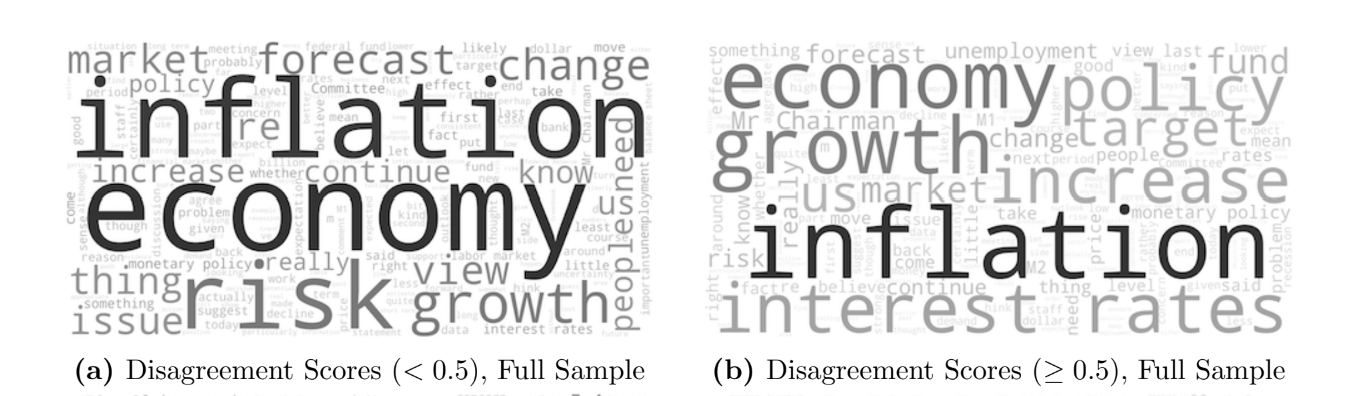

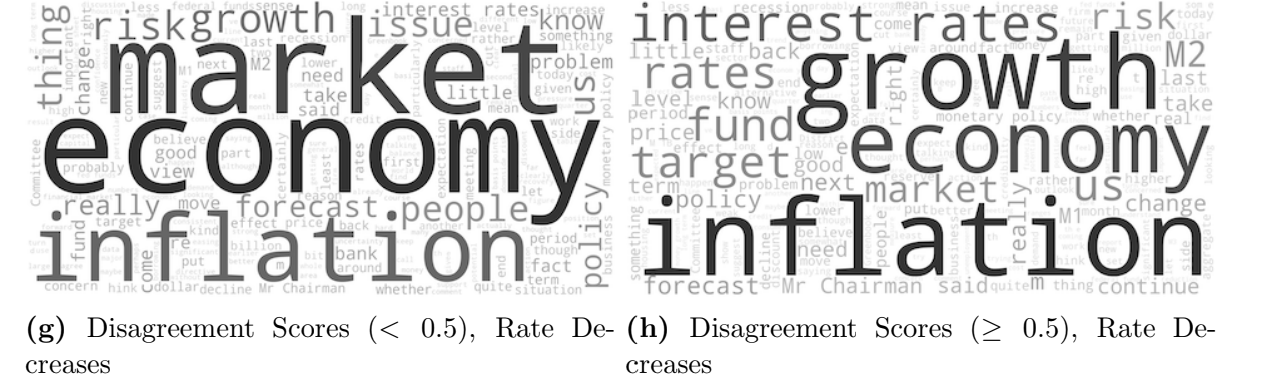

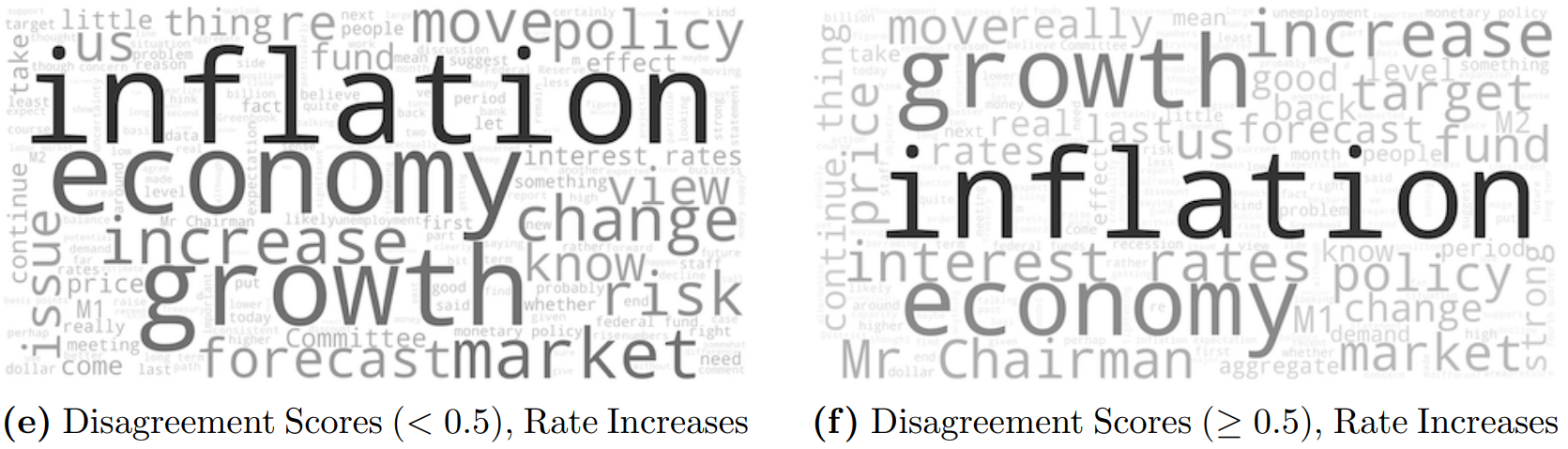

The Word Cloud

The researchers also used the transcript database to build several word clouds to illustrate the potential differences in the policy priorities between those who went with the chairman’s consensus and those who didn’t.

Regardless of whether they disagree from the consensus, “inflation” was FOMC member’s biggest focus.

- For those whose disagreement score is lower than 0.5, “economy” and “risk” are the issues they mentioned the most after inflation.

- “Economy”, “growth” and “interest rates”, on ther other hand, are what those who have high disagreement discussed most.

Of course, what FOMC members’ focuses can also depend on what exactly “the consensus” were during those meetings.

- In rate cut meetings, inflation became only the third most frequent mentioned word for those who followed consensus, after “market” and “economy”

- those who were against these rate cut decisions still most concerned about “inflation”, followed by “growth” and “economy” still.

- For a rate hike meeting, interestingly, the key words are actually similar whether the officials agree with the consensus or not.