Home 2019

Yearly Archives: 2019

How often companies in Eurozone change their prices?

An ECB survey found that the retailers review and change their prices most often, while consumer and business service firms adjust their pricing the least often. Firms in the manufacturing sector, meanwhile, have a price adjustment frequency somewhere in between the above sectors

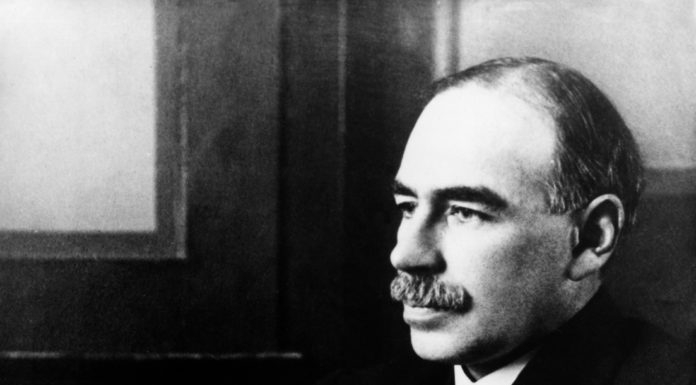

Akerlof on Keynesian-neoclassical synthesis’s departure from Keynes

George Akerlof explains how the Keynesian- neoclassical synthesis dominated the field, and what problems this dominance resulted.

A Pitfall of Global Economic Policy Uncertainty Index

In recent months, the Global Economic Policy Uncertainty index has risen to a level much higher than periods around the 911 Terrorist Attack or the 2008 Financial Crisis, hence the conclusion that the economic policy is unprecedently uncertain now.

But here is why you might not have to worry.

Hong Kong Linked Exchange Rate & HKD-USD interest rate differential

HKD tends to be on the strong side (closer to HKD 7.75 per USD) when the interest rate differential is positive (HIBOR > LIBOR).

Why the Fed announces “not-QE” Treasuries purchase program?

Federal Reserve announced yesterday that it will start purchasing Treasury bills from Oct 15 (Tuesday) until at least the second quarter of next year.

The problem with monetarist’s view of inflation

Long-run stability of the velocity, or the filpside of it, money demand, however, is not a empirically founded assumption.

The repo spike is not liquidity crisis; it is a crisis for Fed’s floor system

The floor system needs a cap on top of it. The sooner the Fed realizes it, the better they will be prepared for the coming financial turmoil.

Is there a Zero Lower Bound?

In a recent research, four European Central Bank economists found that negative interest rate policy in the eurozone can encourage banks to increase lending and encourage cooperations to increase investments.

That is, contrary to what macroeconomics models usually predict, interest rate policy can still has stimulative effect even the zero lower bound is reached.

When will Hong Kong’s Interest Rates Align With the US?

If you think the interest rate gap between Hong Kong and US is a market phenomenon, think again. HK Monetary Authority has a much bigger role than you think

Signs of Eurozone Recession is More Apparent

The latest Purchasing Manager Index (PMI) for the two largest economies, Germany and France, is showing a clear sign of looming recession.