The Non-QE program

Federal Reserve announced yesterday that it will start purchasing Treasury bills from Oct 15 (Tuesday) until at least the second quarter of next year.

- The decision was made after the Federal Open Market Committee (FOMC) held an extraordinary meeting.

- Treasury bills are short-term debts issued by the US government, with maturities up to one year.

In a recent speech, Chairman Jay Powell emphasized that this kind of operation is not “large-scale asset purchase programs that we deployed after the financial crisis“, that is “Not QE.”

- Quantitative Easing is an operation in which the central bank buys long-term government to lower the long-term risk free rate in the market, thus to encourage investors to shift their moeny to higher risk investment (the so-called protfolio balancing effect), and to foster long-term investment by lowering the cost of finance.

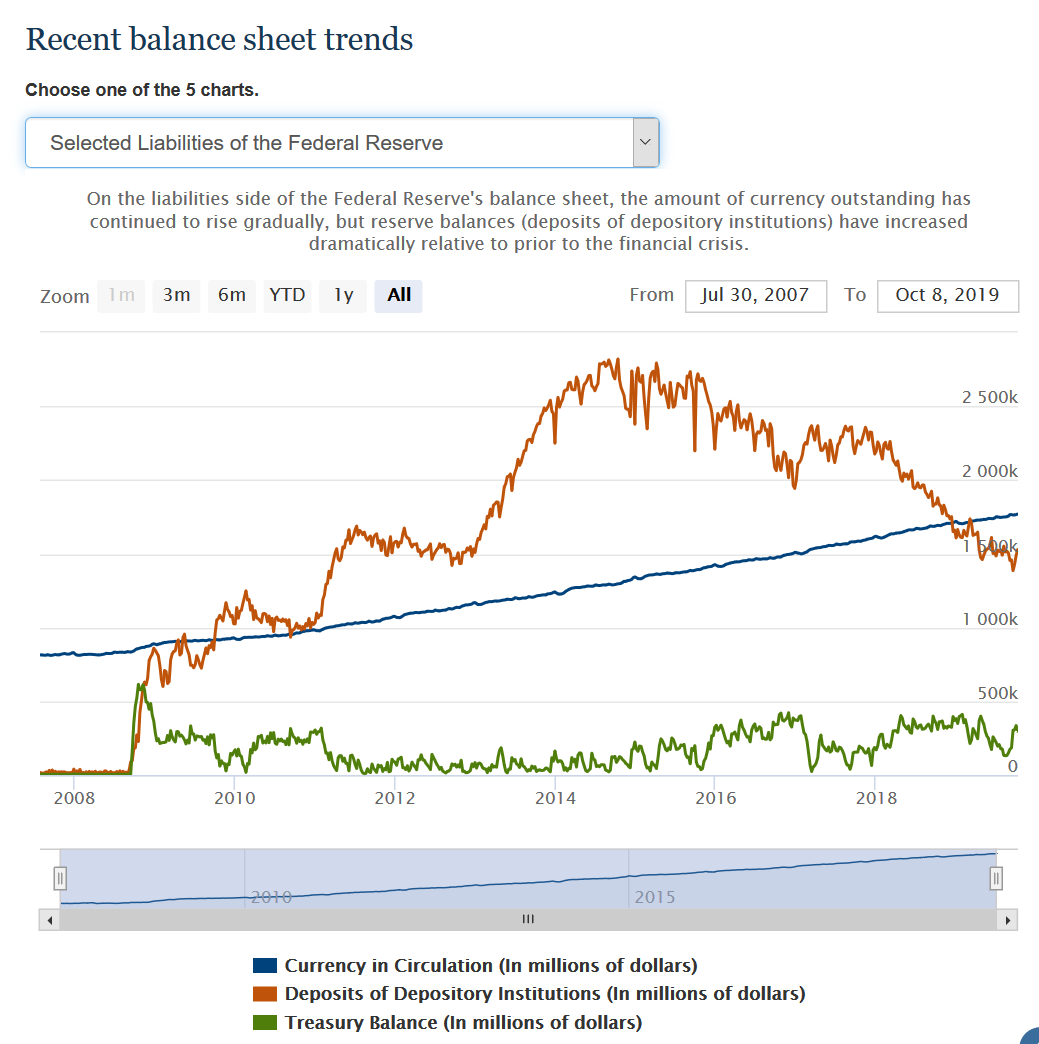

The Fed said the purchase of Treasury bills is to ensure that the Fed maintains an ample reserve balance at or above the level that prevailed in early September 2019, as non-reserve liabilities, for example, currency in circulation, on its balance sheet has been rising.

- The Fed has been keeping the overall size of its balance sheet constant, the rise in currency in circulation resulted in a continuous decrease in reserves in the banking system, even after it stopped selling its Treasury holdings in August.

Ample reserves balance is an important feature of the Fed’s current interest rate regime — the so-called Floor system.

Ample reserves balance is an important feature of the Fed’s current interest rate regime — the so-called Floor system.

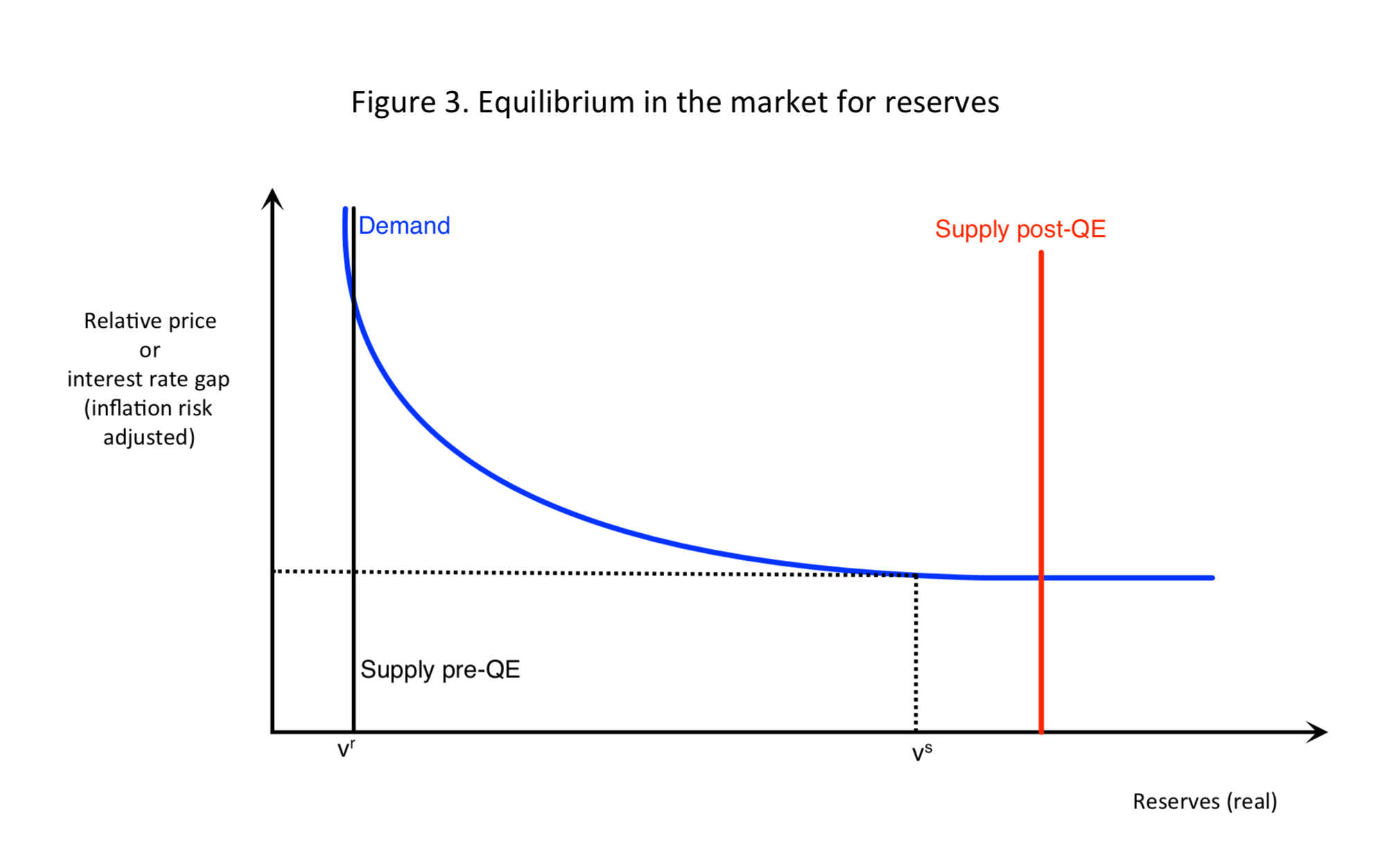

- The demand for reserves is downward sloping, meaning a fall in interest rate will increase the reserves demand. If the supply of reserves keeps increasing, and the interest rate of reserve will fall, until it reaches one point at which the banks have all the liquidity they want, and this is v^s in the figure, and the reserve demand curve become horizontal.

- The Fed decided earlier this year that it is preferable to maintain the level of reserves at the horizontal part of the demand curve, which is the aforementioned ample level of reserves.

- Under this regime, the Fed uses the interest rate on excess reserves (IOER) and overnight reverse repo (ONRRP) to control the interest rates in the money market, instead of altering the supply of reserves via open market operations.

- However, after years of selling its Treasury holdings, which are acquired through rounds of quantitative easing (QE), the level of reserves may lower than the ample level, and resulted in the repo spike episode we saw last month.

Hence, the Fed needs to raise the reserves supply, by buying Treasury bills from the banks, to prevent any more “uncontrollable” rises happening in the future.