The US overnight repo rate shot up to as high as 10% on Tuesday, prompting the NY Fed to stepped in and rolled out a USD 75 billion repo operation, or temporary open market operation, which in the end injected USD 53 billion cash into the short term money market.

Repo is a transaction which a financial institution lends a highly liquid asset, like treasury, to another financial institution for a stipulated period of time (overnight is our current focus) in exchange for cash.

View it another way, institution A borrows cash from institution B, with the liquid asset posted as the collateral.

A rise in repo rate could mean that the cost for borrowing with treasuries as the collateral increased. The reason can be that the value of the treasuries decreased, or that the supply cash in the repo market is too low.

These are in fact the circulated explanations for the recent increase in repo rate. As Alexandra Scaggs wrote in Barron’s, last week the US money market have two concurrent events that nudged the repo rate up. First, companies pulled cash out of money market funds to make quarterly tax payments due Monday; Second, $78 billion of Treasury securities auctioned last week.

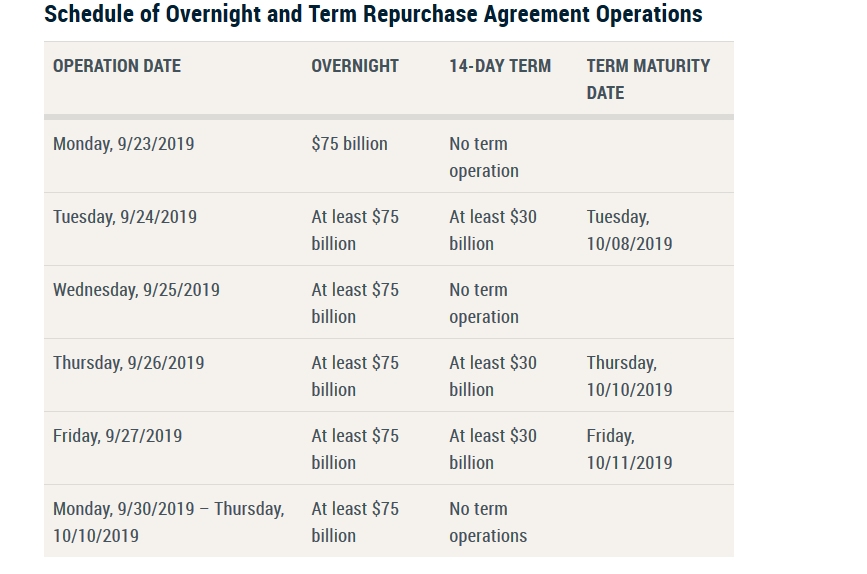

So, the spike in repo rate is driven by temporary factors. It is not a liquidity crisis, just a liquidity shortfall that will soon go away, even though NY Fed has to conduct a second USD 75 billion repo operation on Wednesday, which investors oversubscribed at USD 80 billion; and there is a third one on Thursday; and a fourth one on Friday.

NY Fed even went on to announce they will conduct USD 75 billion daily repo operation every weekday until Oct 10, alongside three 14-day repo operations on Sept 24, 26 and 27.

The Fed is trying to calm the market with these ad hoc liquidity injections, and in my opinion, it will be successful. However, what this incident showcased is that there is weakness in the Federal Reserve’s interest rate regime — the so-called floor system.

Since October 2008, the Fed started to pay interest on excess reserves (IOER) to the banks and it is no longer zero, and constantly higher than the effective Fed Fund rate (EFFR), the rate the banks can earn lending the money out in the interbank market, and by doing so, the Fed essentially eliminated the banks’ opportunity cost of holding reserves. Now the banks have the incentive to hold more reserves, and the supply of it had increased substantially after rounds of Quantitative Easing.

Under this regime, the Fed uses the IOER as the main driver of the money market rates. Money market rates should not deviate from the IOER too much, as arbitrage opportunity will arise and banks with access to IOER will have an incentive to move around its cash from or to the money market to eliminate the spread.

The Fed introduced an additional tool overnight reverse repurchase agreements (ONRRP), which allow money market participants to directly lend money to the Fed, to further enhance its control of the money market rates.

However, what the repo rate spike this week showed is that the IOER-as-the-main-tool regime doesn’t always work and that the arbitrage mechanisms is just not enough.

In theory, banks and money market fund should keep drawing money from excess reserves or ONRRP, and lend out the cash in the repo market, until the rates between the two align. This seems to have happened, but the end result is that the EFFR rose to the top end of the Fed’s designated target range of 2%-2.25%, forcing the NY Fed to intervene with repo operations.

While NY Fed can always use repo operation to tame the repo rate to a reasonable level, the problem is that if interventions become frequent, it defeats the purpose of adopting the floor system, which is to reduce the need to actively manage the level of reserves.

The other readily available tool the Fed has is to lower the IOER further, giving more room for the arbitrage to do its work. The Fed announced exactly that on Wednesday, it lowered the IOER to 1.8% from 2.1%, along with the cut in Fed Fund Rate target. Now the IOER is 5bp above the Fed Fund rate target range (1.75%-2%), compared to the 10bp beforehand (when the target range was 2%-2.25%). This 5bp cut, however, is very likely to be a short-term patch with limited effect.

Before the June meeting last year, the Fed was setting the IOER at the top of the Fed Fund Rate range. Fast forward to now, accumulated 20bp IOER “relative cuts” later, the Fed still have no effective control on the money market rates. Given the evidence, it is hard to argue IOER cuts are effective.

Taken together, it is reasonable to say the Fed can control the repo, but it may have to conduct repo operations frequently for that, and that exposed a weakness of its interest rate regime. What can the Fed do about it?

To the Fed’s credit, it has discussed potential solutions for a problem like this for months. The solution is a standing repo facility. That is, the Fed will have facility which will conduct repo at a fixed interest rate, and at the eligible financial market participants’ request; the facility will take high-quality assets as collateral and lend overnight money to the participants, very much like what NY Fed has been doing, but turn it from an ad hoc tool, into a stand-ready feature.

This idea was discussed in length in the June Fed meeting, where some Fed officials say it can “enhance interest rate control in the current implementation regime” and “could damp volatility in repo rates.”

There were some counter-arguments, like “some participants raised questions about whether such a facility is needed” give the floor system “has provided good interest rate control.” Some official also raised an operational issue, like “setting the rate close to the level of money market rates could result in very sizable Federal Reserve operations on a daily basis that could be viewed as disintermediating the activity of private entities in money markets.”

The Fed has yet made a decision on adopting this repo facility, but given the recent volatility in the repo market, it is hard for Fed officials to claim the floor system “has provided good interest rate control” anymore.

The floor system needs a cap on top of it. The sooner the Fed realizes it, the better they will be prepared for the coming financial turmoil.