In recent research, four European Central Bank economists found that negative interest rate policy in the eurozone can encourage banks to increase lending and encourage companies to increase investments.

That is, contrary to what macroeconomics models usually predict, interest rate policy can still have a stimulative effect even the zero lower bound is reached.

Altavilla, Carlo, Lorenzo Burlon, Mariassunta Giannetti, and Sarah Holton. “Is There a Zero Lower Bound? The Effects of Negative Policy Rates on Banks and Firms.” ECB Working Papers, June 2019. June 2019.

Mainstream Economics believes that once the zero lower bound is reached, further rate cuts will not have many effects as the negative rate won’t be channeled to the customers. When the interest rates on deposit drop below zero, customers will withdraw all the money and keep it as cash to avoid the “tax” negative rate imposed.

So the negative rate won’t be transmitted banks’ customers as the banks ain’t able to set the deposit rate sub-zero, otherwise, they will suffer from huge cash outflow.

ECB’s research, however, suggests that the stimulative effect of negative rate can be passed through the banking system. The key is that banks can set a negative rate on deposits by corporate savers, who won’t be able to conduct their business as easily in cash. But only if the banks are healthy.

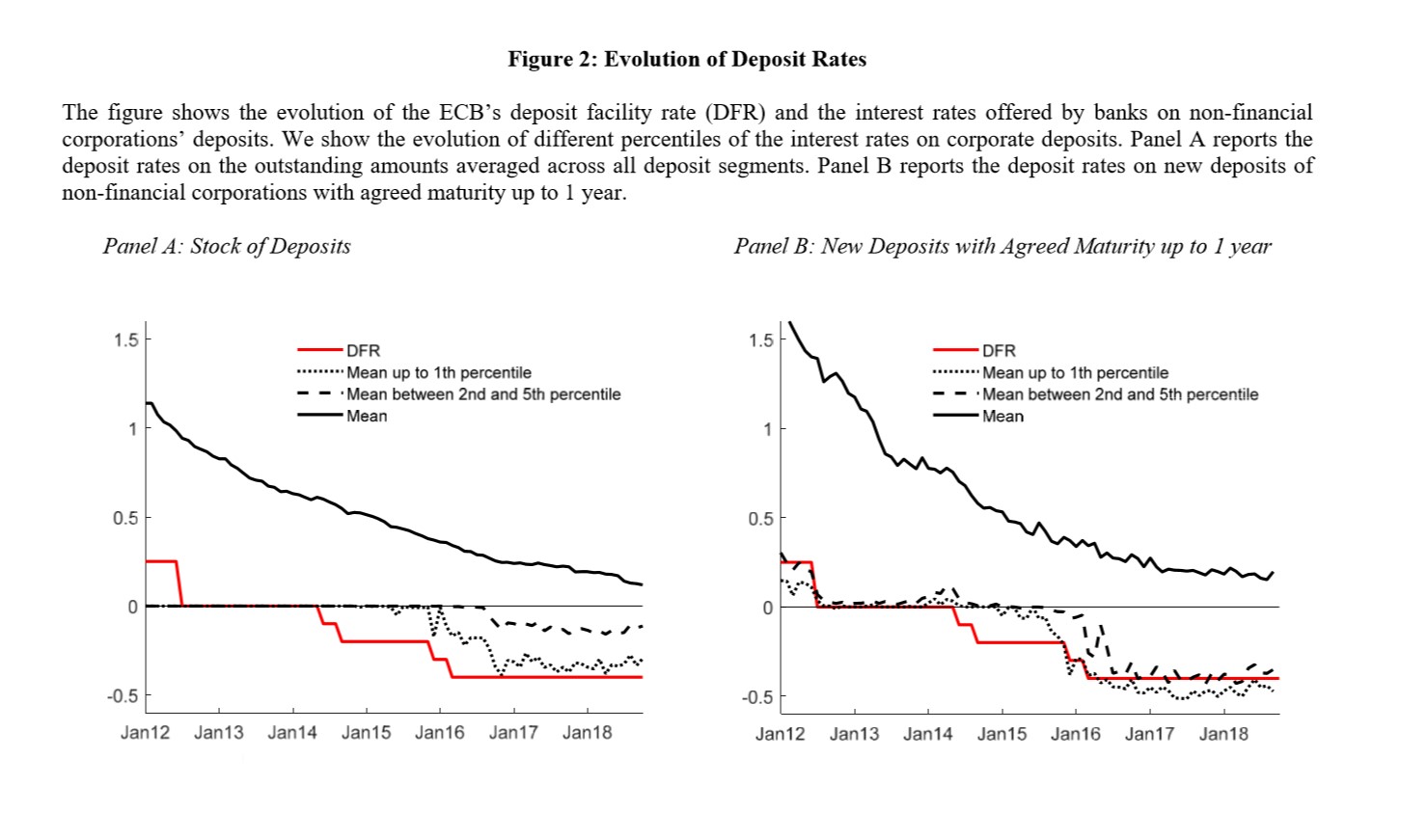

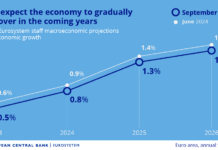

ECB reduced the Deposit Facility Rate, the interest ECB pays when banks deposit money with it, from 0 to -0.10% in June 2014, to -0.20% in September 2014, to -0.30% in December 2015, and to -0.40% in March 2016.

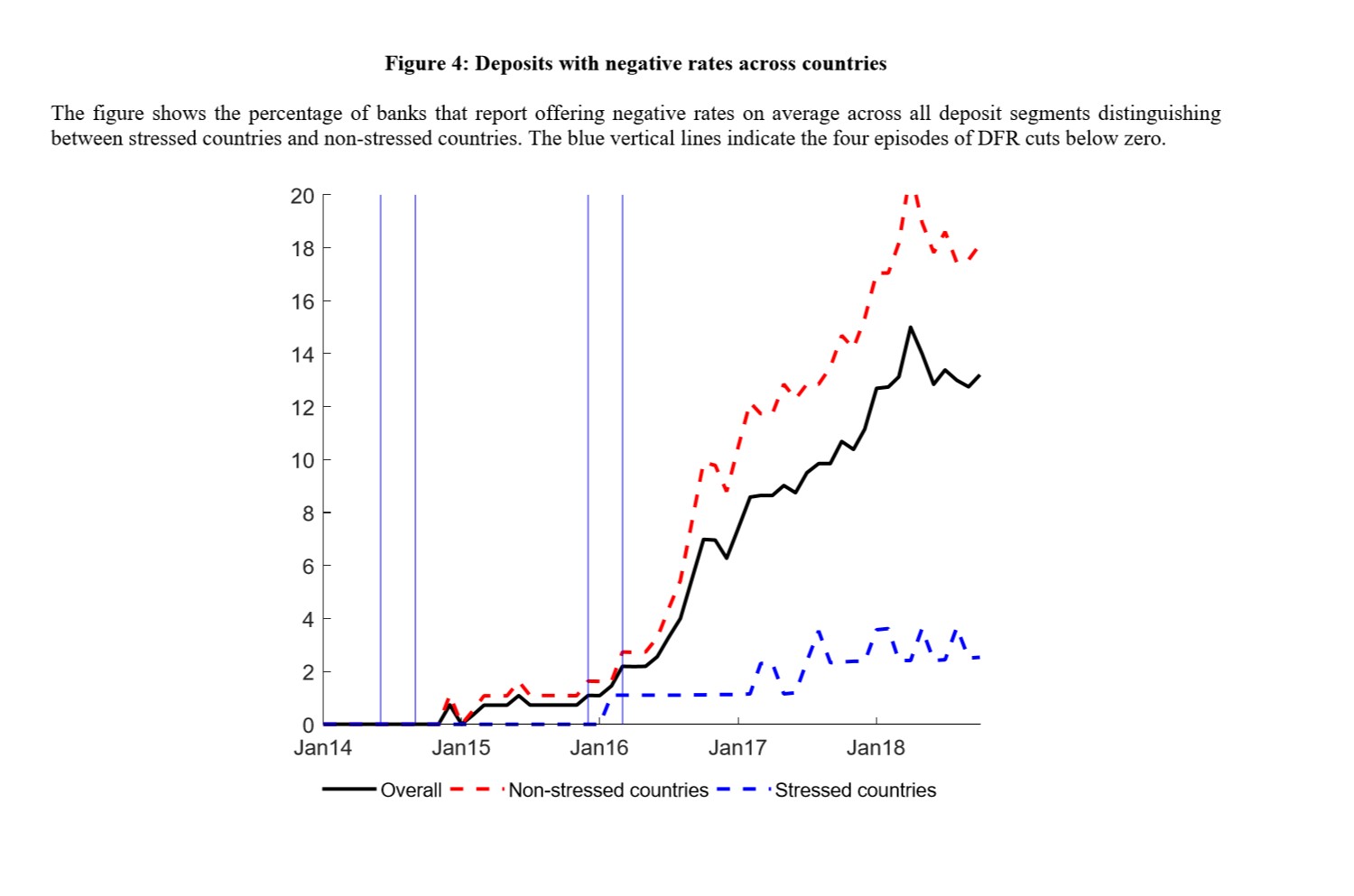

Using confidential data of banks and firms in eurozone from August 2007 to September 2018, Carlo Altavilla, Lorenzo Burlon, Mariassunta Giannetti and Sarah Holton showed that sound banks in the euro area started to charge negative rates on corporate depositors after the ECB’s DFR became negative in June 2014.

The figure above also shows that the banks’ reaction to negative DFR is stronger as the ECB moves more into negative territory. This suggests that the negative rate policy has yet to meet an effective lower bound.

It is worth noting that some banks even set a rate below the DFR on new deposits, as shown in the figure below.

What does “sound banks” means?

In the research, the economists found that banks that operated in countries less affected by the Euro Sovereign Crisis and, at the same time, had a lower CDS spread and the ratio of non-performance loans (NPL) tends to be more willing to offer negative rates to cooperate clients.

- A 10 percentage point increase in the proportion of NPL implies a decrease in the probability of starting to charge a negative rate by 60%.

- A one standard deviation increase in CDS spread decrease in the probability of starting to charge a negative rate by 40%.

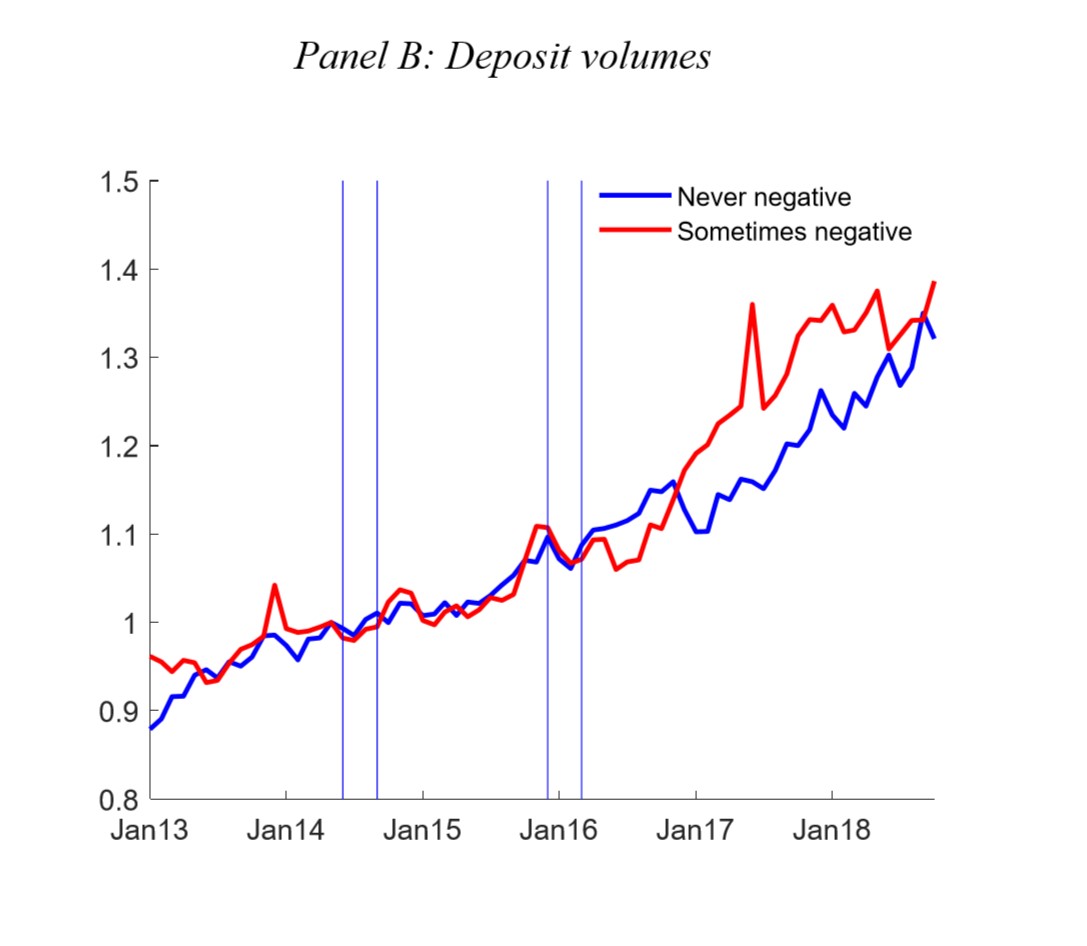

Importantly, those banks didn’t experience a decrease in the deposits they hold after the rate is set below zero. On the contrary, the amount of deposits in those banks increased during the negative rate period.

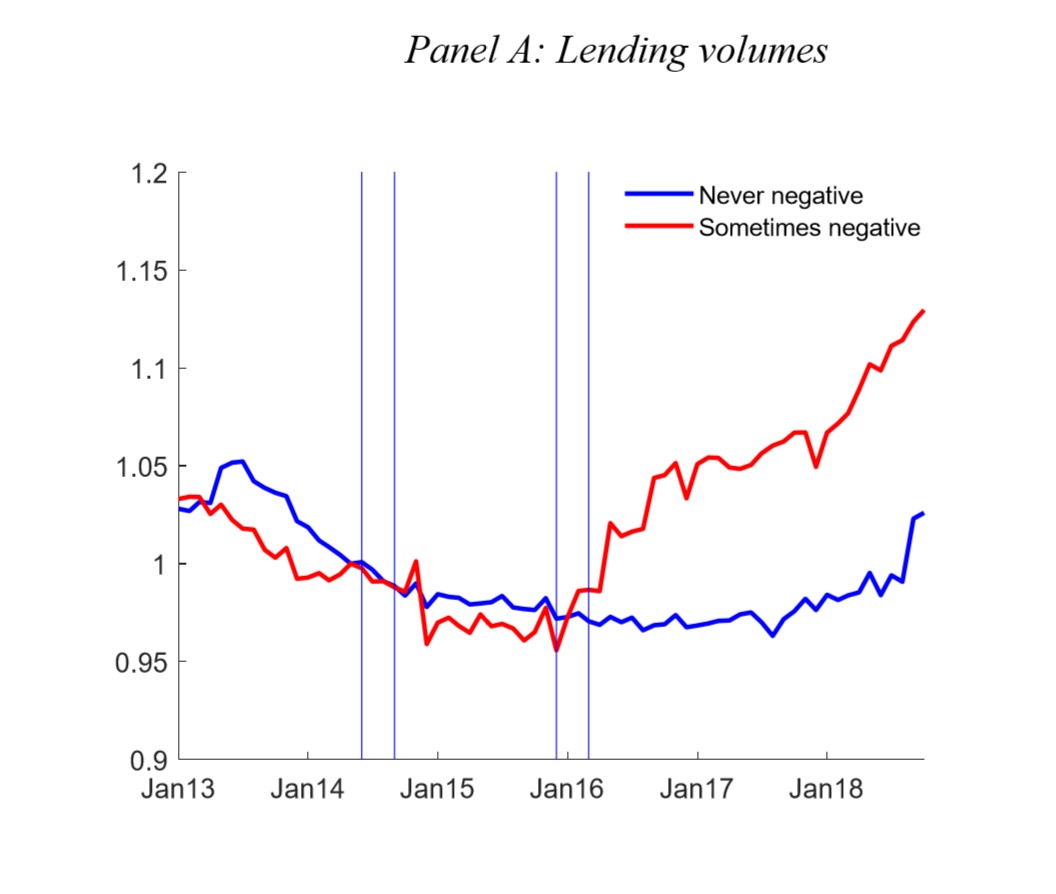

With no significant deposit outflow, which the theory predicts, that means negative rate lowered the cost of funding of the sound banks and allowed them to increase the supply of lending to its clients. This is confirmed by the evidence.

That is to say, the traditional monetary policy transmission channel is not hampered by the zero interest rate. ZLB is not binding, at least not strictly.

The authors go on to suggest there is a corporate channel of monetary policy.

The negative rate can affect firms through banks’ asset composition because it increases the cost of holding deposits. Cash-rich firms may, therefore, decrease the amount of cash held in deposits and invest more without increasing their leverage, they will have an incentive to invest in longer-term, or riskier, assets to try to improve their profitability under the negative rate regime.

- Firms with ex-ante high cash holdings that are associated with banks that offer negative deposit rates decrease their financial loans and current assets and increase their investment.

- Also, the firms that borrow from banks that offer negative rates with higher cash holding tends to have higher profitability (measured by return on equity) on average.

- This suggests that those cash-rich firms were being precautionary in the face of an uncertain economic environment and applied a too high discount rate on investment opportunities. Negative interest rates on deposits increase the cost of holding liquid assets. It tilted the firms in favor of investing and led to increases in profitability, which were previously constrained by the decision of holding back investment

Such investment rebalancing encourages investments in the real economy and increases aggregate demand. The research provides further evidence Thus, sub-zero interest rate is not impotent in stimulating the economy.

Read the whole paper:

No Title

No Description