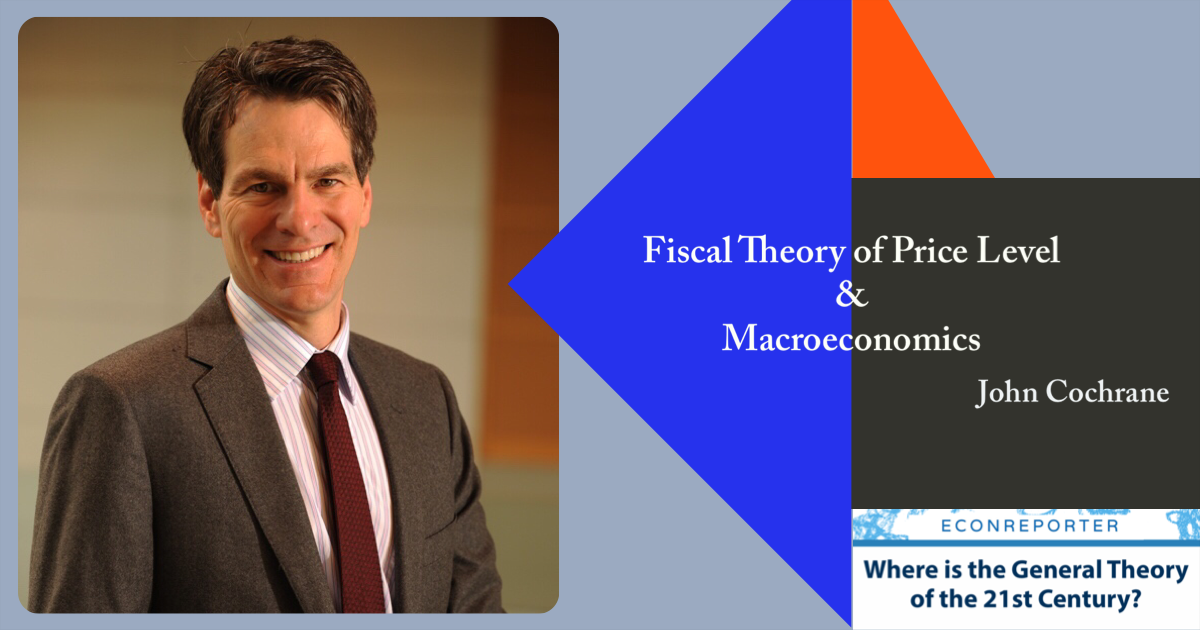

Fiscal Theory of Price Level and State of Macroeconomics | Q&A with John Cochrane...

John Cochrane talks about Fiscal Theory of Price Level and how can we apply this theory on the current macroeconomy.

Why the Fed announces “not-QE” Treasuries purchase program?

Federal Reserve announced yesterday that it will start purchasing Treasury bills from Oct 15 (Tuesday) until at least the second quarter of next year.

The sovereign-bank “doom loop”

Since the Euro crisis, investors and policymakers are well aware of the so-called "doom loop" between the banking system and the sovereign. That is, a crisis originating in the banking system (sovereign) will weaken the sovereign (banking system), which in turn will worsen the banking (sovereign) crisis itself.

In a recent ECB discussion Paper "Managing the sovereign-bank nexus", the 7 economists - Giovanni Dell’Ariccia, Caio Ferreira, Nigel Jenkinson, Luc Laeven, Alberto Martin, Camelia Minoiu, and Alexander Popov - coauthored the paper suggested that the banks and sovereigns are linked by three interacting channels:

What is FTPL (Fiscal Theory of Price Level)?

The Fiscal Theory of the Price Level says that money has value because the government accepts it for taxes, and inflation is fundamentally a fiscal phenomenon

Major Shifts in Macroeconomics Since the Great Recession | Interview with Atif Mian

Atif Mian, co-author of House of Debt, discusses what he thinks are the "revolutionary" changes in macroeconomic academia since the Great Recession.

Hong Kong Linked Exchange Rate & HKD-USD interest rate differential

HKD tends to be on the strong side (closer to HKD 7.75 per USD) when the interest rate differential is positive (HIBOR > LIBOR).

Why hadn’t Federal Reserve rescued Lehman Brothers in 2008?

This week, the trio who was directly responsible for the decision to let Lehman fail – Bernanke, Tim Geithner (then New York Fed President), and Hank Paulson (then Treasury Secretary) – joined together at a panel held by Brookings Institution and spoke about the lessons they had learned from the crisis.

Phillips Curve is Not a Straight Line…

A story about three economists agree with the prevailing consensus that the Phillips Curve of the US is flattened in the last few decades on the one hand; and dispute the idea that the Phillips Curve is dead on the other.

“The Rate of Return on Everything, 1870-2015”

How Alan Taylor, one of the authors of "The Rate of Return on Everything, 1870-2015" explains the liquidity premium problem when we compare the rate of return on Housing and Equity

How the Game of Bank Bargains Created the Financial Crisis? | Q&A with Calomiris...

Welcome to the latest installment of our interview series “Where is the General Theory of the 21st Century?”

“Where is the General Theory of the...