If I have to pick an economics search paper I liked the most in 2017, it is definitely “The Rate of Return on Everything, 1870-2015” by Òscar Jordà, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor. The content of this paper is as its name suggested, consolidating the rate of return on the four most important investment asset, i.e. equity, housing, bond, and bills, between 1870 and 2015.

Here is the abstract:

This paper answers fundamental questions that have preoccupied modern economic thought since the 18th century. What is the aggregate real rate of return in the economy? Is it higher than the growth rate of the economy and, if so, by how much? Is there a tendency for returns to fall in the long-run? Which particular assets have the highest long-run returns? We answer these questions on the basis of a new and comprehensive dataset for all major asset classes, including—for the first time—total returns to the largest, but oft-ignored, component of household wealth, housing. The annual data on total returns for equity, housing, bonds, and bills cover 16 advanced economies from 1870 to 2015, and our new evidence reveals many new insights and puzzles.

I have seen much praise about this paper on the internet already. Here is Branko Milanovic called it “Probably a seminal paper” on twitter.

Probably a seminal paper.

The rate of return on everything 1870-2015https://t.co/98ys1L8m8L— Branko Milanovic (@BrankoMilan) January 2, 2018

Here is Tyler Cowen calling it “I found this to be one of the best and most interesting papers of the year.”

The rate of return on everything – Marginal REVOLUTION

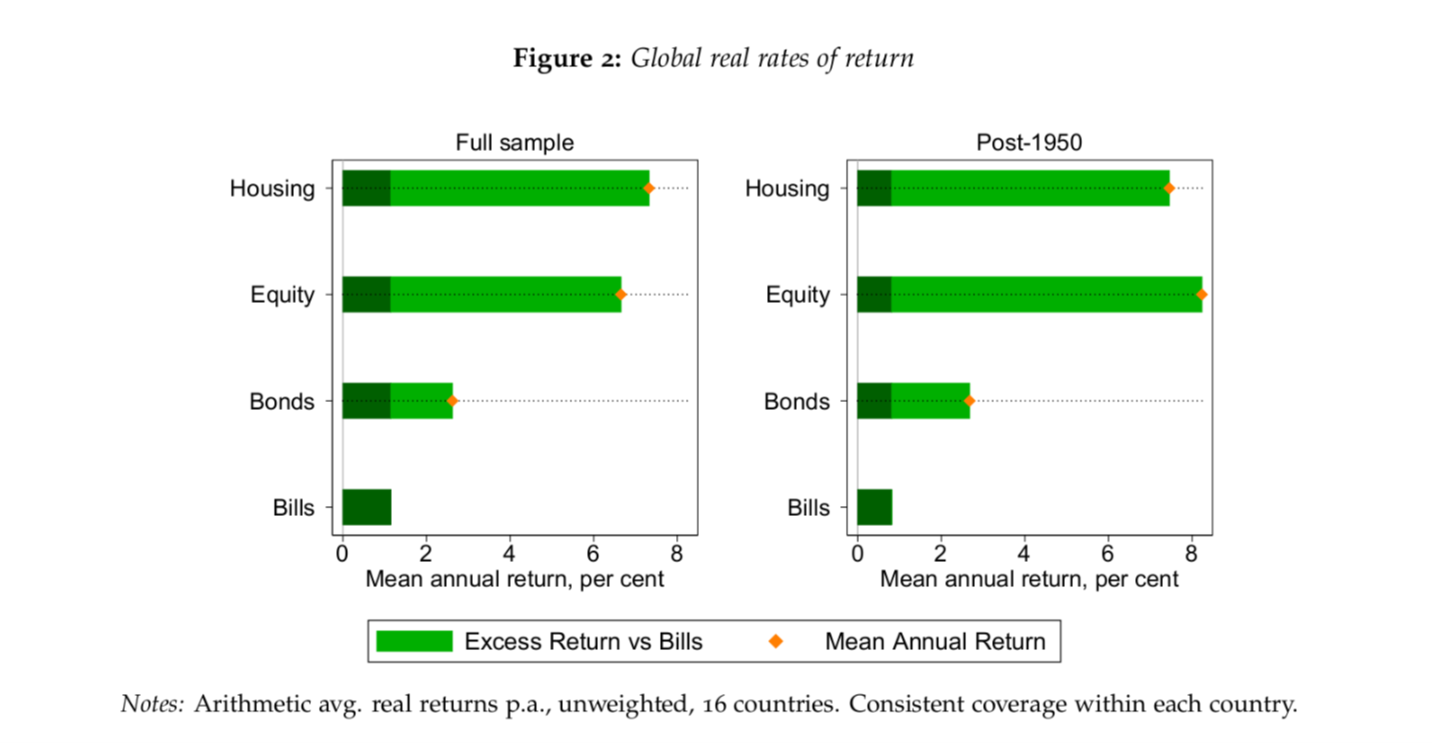

The paper is full of interesting and insightful findings, but I would focus on just one of them in this blog post. According to Jordà et al.’s data, the real rate of return on housing during the sample period is very similar to that of equity, here is the graph they’ve shown in the paper:

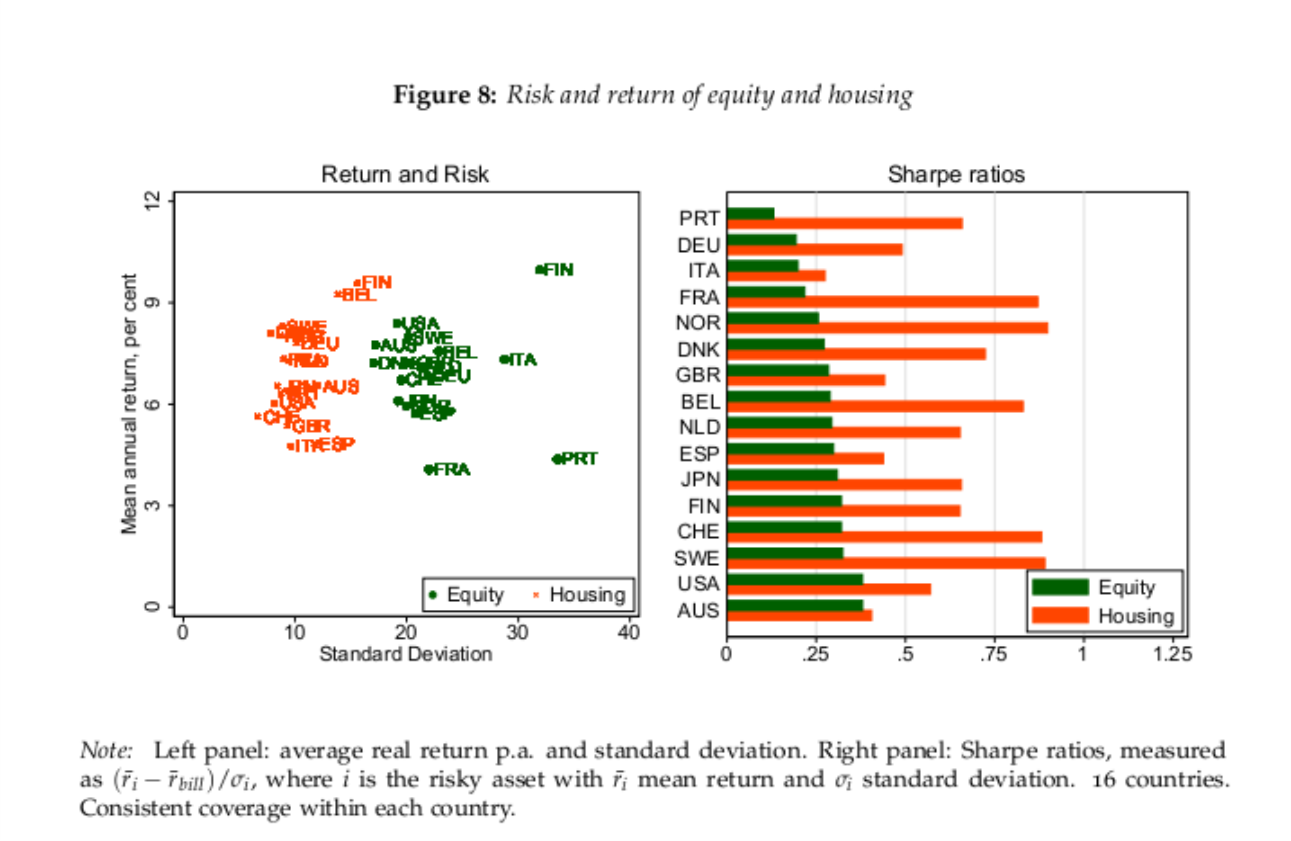

Given the fact that the volatility of return on housing is much lower than that of equity (10 v 22, in terms of standard deviations), the risk-adjusted return on housing is comparatively higher. Here are the graph showing the Sharpe Ratio of the two assets in all 16 sample countries:

This is the result that prompt Noah Smith to write in a recent Bloomberg View column, saying that “ignoring land is a mistake. Despite the explosive growth of corporations since the Industrial Revolution, land still represents a huge percent of all the wealth in the economy. What’s more, focusing only on capital gains neglects the extremely important fact that land earns income from rent. If you live in your own house, this income is implicit — living in your own home means you don’t have to pay rent to someone else. But if you’re a landlord, you get checks every month, just like stockholders receive quarterly dividends…”

But many of the readers in my recent Chinese post about this research has voiced their cautions about using this result too literally. As Noah has mentioned in his post, ” That doesn’t mean that investors should ditch their stocks and run out to buy houses — liquidity is a real issue…”

Many readers asked me how the authors deal with the liquidity differences between housing and equity. They, myself included, expected that the authors have done some adjustments or robustness test about this issue. But to my surprise, there is no obvious mention of this problem.

In order to answer my readers’ inquiry, I have emailed Prof. Alan Taylor of UC Davis to ask him about this issue. He is very nice to give me a reply. “At the moment we are presenting just raw returns for all countries for 145 years. This alone took us several years of work.” He continued,”The good thing is there is no argument about a raw return. In contrast, there is a lot of dispute about how to measure (or rather, guess) a liquidity premium.”

Taylor explains that, in the current stage, they are using the simple asset pricing assumptions to make the comparison between the return of different assets. “In economics/finance, our basic asset pricing theory is about the representative buy-and-hold investor, so that investor never buys or sells, they hold the market. One could think of, e.g., an asset manager holding a portfolio (non-timing) for the long run. I hope this helps.”

At the end of his email reply, he also encourages other researchers to help overcome this issue, “Others will be welcome to take our data and apply a liquidity correction, of course.”