Debt Growth Rate, not Level, Predicts Slowdown

Last week, Bank of England's Deputy Governor for Monetary Policy Ben Broadbent gave an insightful speech about debt dynamics.

An important point Broadbent has...

Akerlof on Keynesian-neoclassical synthesis’s departure from Keynes

George Akerlof explains how the Keynesian- neoclassical synthesis dominated the field, and what problems this dominance resulted.

Helicopter Money is here in Hong Kong? Well…

“The money helicopter has arrived,” Claire Jones writes in her FT Alphaville post, citing Hong Kong Finance Secretary’s announcement of a handout of HKD...

What is the Saturated Level of Reserves?

The Saturated Level of Reserves or efficient level of reserves, is the point which the opportunity cost for banks to hold reserves disappears, and became indifferent towards holding more reserves. The reserve demand curve beyond this point becomes close to horizontal.

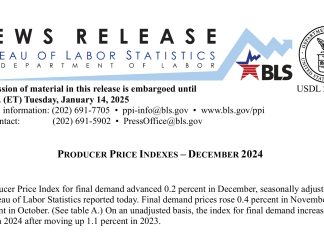

No, PPI is not a measure of wholesale inflation

A standard perception of PPI is that it is a measure of "wholesale inflation", but the BLS told EconReporter that this interpretation of PPI is not at all correct.

Macroprudential Policy – how does it differ from rate hikes?

Macroprudential policies, it is argued, are more targeted and can complement central bank’s use of interest rate policy.

How to use the Fed’s FIMA Repo — the case of Hong Kong

Hong Kong Monetary Authority, the de facto central bank of Hong Kong, announced on April 22 that it will utilize the Fed's FIMA Repo facility to borrow USD 10 billion of cash.

BIS’s latest hunt for Zombie (firms)

In the latest BIS Quarterly Review, researchers Ryan Banerjee and Boris Hofmann consolidated some of the earlier research to illustrate the problem of zombie firms. They argued that the rise of zombies predated the 2008 financial crisis, and has since been dragging down the productivity of the real economy.

IMF Growth Projections and Overfitting in Judgment-based Economic Forecasts

In a recent IMF working paper "Overfitting in Judgment-based Economic Forecasts: The Case of IMF Growth Projections", economist Klaus-Peter Hellwig examined IMF's World Economic Forecasts (WEO) and check if the forecast model suffer from the problem of overfitting.

Why Yellen should have stayed as Fed Governor? | Interview with Conti-Brown

Peter Conti-Brown, author of one of the best book about the institution of Fed, "The Power and Independence of the Federal Reserve", explains what Jay Powell's nomination means to the Fed independence and why Janet Yellen should have stay as governor after his Chair term ended.