Should Federal Reserve use scenario analysis to handle trade war uncertainty?

The Fed is currently in a "wait and see" mode in deciding what is the reaction to Trump's trade policy. But is it possible for the Fed to be a bit more proactive than merely saying "we will be able to update you further when we know more details"?

Enters scenario analysis.

No, PPI is not a measure of wholesale inflation

A standard perception of PPI is that it is a measure of "wholesale inflation", but the BLS told EconReporter that this interpretation of PPI is not at all correct.

Dallas Fed’s Logan cites neutral rate uncertainty as reason to ‘proceed cautiously’ on rate...

Lorie Logan, president of Dallas Fed, expressed worry about uncertainty surrounding the exact level of neutral rate of interest and hinted at the risk that the Federal Reserve's policy rate might already near the point which further rate may starts to fuel inflation again

Federal Reserve has never been this ‘confused’ about neutral rate

Federal Reserve decided to cut rate by an supersized 0.5 percentage point. The decision finally ended the weeks-long market debate of whether the central bank would cut 25 or 50 basis points. One important thing, though, didn't reach the headline: The Fed has never been this "confused" about where the natural rate should be.

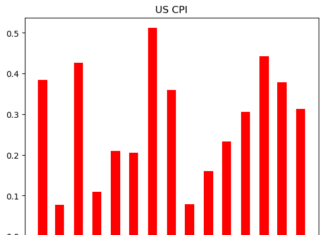

How to make US inflation chart by pulling data from BLS API with Python

An important question is how do we get the series IDs for the data you need. The short answer is through BLS's Data Finder

Measuring Federal Reserve officials’ secret disagreement behind locked doors of FOMC meetings

Dissent votes in Federal Reserve policy meetings are rare, accounting for only 6.37% of the votes between 1976 and 2017. However, opting not to vote against the FOMC consensus doesn't necessarily mean committee members don't "disagree" with it.

Is tipflation even part of inflation?

Or, to frame the question in a more technical way: is tipflation even counted as part of Consumer Price Index (CPI) inflation?

Early signs of inflation expectation de-anchoring back in 2021

Ricardo Reis, economics professor at the London School of Economics, explained that there were telling signs that the increase in cost of living started ealry-2021 was not a "transitory" phenomenon.

Economic benefit of asset market bubble

What the impact of asset price bubbles on US economic growth is.

Why Fed projects to cut rates next year even it expects failure to reach...

Inflation projections by Fed officials show that PCE inflation will not reach 2% by the end of 2025. Why the Fed expects to cut rate next year then?