Macroprudential Policy is a popular tool to curb systemic financial risks since 2008 financial crisis. It works under similar concepts as the traditional, simple monetary policy. Like central banks rising rate, the aim is to increase the cost of lending for banks and other financial players, reducing excessive lending in the system.

Why use tools like loan to value ratio, reserves requirement and capital ratio to do the job when the central bank can use one powerful interest rate to lean against the wind and stop all the bubbles?

Macroprudential policies, it is argued, are more targeted and can complement central bank’s use of interest rate policy. This is an argument which economists Soyoung Kim and Aaron Mehrotra tries to empirically demonstrate in their working paper, for the Bank of International Settlement, “Examining macroprudential policy and its macroeconomic effects – some new evidence.”

In their paper, Kim and Mehrotra uses a SVAR model with economic data from 32 economies (19 advanced and 13 emerging markets) from 2000 to 2014, to derive the estimate of the effect of macroprudential policy and monetary policy tightening over a period of time.

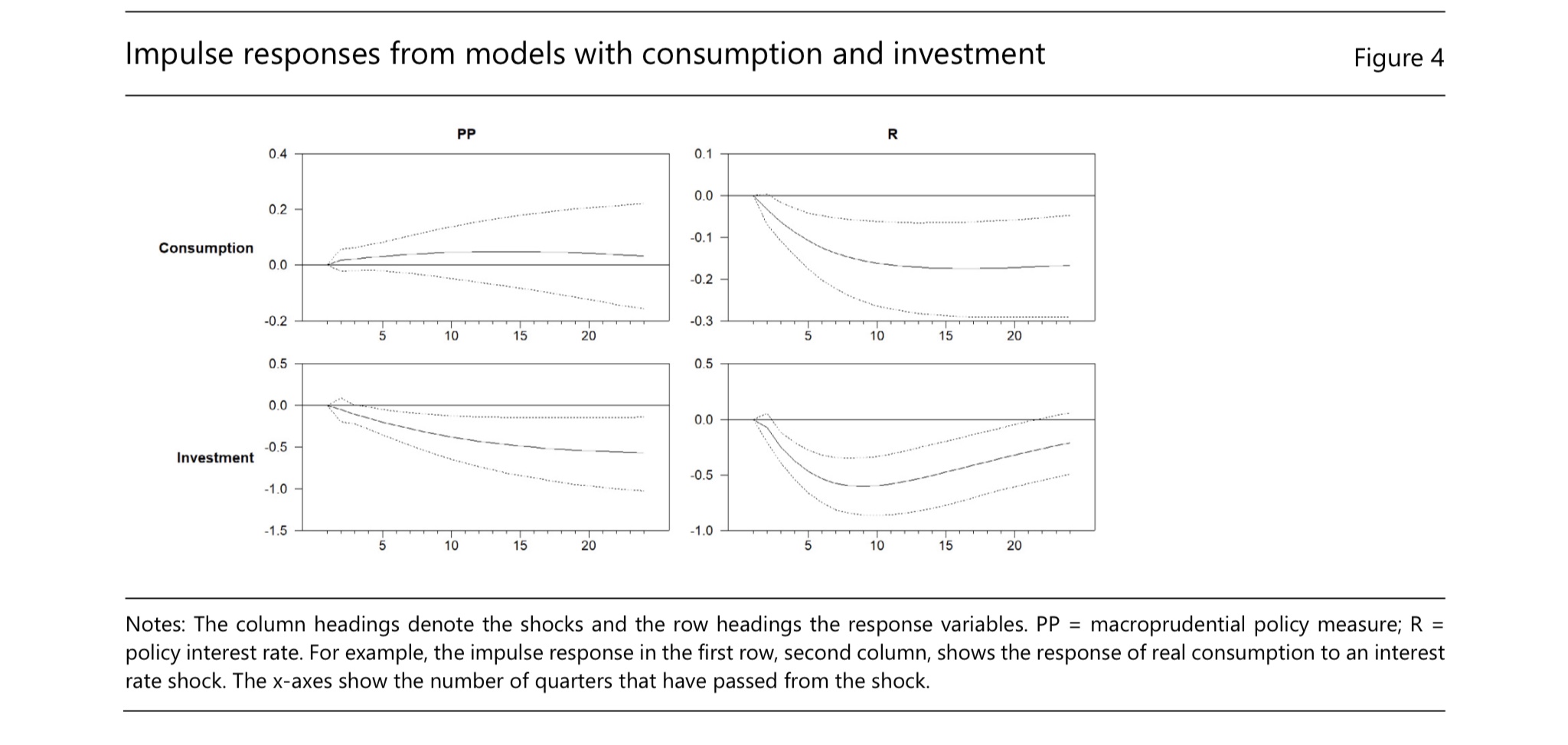

After a contractionary macroprudential policy shock (PP in the figure below), their estimate shows that, in general, the economy will experience reductions in the level of GDP, CPI and total credit (CRD). Here, we can see a rise in interest rate (R in the figure) generates similar effects in these three statistics.

The difference is that rate hikes will lead to a fall in consumption, but a contractionary macroprudential policy won’t, according to the estimates.

Another difference between the two is found in the effect on the level of credit. While the tightening of either one can both generate reduction in household credit, only a contraction in monetary policy results in an immediate fall in corporate credit.

Macroprudential tightening will reduce lending to business after more than a year, but effect is not statistically different from zero, according to the estimates.

The author thinks that macroprudential actions aimed at corporate credit could be subject to “leakage” effects, that is, domestic banks can increase their reliance on market-based or foreign funding if credit dries up. This effect make macroprudential policy less powerful compared to monetary policy, which has a more widespread impact on the economy, as it sets the price of credit in a given currency and affects all financing in the economy.

In sum, these findings suggests that macroprudential policy mostly affect the economy via investment, in particular residential investment, and household credit, while monetary policy shocks affect both consumption and investment, and credit to firms as well as credit to households.

A policy implication is that, if an economy is undergoing a credit boom but inflation remains low, contractionary macroprudential policy coupled with expansionary monetary policy may achieve the result the authorities seek, as macroprudential policy tends to have a narrower effect on the economy in terms of the expenditure components and the affected sectors, compared with monetary policy, keeping the trade-offs between the two in check.

Reference:

Mehrotra, Aaron, and Soyoung Kim. “Examining Macroprudential Policy and Its Macroeconomic Effects – Some New Evidence.” BIS Working Paper, December 2019..