In a previous article, we have discussed some empirical pattern following bubble episodes in the US housing market, detailed by a research paper written by economist Byron Tsang and Xiaojin Sun who found empirically that housing prices tend to rise further for one further year after a bubble episode developed before a crash occur.

Here we have another research that looks into a related but broader question: what is the impact of asset price bubbles on US economic growth.

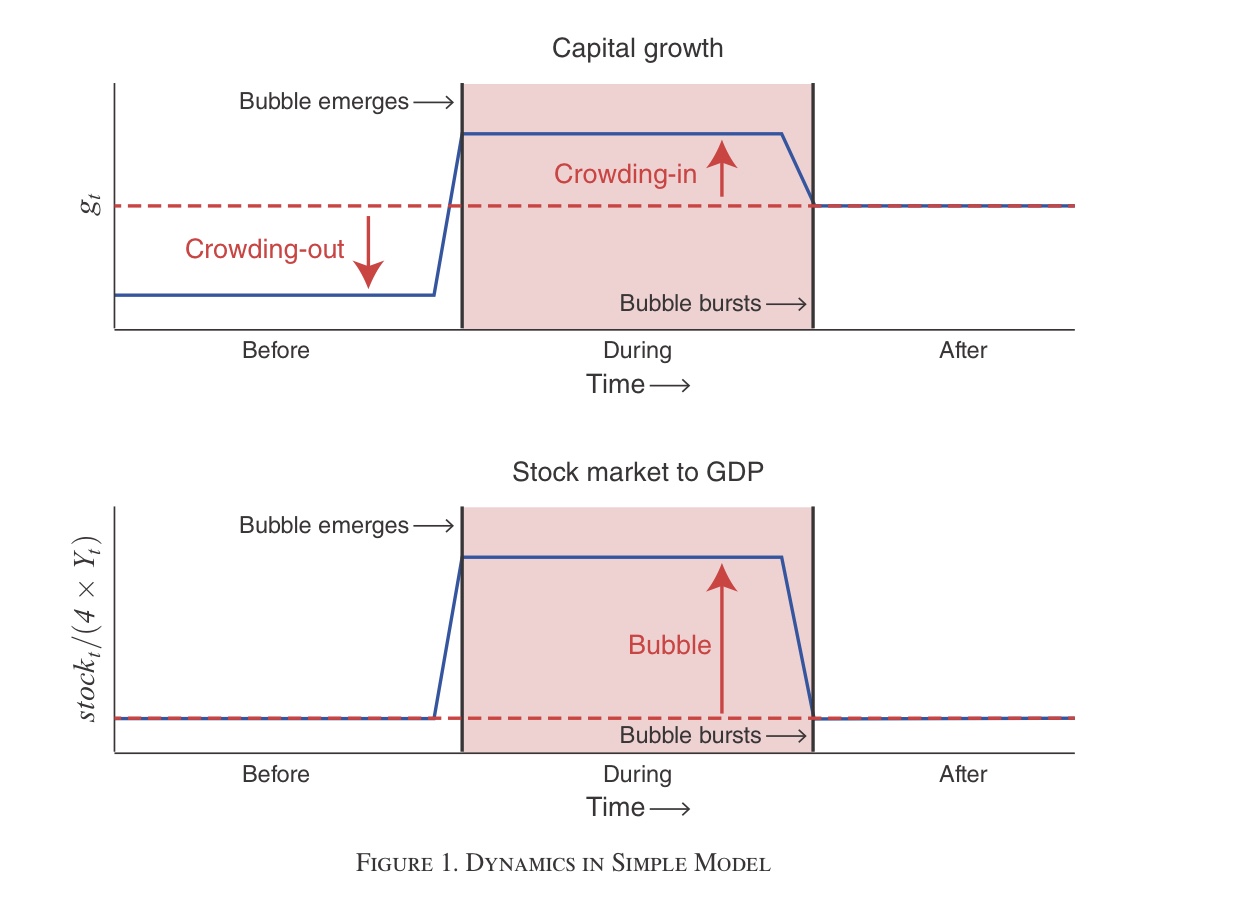

Bubble can crowd-in — or crowd-out — investment

In their recently published research on the American Economic Journal: Macroeconomics, economists Pablo A. Guerron-Quintana, Tomohiro Hirano and Ryo Jinnai built an endogenous growth model with overlapping generations, to look into the ups and downs in investment and economic growth due to bubble episodes.

- In their model, a realized bubble can help increase assess to financing in the economy and speed up capital build-up — a crowding-in effect of bubble.

-

On the other hand, expectation of bubble would lead households to think they will soon get wealthier by riding the upward trend in the asset markets. This positive wealth effect leads to increase in consumption and crowds out investment.

Which effect dominates?

Then a question is, which effect — crowding-in or crowding-out — dominates.

One answer from the model is that it depends on the development level the economy’s financial system.

- In an underdeveloped financial market, the exuberance can help increase investment and facilitates more efficient capital allocation;

- thus, the crowding-in effect during a bubbly episode dominates.

But in an economy with advanced financial system, recurrent bubbles can be harmful to long-run growth.

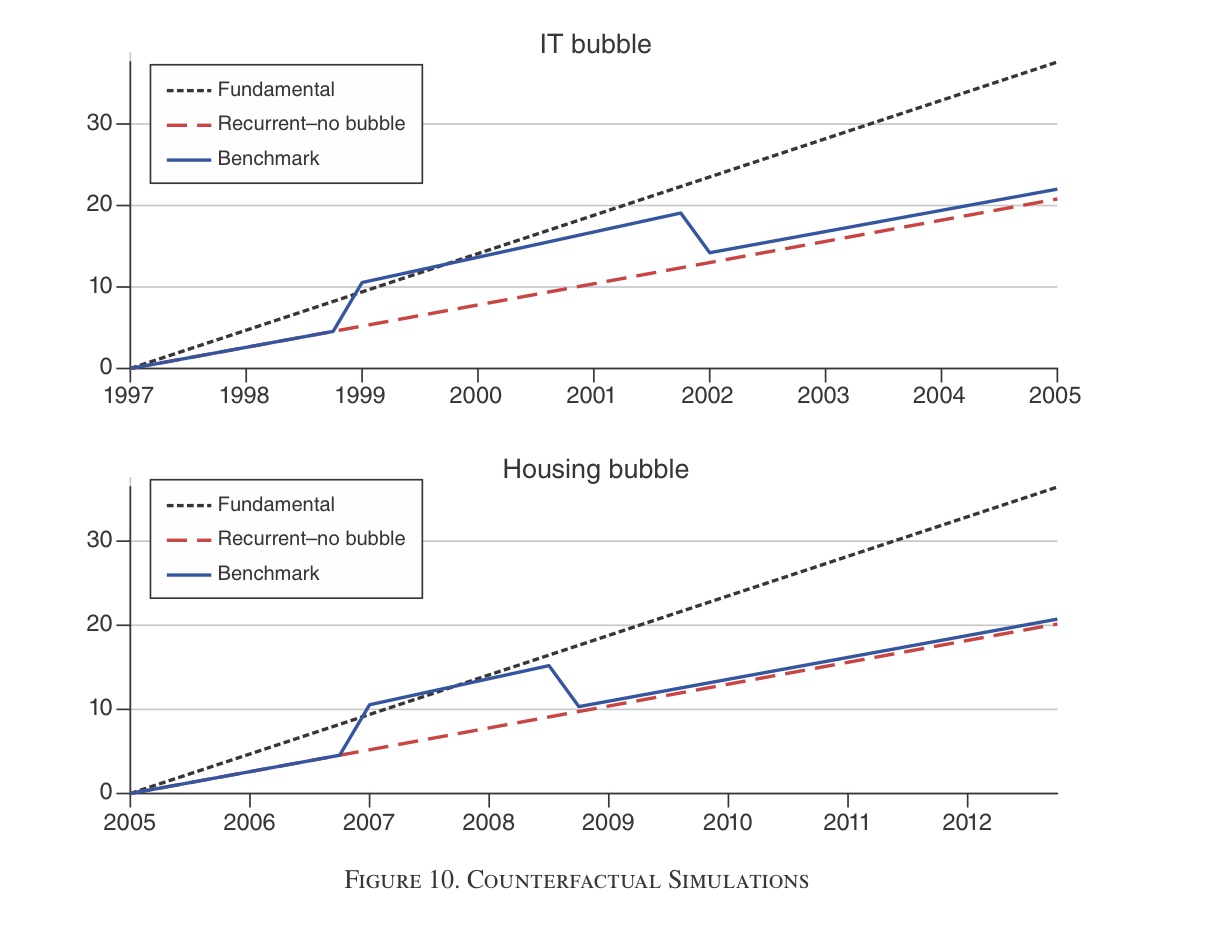

The researchers then applied their models to the US economy and stock market from 1984 to 2017, a period in which they identified two bubbles episodes: the 1997 to 2001 dot-com bubble as well as the housing bubble prior to the Great Recession.

- Compared to a counterfactual world in which the two bubbles didn’t materialize, US GDP was estimated to have raised by about 2 percentage points.

- The dotcom bubble contributed about 1.2 percentage points while the housing bubble boosted 60 basis points.

Still, if there were no bubble, ever…

However, the researchers also used their model to simulate a world in which bubble never occur, i.e. the crowding-out effect of an anticipated bubble is absent.

- The trend growth of this scenario (fundamental) will be even higher than the “real” world scenario, in which the bubbles had boosted the US economic output.

- Guerron-Quintana, Pablo A., Tomohiro Hirano, and Ryo Jinnai. 2023. “Bubbles, Crashes, and Economic Growth: Theory and Evidence.” American Economic Journal: Macroeconomics, 15 (2): 333-71.