Fed’s swap lines help easing Covid-era global dollar shortage

Countries with swap line arrangement with Federal Reserve, be it the standing ones or temporary, saw smaller increases in spread during the initial pandemic stress period.

‘Unusually low’ Hong Kong interest rate is a policy choice*

A careful study of Hong Kong's currency peg that explain why the current low-interest rate environment can be interpreted as a result of the Hong Kong Monetary Authority's policy choice.

Akerlof on Keynesian-neoclassical synthesis’s departure from Keynes

George Akerlof explains how the Keynesian- neoclassical synthesis dominated the field, and what problems this dominance resulted.

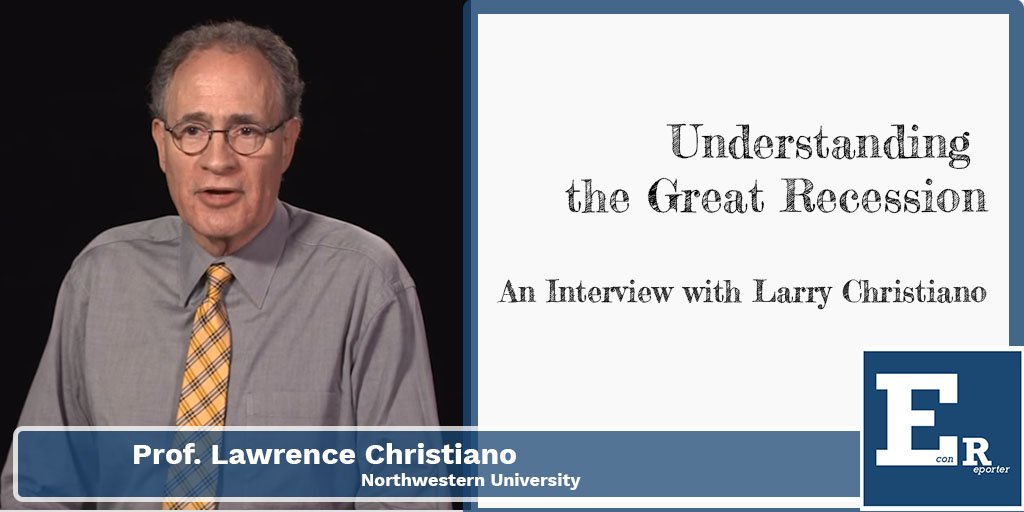

What is Hysteresis?

Hysteresis is referred to the hypothesis that recessions may have permanent effects on the level of output relative to trend.

The Missing Profits of Nations and Multinationals’ Extreme Profitability in Tax Havens

The economics of tax evasion is a growing field in academic economics. There are much new exciting research trying to understand the mechanism behind global tax evasion. "The Missing Profits of Nations” by Thomas R. Tørsløv, Ludvig S. Wier and Gabriel Zucman is one of the most noteworthy research on the dynamic behind global tax evasions.

What is the Saturated Level of Reserves?

The Saturated Level of Reserves or efficient level of reserves, is the point which the opportunity cost for banks to hold reserves disappears, and became indifferent towards holding more reserves. The reserve demand curve beyond this point becomes close to horizontal.

The problem with monetarist’s view of inflation

Long-run stability of the velocity, or the filpside of it, money demand, however, is not a empirically founded assumption.

Shadow Fed Chair — and Powell’s nuclear option to counter it

President Trump's plan to install a "Shadow Chair" months before Jerome Powell's term ends will definitely reshape US monetary policy — but it could face a surprising challenge from Powell himself.

Macroprudential Policy – how does it differ from rate hikes?

Macroprudential policies, it is argued, are more targeted and can complement central bank’s use of interest rate policy.

Federal Reserve has never been this ‘confused’ about neutral rate

Federal Reserve decided to cut rate by an supersized 0.5 percentage point. The decision finally ended the weeks-long market debate of whether the central bank would cut 25 or 50 basis points. One important thing, though, didn't reach the headline: The Fed has never been this "confused" about where the natural rate should be.