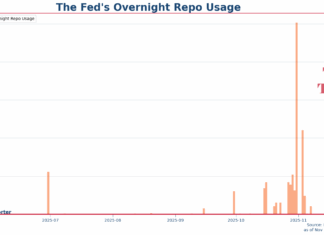

Why the Fed’s Standing Repo Facility Isn’t for Daily Use: An Explainer

"The [Standing Repo Facility (SRF)] rate is set at the top of the FOMC’s target range for the federal funds rate. This combination of an ample supply of reserves and an SRF rate at the top of the target range reduces the day-to-day reliance on the facility except during periods of significant upward pressure on rates resulting from strong liquidity demand or market stress," said John Williams

September FOMC Meeting: The Potential Dissenters

The Federal Reserve is expected to cut its benchmark interest rate by 25 basis points this week. This has been the baseline market assumption since Chairman Jerome Powell's speech at Jackson Hole, in which he proclaimed, “the shifting balance of risks may warrant adjusting our policy stance."

The question is, how many dissenting votes will Powell face in this meeting?

Hold on, Bank of England: The Fed is not so different from you on...

The Bank of England on Thursday released its latest Monetary Policy Report, announcing its decision to lower its policy rate by 25 bps to 4%. The report contains a lot of excellent analysis, including on the recent rise in food prices, the effect of trade war as well as a review of its quantitative tightening policy.

But one thing, a comparatively much less important thing, in the review just stuck in my mind...

Trump appointees will get Fed board majority when Powell is gone – and it...

Trump-appointed Fed governors will hold a board majority by the time Powell steps down as a governor. And that could matter a lot.

‘Unusually low’ Hong Kong interest rate is a policy choice*

A careful study of Hong Kong's currency peg that explain why the current low-interest rate environment can be interpreted as a result of the Hong Kong Monetary Authority's policy choice.

Shadow Fed Chair — and Powell’s nuclear option to counter it

President Trump's plan to install a "Shadow Chair" months before Jerome Powell's term ends will definitely reshape US monetary policy — but it could face a surprising challenge from Powell himself.

Why is the Hong Kong-US interest rate spread so persistent? — Currency peg in...

A spread of over 3.5 percentage points between US and Hong Kong Interest rate persisted for close to two months and so far arbitrage has failed to close the gap, leading to discussion of whether Hong Kong's Linked Exchange System is failing. This article, however, will explore some technical factors behind this interesting interest rate gap.

Hong Kong dollar amid ‘Asian Financial Crisis in reverse’ — basic explainer

An explainer on how Hong Kong Linked Exchange Rate System works, what Aggregate Balance is, and how interest rate arbitrage help maintains Linked Exchange Rate System.

Where are the endpoints of QT? Ample Reserve System vs Demand-driven Floor System

Quantitative tightening (QT)—a process central banks use to reverse years of liquidity creation from quantitative easing (QE)—is concluding in many advanced economies. The central banks are growing confident that reserve levels in their financial systems are nearing their endpoints.

Where are the endpoints of QT and what come next?

Should Federal Reserve use scenario analysis to handle trade war uncertainty?

The Fed is currently in a "wait and see" mode in deciding what is the reaction to Trump's trade policy. But is it possible for the Fed to be a bit more proactive than merely saying "we will be able to update you further when we know more details"?

Enters scenario analysis.