In a research paper, “The Burst of High Inflation in 2021–22: How and Why Did We Get Here?“, Ricardo Reis, economics professor at the London School of Economics, explained that there were telling signs that the increase in cost of living started ealry-2021, which was rising rapidly above the Fed’s 2% target and remain elevated since then, was not a “transitory” phenomenon.

The signs were inflation expectations in the US had already started de-anchoring.

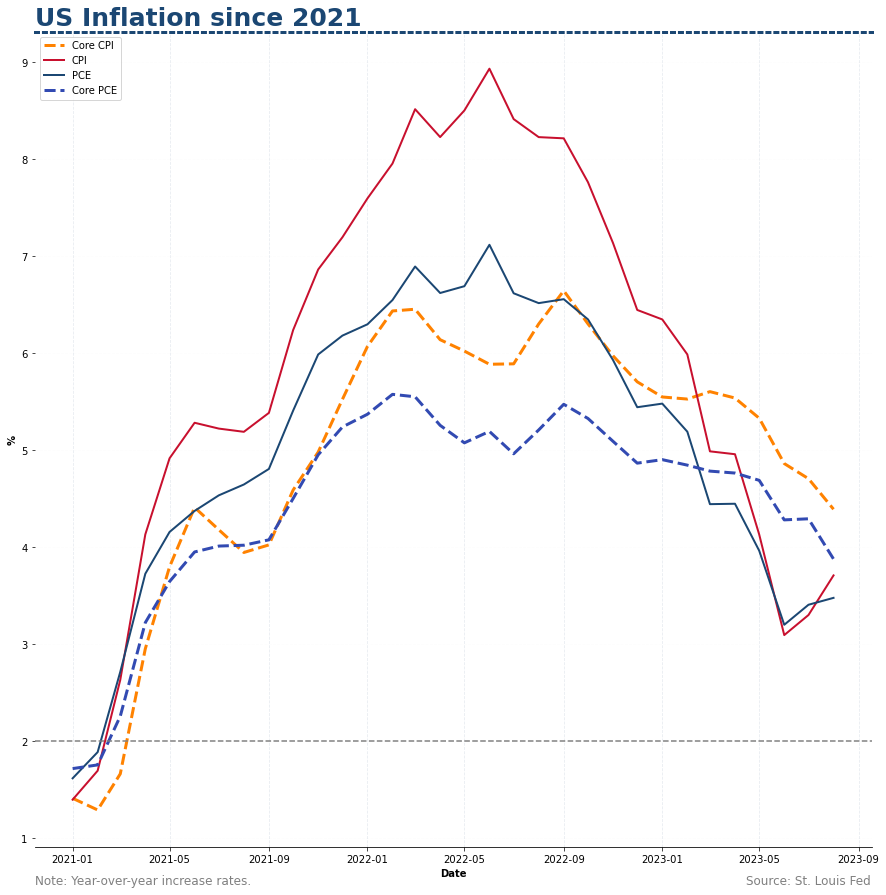

With hindsight, we now know that all those “transitory inflation” predictions back in 2021 were far from correct.

Both headline CPI and PCE price index continued to rise throughout 2021 and peaked mid-2022. Core inflation indicators has yet to fall back to the US central bank’s 2% target as of Q3 2023.

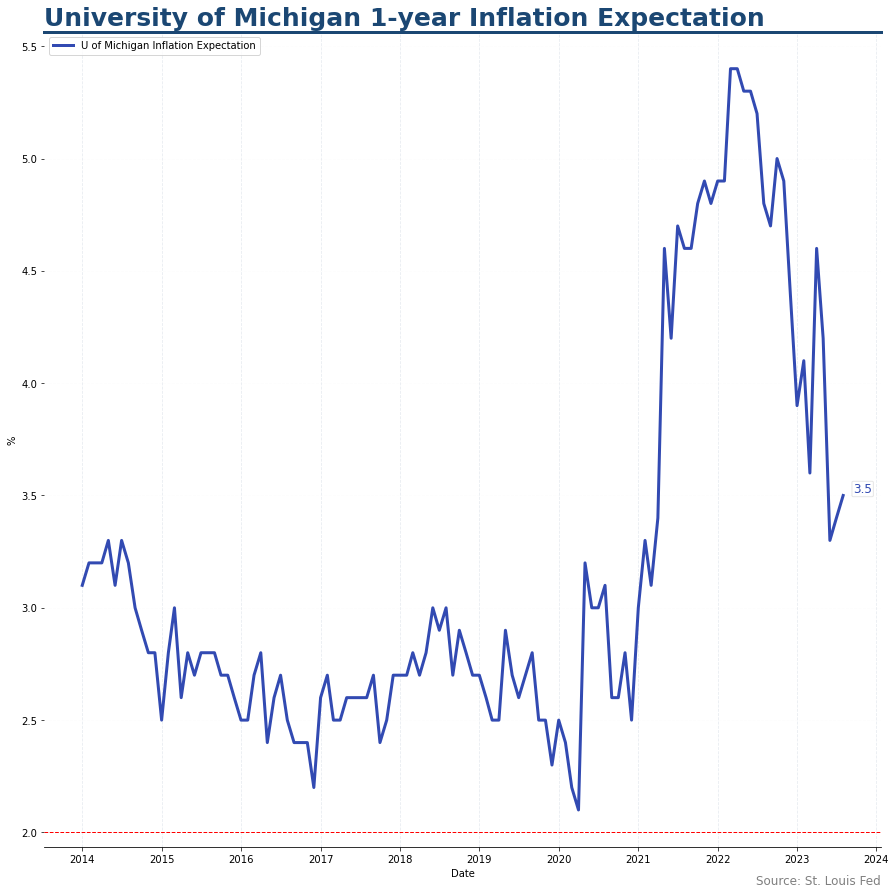

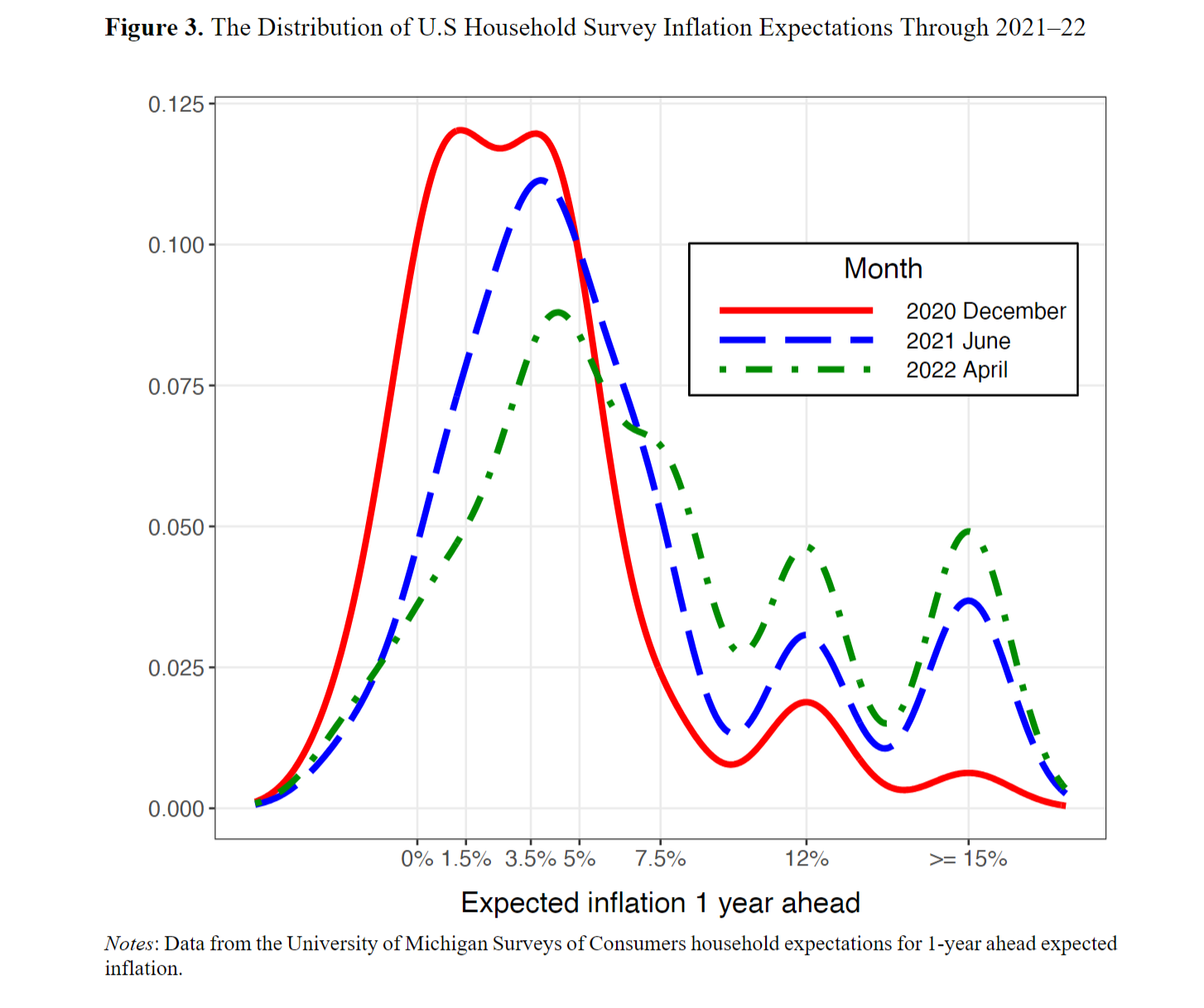

In a reexamination of this inflation episode, Reis pointed out that inflation expectation actually flashed signs of de-anchoring in the University of Michigan Surveys of Consumers as early as mid-2021.

Inflation expectation for one-year ahead captured by University of Michigan Surveys of Consumers shot up from the mid-2021 and topped 5% in the following year.

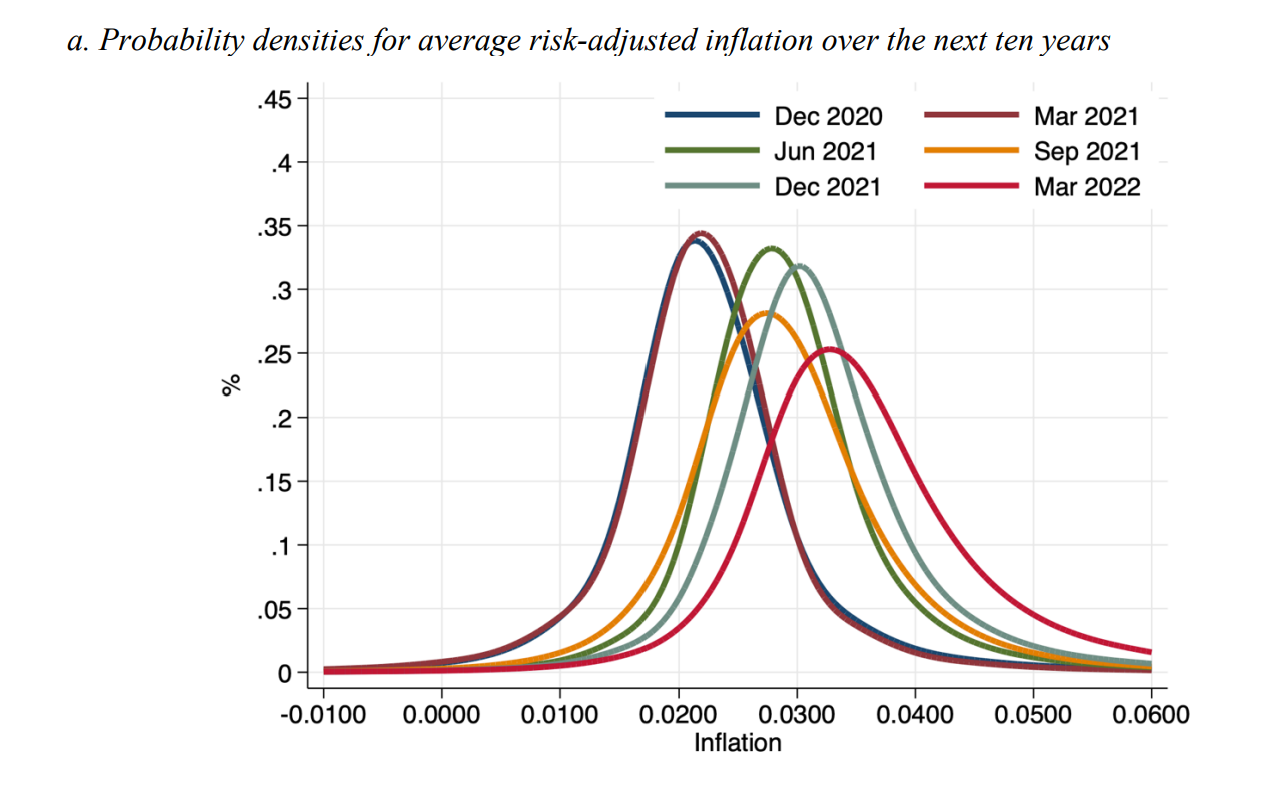

Prior to the surge in headline figure, which shows the central tendency of the surveyed expectations, Reis said the rapid increase in inflation expectation was actually preceded by a higher skewness in the measure, which showed a “rising share of households started expecting that inflation would be higher.”

More and more surveyed households expected that inflation can reach level above 5%, as you can see in the graph above, shifting the expectation distribution to the right. Similar shift of inflation expectation also appeared in the US in the late 60s, and a leftward shift foreshadowed a disinflation in the early 80s, Reis added.

More and more surveyed households expected that inflation can reach level above 5%, as you can see in the graph above, shifting the expectation distribution to the right. Similar shift of inflation expectation also appeared in the US in the late 60s, and a leftward shift foreshadowed a disinflation in the early 80s, Reis added.

Similar signs appeared in the options prices that predicts the long-term inflation. Investors were increasingly betting on a higher probability of elevated inflation rate over the next ten years, as the probability distribution implied by options prices shifted to the right since mid-2021.

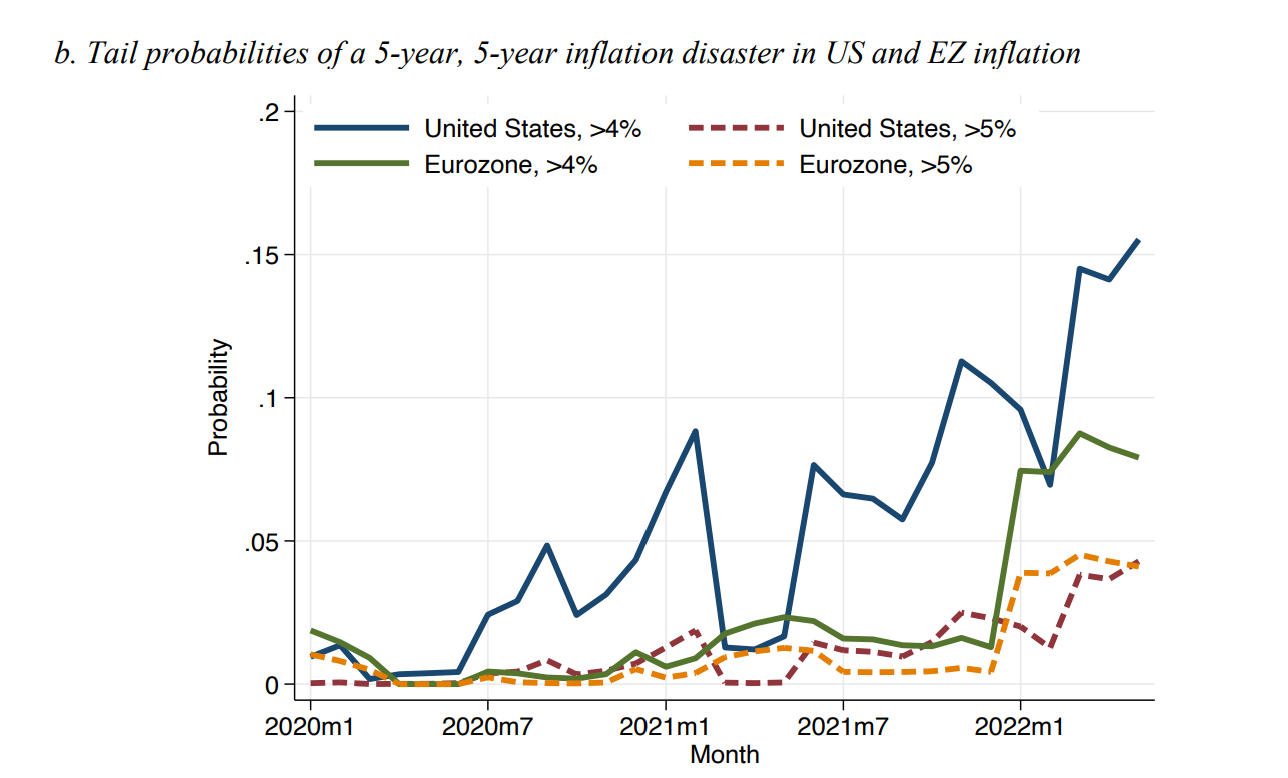

Alongside with that, investor started purchasing more insurance against “inflation disaster” scenario. The perceived probability of inflation rising over 4% in the 5-year, 5-year period (that is the five-year period starting five years later) also rose since mid-2021. This, Reis wrote, can be interpreted as investors started to doubt the Fed’s credibility in keeping inflation within its 2% target.

As the inflation expectation starts to de-anchored and the Fed’s credibility began to weaken, the central bank had less control over the inflation surge and partially contributed to the continued climb in general price level.

--- Follow us on Bluesky and Google News for our latest updates. ---