Last Updated:

Welcome to the latest installment of our interview series “Where is the General Theory of the 21st Century?”

“Where is the General Theory of the 21st Century?” is an interview series which we ask top economists a very important question: “Why haven’t economists come up with a new General Theory after the Great Recession?” We want to know how the macroeconomics academia has evolved since the Great Recession, and why the responses from macroeconomists since 2008 are different from their counterpart in the 1930s.

In this installment, we continue our discussion with Prof. Charles Calomiris, Henry Kaufman Professor of Financial Institutions at Columbia Business School. The topic of this installment is the missing role of politics in economics models of banking crises. We also discussed if Calomiris thinks macroeconomics has a similar problem.

One might first read the first part of our interview, which Calomiris explained the role of political institutions in causing the Financial Crisis of 2008.

(The interview is edited for clarity. All mistakes are ours.)

Q: EconReporter C: Charles Calomiris

Q: You have mentioned in the last chapter of the book “Fragile by Design” that most general theories on banking crises, namely those focus on banking structures, interbank connections, and human natures are not sufficient explanations of crisis. Why do you think that the political narrative is the key determinant? Why is it neglected in mainstream economics?

C: It’s a good question. Let me just start by pointing out that the simplest facts are sometimes the most important ones. Strangely, when economists are trying to think about banking crises they have been the ones that have been the most ignored by economists.

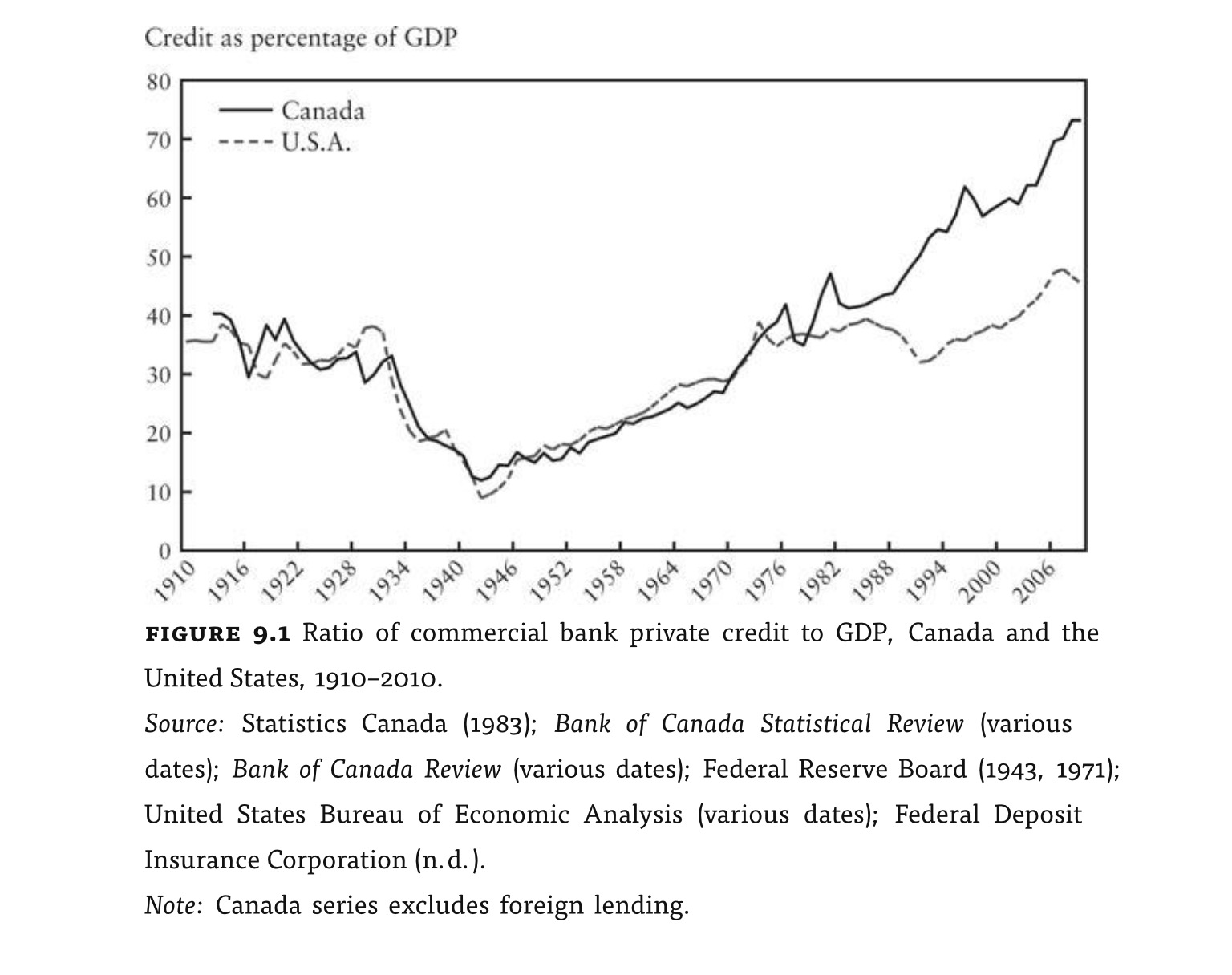

Let’s point out that the simple facts are that the banking crises are not happening constantly, and they are not happening in all countries. For example, Canada has never had a banking crisis. Never. The always have had a very large banking system the last 200 years, almost. They have a very risky economy which relies primarily on the commodities-exporting as well as the manufacturing sector. So, Canada has a very volatile GDP over its history. It is not that the lack of banking system, yet they haven’t had a banking crisis.

If the whole world is like Canada, there would not be a banking crisis literature in economics because there would never have been a banking crisis to write about. That’s very funny to me. (Laughter)

I like to say that if it weren’t the fact that America is sort of the capital of the economics profession, economists wouldn’t have come through graduate school thinking that banking crisis was so common. They would have thought that banking crises never happened if Canada was the US in terms of its influence, power, and size. It is why people in the economics profession have thought that banking crisis is constant, it is because they have been constant in American history. But American history is actually quite peculiar in that regard. Prior to the period 1874 to 1930, there were about 10 banking crises in the world that were really significant and 5 of them happened in the US.

Now, if we look at the last 40 years, many countries have avoided having any banking crises. In particular, some countries have managed to have a very large banking system and yet no banking crisis. Those countries include Australia, New Zealand, Hong Kong, Malta, Singapore and Canada. While at the same time, the US has had two major banking crises, you could even argue more than two. Which put it into a category that is very unusual. The US s in the category of about 1/5 of the countries in the world that have had more than one than one banking crisis in the last 40 years. Those are countries like the Democratic Republic of Congo, Chad, and Argentina.

If you step back for a minute and just think: “Are banking crises something that happens all the time?” No. But they are much more frequent now than they used to be. That leads us back to the fact that in democracies politicians are using the banking systems for political purposes very destructively, as I have pointed out in the research that I have been doing with Sophia Chen.

Not only that they are higher now than they used to be. They happen in some countries more than the others, both historically and currently. That shows you that it is not something inherent in banking systems that we must have crises. It’s a political choice. It is the political choices that change over time and differ across countries.

If economists were thinking more about history and politics, they wouldn’t have written down models of banking crises that were so mechanical. So I sometimes like to tease my theorist friends by saying to them: “Where is the country subscript in your model of banking crises?” They would look very puzzled. Then I say to them: “Your model pretends to be a universal model that apply to all countries but then how would your model explain the differences between countries like Canada and the US?” Then they would just look kind of annoyed and hope that I just go away. I am getting in the way of their little game of writing down silly little sets of equations pretending that it is general.

I think this is a big problem in economics theory because we pay people very good salaries to go around theorizing things that may not be very relevant. I am not suggesting that theories are not relevant. I am suggesting that some theorists are not really interested in coming to grips with reality. I think that’s inappropriate for theoretical modeling to be done in the way that some obviously contrary to reality. Theories are very relevant for understanding the potential for crises as a matter of economic reasoning, but they have to be models that explain the politics. So we think that our book is the beginning of getting economists to think about modeling in this direction.

I think that my subsequent work now with Sophia Chen [note](The papar is called “The Spread of Deposit Insurance and the Global Rise in Banking Risk since the 1970s”, still work in progress by the time this article is published)[/note] is also pointing into the direction of getting economists to try to answer the question that is really relevant — Why so many democracies designing to destabilize their banking systems by protecting banks and in return requiring the banks to finance risky mortgages? Why is that happening in the last 40 years all over the world? That is an interesting question. We have to come to grips with that question if we are going to find a way to deal with the current pandemic of banking crises.

We can’t just pretend that this is just all some constant sets of math equations. There is something very real and very disruptive that is happening. We can’t even recognize that it is happening unless we climb of our little hole of equations about banking. We have to think more broadly or else we are not even going to recognize that something new is happening. It’s really remarkable to me that I think many economists writing about banking ain’t even aware that the last 40 years are completely different and much worse than any period in human history. If we don’t start thinking about integrating political modeling with economic modeling of banking crises, we don’t even know what the basic facts are important, much less how to deal with them.

Q: After the Great Recession, macroeconomists are working to incorporate financial sector in their mainstream models. But do you think that it is more important for them to incorporate politics into their models, rather than financial sectors?

C: No. What you are referring to are macroeconomic models. From the standpoint of trying to understand the macroeconomy and writing down general equilibrium models, because you have got so many different things in such a general model, you have to take what is given in terms of the structure of the banking system and included them simply as a set of facts. So you want to include what I would call the high-risk components in the banking sector in your macroeconomic modeling. The purpose of that is not to explain why the banking sector is risky, but simply to take account of the risks as the propagator or magnifier of macroeconomic shocks.

So if you are a macroeconomist trying to predict volatility, your job is not to explain where the banking regulation is coming from but simply to understand it well enough so that you can model the macroeconomy. I would say that the macroeconomic model is very far from accurately capturing and including the financial systems in macroeconomic models. The DSGE models, of course, have no financial sector in the model prior to the crisis and they are still very elementary. However, I don’t blame them for not modeling the politics because that’s not the purpose of their models. Nonetheless, I think when banking theorists or banking historian or banking economists who are trying to understand cross-country and cross-time differences in banking crisis and banking system structures. There, it is very important for us to try to find other ways to include the political influences. It doesn’t mean that every model has to do that, but certainly, we need recognize that. I think the incentives in the economic profession are very misaligned. The economists have the incentives to get published, to pretend that whatever idea they have is very important, even when the idea is neglecting many other things.

So, I don’t blame the macroeconomists, their job is to incorporate the facts about the banking system in a very general model as best as they can. But I do blame the banking specialists, theorist and empirical banking specialists for not taking full account and for not admitting the narrowness of their ability to explain.

I just think that this is part of the incentives of academic research. I don’t blame individuals but I think that we editors of academic journals need to make sure that we don’t sort of further the ignorance that we at least say if something is a very narrow model, then somewhere in the model they should say: “Of course this model can’t explain the most basic facts. Nonetheless, it’s an interesting exercise for the following reasons…” That would be at least be more truthful and honest than pretending that “this model explain banking crisis” without any references to the fact that it doesn’t explain the most basic differences across countries and across time that are defining this current pandemic that we are living through. That’s what I found objectionable. It doesn’t bother me that macroeconomists ain’t able to explain things in their general models.

Q: In terms of macroeconomic policy and macroprudential policies, how can we incorporate political and historical narratives in the policy making process?

C: Of course they never do that. They want everything to sound very technical and don’t want to admit that they are playing politics. As we say, the last thing devil wants is for people to believe he exists. If you recognize that devil exists, you know god exists too. Politicians don’t want you to recognize that they and their incentives are creating banking crises. Quite the opposite.

Q: Anything that academics can do to help?

C: If we the academics are doing our job, we are use reasoning and facts to try to understand the world. It doesn’t mean that everyone has to be a historian, you could be a theorist. But if you are writing about a topic, I think it’s incumbent on you to learn enough of the basic facts to know what is important before you start doing your writing. That’s what I think academics can do better – make sure that there is a better understanding of the most important facts.

I think we as a profession are actually amplifying the politician’s narratives by claiming this is all technical problem when in fact what we should be doing is acting as an antidote to the politician’s narratives by pointing out that this is very much of a political problem. But the first thing that has to happen is the pervasive ignorance among academics has to change. Editors of academic journals have to require academics to be more modest and honest so that we have the right kind of message that we are giving. Ignorance is the main problem. You might think that professors are very knowledgeable and wise. But I am not sure that is an accurate portrait.

EconReporter is an independent journalism project dedicated to providing top-notch coverage on all things economics.

💡 Follow us on Bluesky and Substack for our latest updates.💡