Cloud Y

US inflation eases further in February as energy prices drop, PCE index shows

Inflation in the US showed further signs of easing as the yearly growth of core PCE price index slowed to 4.6% in February, while the headline number increased by 5%.

Fed-preferred PCE price index accelerated in January

Core PCE inflation rose 4.7% in January YoY, beating expectation of 4.4% increase. The Fed-preferred price index rose 0.6% MoM compared to the market expectation of 0.5%.

Market sees Bank of England to raise rate to 4% by May

The financial market expecting the UK policy interest rate UK will break 4% by May, more than double the current level of 1.75%. Financial Times reported.

The sizes of Sept rate hike to be decided on upcoming data, Fed officials...

Ahead of Jay Powell's keynote speech in Jackson Hole on Friday, two Fed officials said more rate hikes are still warranted, but they said it's too early to decide on the size rate increase yet.

Fed’s swap lines help easing Covid-era global dollar shortage

Countries with swap line arrangement with Federal Reserve, be it the standing ones or temporary, saw smaller increases in spread during the initial pandemic stress period.

US bans energy imports from Russia

"Russian oil will no longer be acceptable at US ports," President Biden said.

World Bank seeks to provide further USD 350 million loans to Ukraine

The World Bank is aiming to fast track the process to provide Ukraine an additional USD 350 million loan in the next few days, or as soon as the end of this week, Reuters cited people familiar with the plans.

Sberbank’s European subsidiaries placed under payment moratorium amid sanctions

EU’s Single Resolution Board has enforced payment moratorium on three European subsidiaries of Russian bank Sberbank, which is under US-led sanction, and is accessing whether any resolution action would be need to to protect public interest.

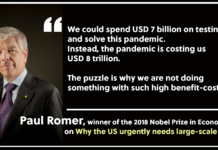

Interview with Paul Romer on large scale Covid testing – Transcript

Edited transcript of our interview with Paul Romer, on why the US urgently to scale up testing for Covid-19 and why he thinks the covid-crisis amounts an intellectual failure

US needs large-scale Covid testing urgently: Nobel winning economist Paul Romer

In an exclusive interview with EconReporter on Tuesday, Romer, co-recipient of the 2018 Nobel Prize in Economics Science, urged the US to adopt large-scale testing immediately to halt this most detrimental economic slump ever since the Great Depression in the 1930s.