Cloud Y

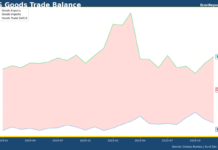

US goods trade deficit hits all-time high in 2025—What does it mean for Q4...

US trade deficit continues to widen in December after hitting recent year low in October. The total import was USD 70.3 billion higher than export in the last month of 2025, according to the US Census Bureau.

Planet Money Book—a long-time listener, first-time reader’s review

Planet Money Book is an excellent introduction to economics and finance and reminded me why it is good to have Planet Money in our life.

Understanding Hong Kong’s Exchange Fund Bills & Notes — Liquidity Flow Analysis

Exchange Fund Bills and Notes are debt securities issued by the Hong Kong Monetary Authority (HKMA) to manage liquidity in Hong Kong's banking system. It is a key tool for controlling how much cash is available in the banking system.

This post helps track Hong Kong's monetary operations and their real-time impact on banking system liquidity

US Trade Deficit Stabilizes as Post-Tariff ‘Front-Loading’ Fades

US trade deficit rebounded to USD 56.8 billion in November after recording a USD 29.2 billion shortfall, the smallest monthly since 2009, in the previous month, the US Census Bureau reported Thursday.

Bank of Canada Watch

The Bank of Canada on Wednesday decided to hold policy rate at 2.25% unchanged, as expected by markets. However, what is a notable is the Bank continues to show dovish bias given the recent rebound in economic data.

Reserve Management Purchases: The return of ‘non-QE’ asset purchases

Reserve Management Purchases (RMP) is a form of open market operations under which the Federal Reserve injects reserves into the banking system through "permanent" asset purchases with an aim to ensure the level of reserves remain "ample".

Canada Labor Market Watch

Canada's unemployment rate dropped substantially and unexpectedly to 6.5% in November, from 6.9% in the prior month, showing signs of a much-needed resiliency in the North American economy.

Standing Repo Facility Watch – Is the Fed’s ceiling tool working?

The Federal Reserve announced after the December meeting that it removed the aggregate limit on the Standing Repo Facility (SRF).

Repo rates spiked toward the end of the week, with SOFR and the Tri-party General Collateral rate (TGCR) reaching 4.12% and 4.08% on Friday, respectively, breaching the Federal Reserve's overnight interest rate target range.

Canada GDP: an Up-to-date checkup on the Canadian economy

While GDP rebounded by 0.65% in Q3 (2.6% annualized), the expansion was driven almost entirely by a 2.2% drop in imports.

Canada GDP rebound masks lackluster domestic demand

The Canadian economy saw a significant rebound in the third quarter. A 0.65% expansion in the quarter was more than enough to recover the downwardly revised 0.47% contraction in the previous second quarter.