Last Updated:

DEC 10 UPDATE

The Fed Scraps Standing Repo Facility Daily Usage Limit

The Federal Reserve announced after the December meeting that it removed the aggregate limit on the Standing Repo Facility (SRF).

The Federal Reserve Bank of New York said that after the daily aggregate operational limit is lifted, SRF moves to a full allotment format, meaning all bids for liquidity at the facility will be awarded in full. The previous aggregate limit was USD 500 billion a day.

Still, each eligible counterparty faces a per-proposition limit of USD 40 billion, given that the participants may submit one submission per security type during each of the twice-daily operations.

The Fed also announced it will restart its Reserve Management Purchases, buying USD 40 billion worth of Treasury bills in the first month.

What is the Standing Repo Facility?

The Standing Repo Facility (SRF) is the Federal Reserve’s permanent “ceiling tool.” Established in July 2021, it allows Primary Dealers and eligible banks to borrow cash overnight from the Fed by offering safe assets such as US Treasuries and agency mortgage backed securities as collateral.

The Specs

- The Rate: Priced at the top of the Fed Funds target range, acting as an interest rate ceiling tool.

- The Limit: No aggregate operation limit. Participants face a USD 40 billion per-proposition limit, given that they can submit one proposition per security type during each of the twice-daily operations.

- The Goal: To prevent a repeat of the 2019 Repo Crisis by ensuring cash is always available during stress events.

Why the SRF isn’t Fixing the “Leaky Ceiling”

The fact that Standing Repo Facility once again failed to put a cap on the money market interest rates showed that the so-called “leaky ceiling” problem continues to haunt the Fed.

Should the Fed be more concerned that its interest rate ceiling tool failed to put a lid on the repo rates?

Looking through the period-end surges

Period-end surges in repo rates are generally regarded as “tolerable” by the Fed. This is because the main culprit during such periods is well known.

Dealers usually find their balance sheet capacity limited by regulatory factors, so they reduce their participation in the repo transactions, generating volatility in the repo rates.

As these period-end fluctuations more often than not reflect regulatory limitations instead of a genuine market-wide liquidity shortfall, the Fed has some leeway to look through these effects.

Repo rates are not the Fed’s official target

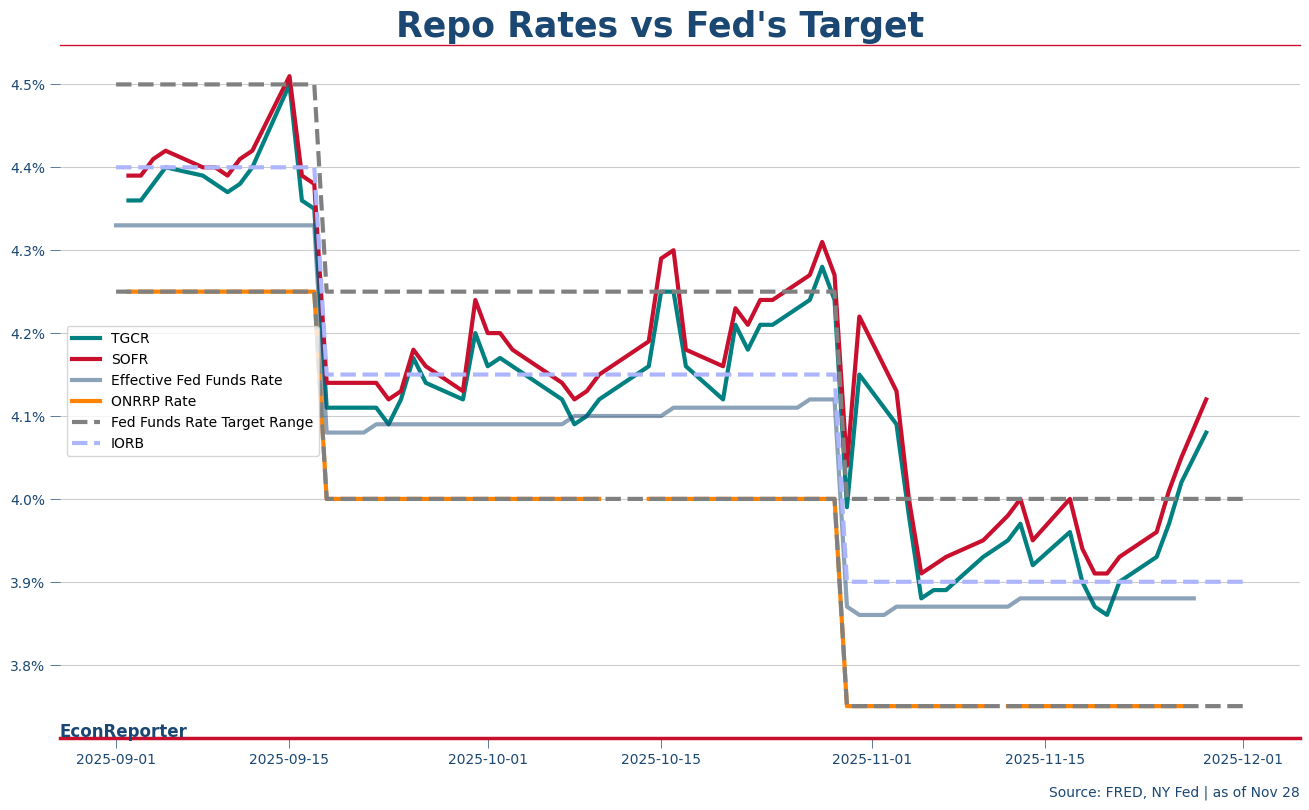

As Roberto Perli, manager of the New York Fed’s System Open Market Account, said in a mid-Nov speech, repo rate surges are “not concerning” because the target range is defined in terms of the federal funds rate (FFR). As long as the effective FFR is below the US central bank’s upper limit, the Fed should not panic.

It’s only when the repo rates stay “persistently or substantially above the top of the target range” that the situation would become problematic, as “they could pull up the EFFR and pose difficulties for rate control,” Perli explained.

It’s a liquidity backstop and it carries stigma

SRF is designed as a liquidity backstop, instead of a liquidity provision tool. As New York Fed President John Williams emphasized, banks should not rely on the this facility as a source of liquidity day-to-day. Hence, the SRF is supposed to be quiet on “normal” days; but its usage should shoot up when there are temporary liquidity strains in the system, much like the usage pattern during November.

This usage pattern, nonetheless, can breed a stigma problem, where financial institutions would become wary of sourcing liquidity from the Fed tool as ‘unusual’ usage would be considered as a sign of weakness. Banks tend to avoid any association with such signals at all costs as loss of confidence can destroy a bank in an instant.

Even though only overall SRF usage—instead of the amount an individual financial firm lends—is disclosed daily, primary dealers in a mid-November behind-the-door meeting told the New York Fed that they are reluctant to use SRF because they consider “borrowing directly from the central bank still carries a stigma and could be seen as a sign of trouble,” as Bloomberg reported.

What Next?

The Fed restarts Reserve Management Purchases with USD 40 billion monthly purchases

The Fed announced after their December meeting that it will purchase “Treasury bills and, if needed, other Treasury securities with remaining maturities of 3 years or less to maintain an ample level of reserves.”

New York Fed in a separate statement announcing that it will kick off the RMP program with a monthly Treasury bills purchase amount of USD 40 billion starting Dec 12.

- Subsequent monthly purchase amount “will be announced on or around the ninth business day of each month,”

- The pace of RMPs will “remain elevated for a few months” as the New York Fed plans to offset an “expected large increases in non-reserve liabilities in April,”

- After that, the pace of purchases “will likely be significantly reduced” to meet “expected seasonal patterns in Federal Reserve liabilities.”

What is Reserve Management Purchase?

Central Clearing

The Fed is also planning on easing the month-end repo rate surge by introducing central clearing in SRF transactions. Central clearing can help free up dealers’ balance sheet capacity to lend from the SRF.

As explained in the October meeting minutes, “[c]entral clearing could increase counterparties’ willingness to use the SRF when there is upward pressure on repo rates, which would damp pressures on the federal funds rate.”

Previous Updates

November 2025: Standing Repo Facility Usage surge again at month-end

November 2025: Standing Repo Facility Usage surge again at month-end

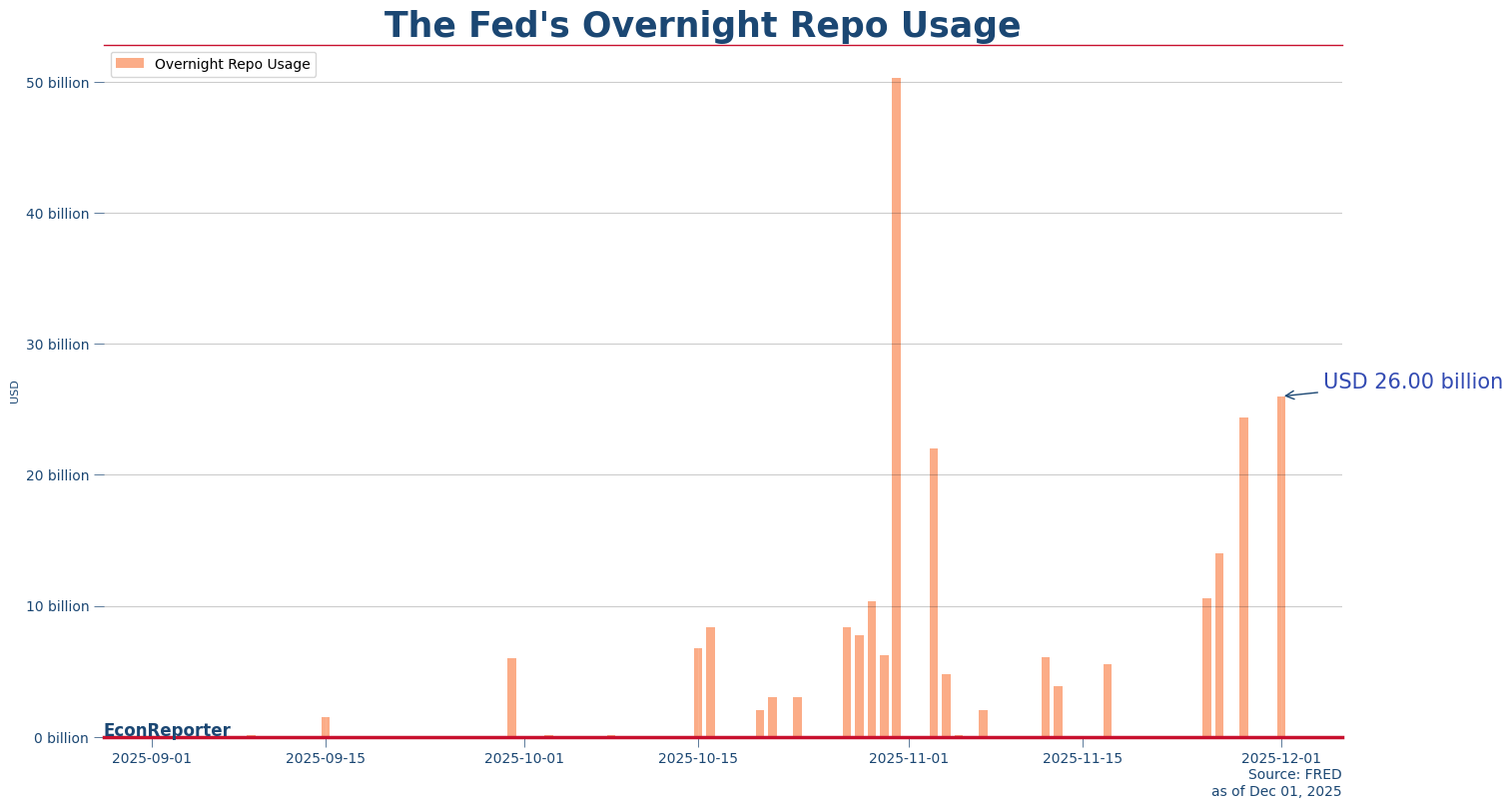

US banks and primary dealers have ramped up usage of the Standing Repo Facility in the last week of November, ending the month with a USD 24 billion usage of the lending facility.

Repo rates spiked toward the end of the week, with SOFR and the Tri-party General Collateral rate (TGCR) reaching 4.12% and 4.08% on Friday, respectively, breaching the Federal Reserve’s overnight interest rate target range.

Key Implications: This is the second month-end in a row the Fed saw repo rate surge past its federal funds rate target range. December 1 is also the day the Fed ended its quantitative tightening program, which should help ease liquidity strain in the market in general.

📚 Deep Dive on the SRF

Track the evolution of the Fed’s ceiling tools through our archived analysis:

-

- Why rates are breaking the cap: The Fed’s ‘Leaky Ceiling’ Problem

- The philosophical difference from the Bank of England’s demand-driven system: Backstop vs. Provision

- Why Ending QT Too Soon Risks Discrediting the SRF

- Why SRF should be the most important Fed tool post QT: The Fed’s Post-QT Tool?

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡