Last Updated:

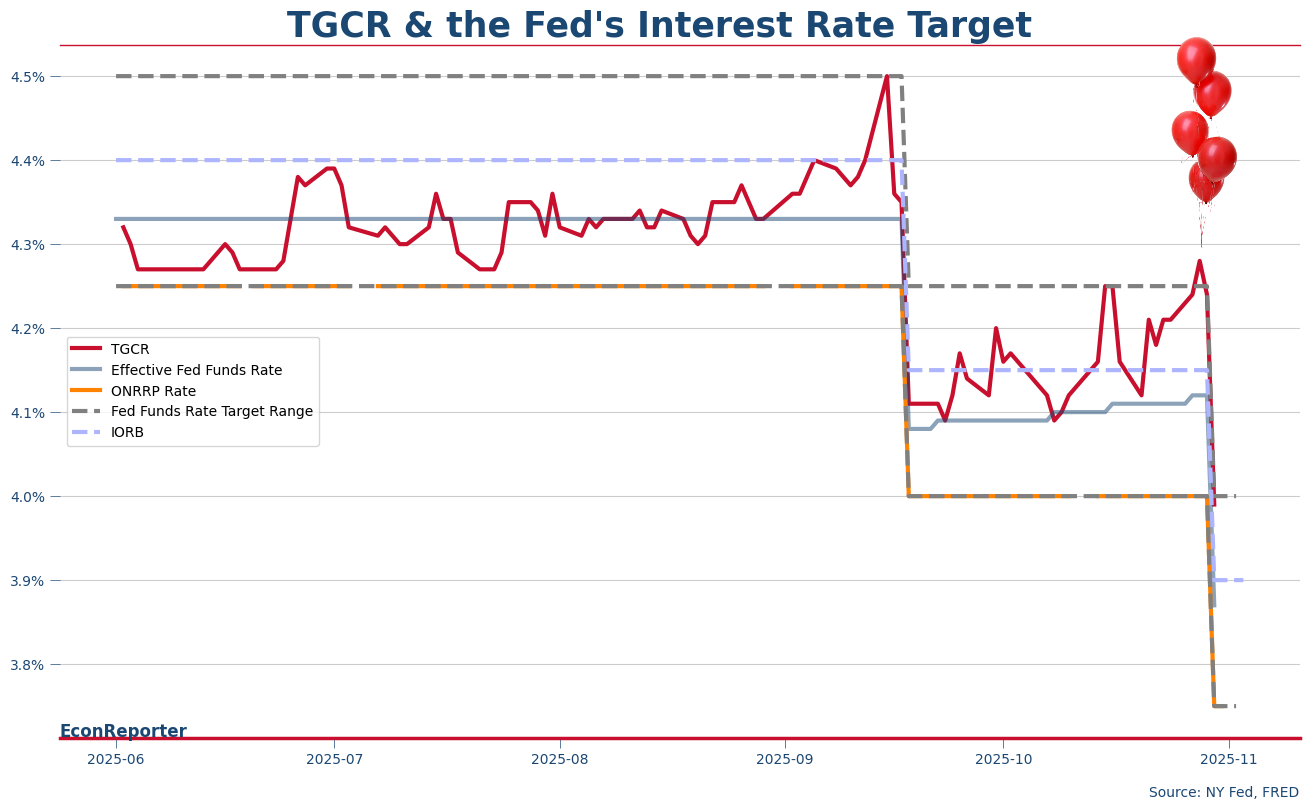

“But it looks like a ‘leaky ceiling’… ” said Beth Hammack, president of the Federal Reserve Bank of Cleveland at a fireside chat during the Evolving Landscape of Bank Funding conference.

She then corrected herself, “I don’t need to call it a leaky ceiling… but it looks like a balloon is floating away.”

Here Hammack was describing the movement of overnight repo interest rates in the money market in recent months. The ceiling is the upper limit of the Federal Reserve’s Fed Funds rate target, which is supposed to be enforced by two of the Fed’s so-called ceiling tools—the Standing Repo Facility and the discount window.

The balloon floating away analogy? Hammack was describing the current situation in which the ceiling tools are far from effective and they are allowing the repo rates to break through above the upper limit.

Why Is the Ceiling ‘Leaking’?

This conversation provided the backdrop of why the US central bank decided to end its quantitative tightening program: repo rates are seemingly unresponsive to the spike control system. The culprit? According to Hammack and Dallas Fed President Lorie Logan, it’s that banks and primary dealers refuse to take advantage of the Standing Repo Facility.

“Banks aren’t participating and taking advantage of those tools that we have, like the Standing Repo Facility,” said Hammack.

In theory, when the repo rates, like the tri-party general collateral rate and the SOFR, rise above the interest rate the Fed stands ready to lend out money through the ceiling tools, banks can borrow money from these facilities instead of from the market at higher repo rates; and they can even redistribute that liquidity in the money market through repos transactions.

“Drawing on the SRF when the rate is economical is a sound way for a Primary Dealer to serve the market. With rates averaging higher than they were just a few months ago, the likelihood of the SRF rate becoming economical on some days is higher. Dealers may now need to step up their readiness to access the SRF in response to rate moves,” said Logan in her speech Friday.

Asking (or pressuring) Primary Dealers and banks to use the SRF more actively is the most obvious thing for the Fed to do, as these two categories are the authorized counterparties for the facility. Potentially due to the encouragement from these two regional Fed presidents (or, more possibly, due to the fact that it was the month’s end), the usage of the SRF rose to over USD 50 billion across the two auction sessions, taking up about 10% of the available daily limit.

Beyond Moral Suasion: The Fed’s Options

Is moral suasion enough to make the SRF a more effective ceiling tool? That is still to be seen. There are other options, though. One popular suggestion is for the Fed to restart asset purchases, particularly buying more Treasury bills, to create more reserves and to ease this period of liquidity strain.

From what Chairman Jerome Powell said during the post-meeting press conference, though, the Fed seems to think this is a medium-term plan. They would prefer to do that after other liabilities (like currency) on the central bank’s balance sheet start to eat into reserves.

Another option is, as some JPMorgan strategists suggested, to lower the minimum SRF offering rate by five basis points. If the banks and Primary Dealers can have access to Fed-provided liquidity at a rate lower than the Fed’s interest rate upper target, they can help redistribute liquidity in the money market before repo rates break the ceiling.

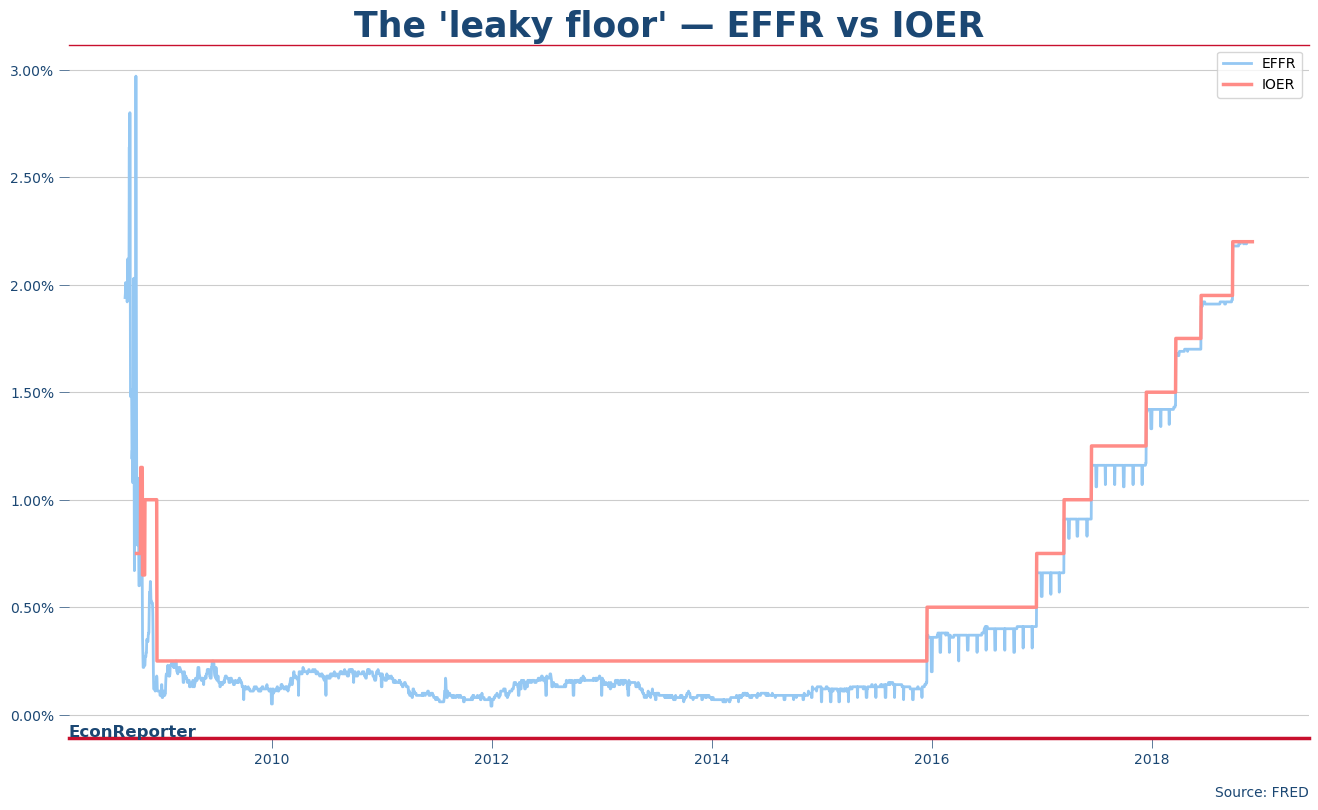

Learning from the ‘Leaky Floor’

Remember Hammack mentioned “leaky ceiling” at the quote at the start of this article? It’s actually a reference to the so-called “leaky floor” problem the Fed faced when it first used interest rate on reserves (IOR) as the policy overnight rate floor. This also suggests another “fix” to the Fed’s interest rate “roof”.

As only banks, formally, depository institutions, have master accounts at the Federal Reserve System, hence only they can receive interest generated from their reserve holdings. Other participants in the Federal Funds market, such as Government Sponsored Enterprises (GSEs) and Federal Home Loan Banks (FHLBs), have no access to the IOR, and this dragged the effective Federal Funds Rate (EFFR) below the Fed’s target range, as they are willing to lend out money for an interest rate lower than the IOR.

The Fed’s solution was to establish the overnight reverse repurchase agreement facility (ON RRP) to engage in reverse repo transactions with a wider range of counterparties including not only banks and investment banks, but also money market funds and GSEs such as Freddie Mac and Fannie Mae.

As David Andolfatto, chair of University of Miami’s Department of Economics and a former Senior Vice President at the Federal Reserve Bank of St. Louis previously suggested to EconReporter, the Fed should allow more counterparties to have access to the SRF, making it a symmetric setting as they can use ON RRP as a deposit tool. In this way, SRF will have a more direct influence on the repo rates in the money market, in a similar way the ON RRP solved the “leaky floor” problem.

A Race Against Discredit

Nonetheless, it’s very possible that the Fed will give the banks some more time to respond to Hammack and Logan’s moral suasion and engage with the SRF before they take further actions. The Fed already stopped QT out of fear that repo rates were “floating away like balloons.” They need to continue acting nimbly to fine tune the ceiling tools before they are totally discredited.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡