A relatively unexpected discussion among Federal Reserve officials during November FOMC meeting was that “some” committee members suggested a future consideration of lowering the ON RRP facility rate by 5 basis points to align it with the lower bound of the central bank’s fed fund rate target range.

“Some participants remarked that, at a future meeting, there would be value in the Committee considering a technical adjustment to the rate offered at the ON RRP facility to set the rate equal to the bottom of the target range for the federal funds rate, thereby bringing the rate back into an alignment that had existed when the facility was established as a monetary policy tool.”

Why the Fed needs to consider a further cut in ON RRP rate? More importantly, what is ON RRP?

What is ONRRP?

ON RRP is a Federal Reserve facility which allows money market funds to deposit their extra liquidity in the central bank overnight through a repurchase agreement. MMFs can earn interest from the facility. As this interest income is generally “risk-free”, the ON RRP rate effectively sets a lower bound of how much MMFs would charge when they lend out money and helps the Fed to establish an interest rate floor in the money market. ONRRP is thus a major interest rate tool in the US central bank’s policy portfolio.

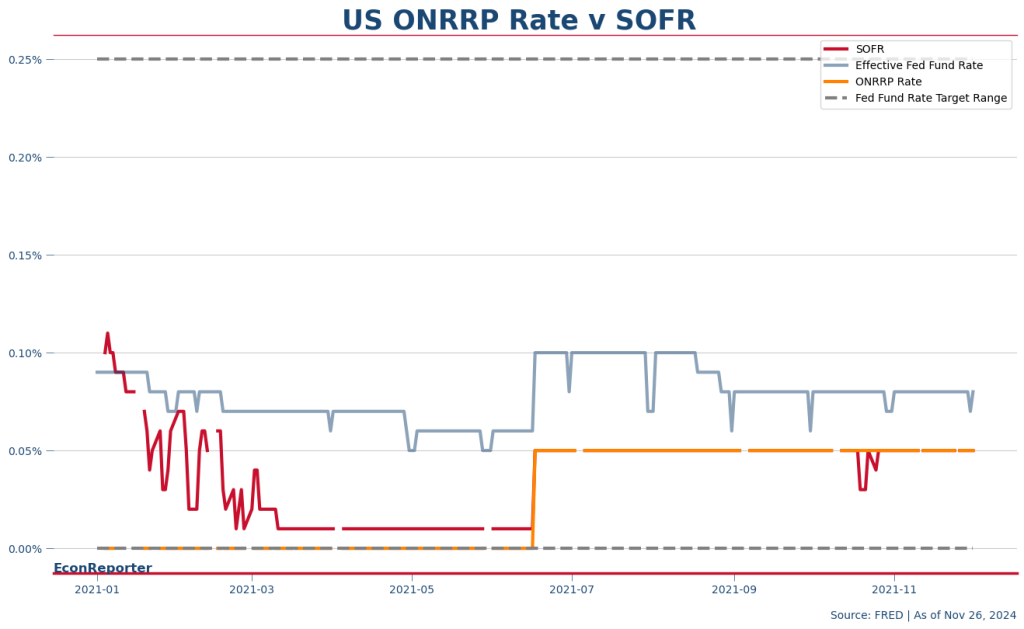

ONRRP rate is 5 bps above FFR lower bound since mid-2021

ONRRP rate has been set at a level that is 5 bps above the lower limit of Fed fund rate target range, which is currently set at 4.5% – 4.75%, since June 2021.

The decision back then was to nudge the money market interest rates up by a bit as they were trending downward, toward the bottom of Fed’s interest rate target range.

Back then the financial system was awash with liquidity as the central bank was injecting USD 120 billion a month into the system via QE. ONRRP facility usage rose from less than USD 1 billion around the end of 2020 to about USD 584 billion, when the technical tweak of ONRRP rate was announced. By providing riskless interest to MMFs at a sightly higher level, the Fed successfully guided the overnight market rates higher, for example SOFR was largely aligned with the ONRRP rate after that point.

Why Fed mulls lowering ONRRP rate now?

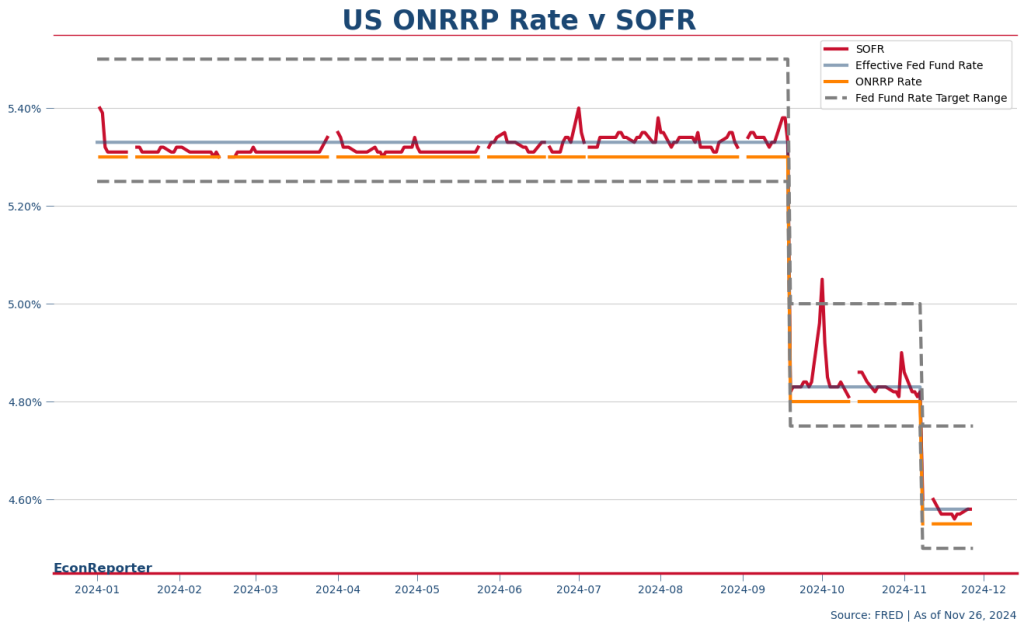

Now the problem is reversed. Less than USD 198 billion were deposited as of Friday (Nov 29, 2024). The declined usage is part of the results that the Fed is extracting “excess liquidity” from the financial system through QT. As the amount of bank reserves are decreasing toward the level which the Fed describes as the “ample”, a level not too high and neither too low that further reduction in reserves would generate unwarranted increases in market rates, SOFR has been edging toward the top half of the Fed’s target range.

By lowering ONRRP rate by 5 bps, this could make parking money inside the repo facility a bit less attractive, squeezing liquidity out into the money market and help hold down the rates by a bit.

“The staff also noted that lowering the ON RRP offering rate 5 basis points would align the ON RRP offering rate with the bottom of the target range for the federal funds rate and would probably put some downward pressure on other money market rates.”

This little nudge is even more relevant given the spike of market overnight rates happened at the end of Q3. As told by Fed’s staff during the Nov meeting:

In secured funding markets, rates on overnight repurchase agreements (repo) increased sharply and were volatile around the September quarter-end but, on other dates, generally stayed just above the rate offered at the overnight reverse repurchase agreement (ON RRP) facility.

They attributed this quarter-end episode to “a combination of typical balance sheet constraints associated with financial reporting dates and a large net settlement of Treasury coupon securities that took place on the same day.”

A slightly lower ONRRP rate will likely help the Fed gain better control of the overnight repo interest rates and contain interest rate spikes in high demand periods such as the quarter-ends.

Independent Economics Journalism

Stay ahead of the curve — follow EconReporter for in-depth coverage on economics & markets.