In this episode of “Where is the General Theory of the 21st Century?”, we talk to Professor Lawrence J. Christiano, chairman of the Department of Economics and Professor of Economics at Northwestern University and one of the leading researchers in Macroeconomics and DSGE models.

Introduction

“Where is the General Theory of the 21st Century?” is an interview series that explore the evolution of macroeconomics academia since the Great Recession.

Do we have some revolutionary changes in the macroeconomics after 2008, just like we had had the “Keynesian Revolution” after the Great Recession? Why haven’t economists come up with a new General Theory after the Great Recession? Our in-depth interviews with influential economists will provide answers to these questions.

In this interview, Prof Christiano shared his view on the development of post-2008 academic macroeconomics.

We’ve asked Prof Christiano does he agree that modern macroeconomic models are too complicated for the general public, or even policymakers and if he agrees that economic models should be “simpler”? Should Macroeconomists hang on their faith in DSGE models? Should they explore alternative paths?

(The transcript is edited for clarity. All mistakes are ours. Cover Photo Credit: IMF Youtube Channel)

Is there another Keynesian Revolution?

Q: EconReporter C: Larry Christiano

Q: Do you think that there are any “revolutionary” changes in the macroeconomics since the Great Recession?

C: I think what we saw after the Great Recession is largely an acceleration of the changes that had been in existence before. That is in the same way as the Great Depression, and Keynesian Revolution was not something that was started in the 30s, but really in existence before.

There has been a debate for a long period over what it is that caused the fluctuation. Is it things that are on the supply side of the economy? Or is it things on the demand side of the economy? One very important reminder from the 2008 crisis was that the demand side of the economy could be very very important.

The demand side of the economy is one of the features that the earlier Keynesian Revolution had captured. And as a consequence, all of those things that are part of the Keynesian Revolution actually became part of conventional wisdom about macroeconomics. But in terms of sudden change of thinking and wholly new ideas, that we did not see. But nor did we see that in the Great Recession.

Q: In the note “The Great Recession: A Macroeconomic Earthquake” for the Minneapolis Fed, you have mentioned that the Great Recession has two impacts on the macroeconomics. One is that the ISLM perspective becomes relevant again, which is now incorporated in the New Keynesian models.

To what extent, you think New Keynesian is an extension of ISLM?

C: I think in every broad way of thinking about macroeconomics has a really really simple model associated with it. A model that you can teach to undergraduates. The model that is best associated with the center of gravity in academics in the 80s and the 90s was probably the Real Business Cycle model (RBC). That was a simple model that you could convey to the undergraduates, and it would also capture the general thinking of people researching in the area. The model itself simplified what researchers are thinking about, yet it captured the essence of the framework.

The current conventional model, i.e. the oversimplified representation of that model, now has shifted from the RBC model to the ISLM model which captures very much the ideas that are in modern dynamic models. Technically, the modern dynamic model is built on the RBC, although the economics of them is very different.

I guess I see ISLM as the new oversimplified representation of the way people think about the economy now. What I mean by oversimplified is that the fundamental question can’t actually be answered by this version of the model. It is just the simple language for people to talk about things, but not a substitute for careful thinking. For example, you don’t even know if the depreciation of the exchange rate shifts the IS curve to the right or the left. That requires much more elaborate model which was very much in contact with the data, particularly with microdata.

So, the ISLM model is more like the language that is used to teach the undergraduate but not as a substitute for serious dynamic models. As in the RBC, no one thought literally that the Solow production function is the best characterization of the data, but it captures the spirit of the theories.

Communicating with the Public

Q: What you have said remind me of what Olivier Blanchard has recently said about macroeconomics models.

In his note for PIIE “On the Need for (At Least) Five Classes of Macro Models”, Blanchard suggested that there should be at least five types of macro models.

Among them, the DSGE would be used for explorations and discussion of the distortions; policy models should be based on a different kind of structural econometric models; and, for the communications with the public, we should use certain toy models like three-equations models, etc. But as you have said, toy models like ISLM are just oversimplifications of the current macroeconomics thinking.

For me, as a journalist, it is chanllenging to describe any of the modern macroeconomics ideas developed since the RBC. Do you agree that it might actually make communicating modern macroeconomics thinking to the public more difficult?

Further Reading

Blanchard on “DSGE model and the State of Macroeconomics” | #WITGT21 |

C: As I talk a lot with central bankers, ISLM is very much at the heart of the way central bankers think about the economy, at least those policy makers. What I mean is they generally believe that in the short run at least, demand matters a lot. They think about the connection between interest rate and demand. For example, in the case of China, the PBOC was very concerned about a slowdown in growth. Their response to that was to cut the interest rate. That is very much part of the Keynesian framework that the interest rate plays an important role and a component of aggregate demand. In the short run, aggregate demand has a significant impact on output.

I am not sure people know how to shift the curves around and what the slopes are, and things like that. I do think there are various levels of understanding. The most elementary level would be that demand matters, things that make people spend more would also make the economy expands. Policy matters because a cut in the interest rate makes people increase their spending. Fiscal policy matters because it represents an increase in spending itself. For those, I don’t think any models are needed. But my own sense is that when you think about it as a language, for policymakers for example, even if those people were not trained in economics at all, they would be very comfortable with that view. That view, and the paradigm in which that view lives is based on the ISLM model.

Now, if you take a very simple view that demand matters, fiscal and monetary policies can affect it, the next level down, in the sense of mathematical or intellectual vigor, would be the ISLM model. Actually, there is a surprisingly large number of people who are familiar with that, because anybody who has taken an undergraduate course in economics would have studied the ISLM model. Every single textbook is written since the 1950s, throughout the period, always emphasizes the ISLM model. Yet, even there the thinking is not going deep enough. As I’ve said a moment ago, even the most basic questions can’t really be answered in a comfortable way by just looking at the ISLM model. You have to go much much deeper.

In a way, I am describing Blanchard’s five models. You need models of various levels. At the very bottom, you have the complicated models with many equations and all of these things; At the very top, it is the simple language which you use to talk to policymakers; one layer down, it is where you talk to policymakers who have taken economics courses at the undergraduate level; multiple layers down, you start talking about many equations and the direct connection with the data, and debate about obscure things, like “have the data been seasonally adjusted?” and stuff like that.

All of that, that’s the whole mechanism of thinking about macroeconomics. It does involve lots of models. But I think at the very top level, it is the most natural language, at least for the policymakers I know about, that fits in.

Now, I want to offer a different perspective on that. In some ways, RBC, for example, as a very simple model is much much harder to understand. Because in the RBC the real interest rate is determined by the private economy and the central bank has no impact on that whatsoever. Yet, there is a lot of evidence that central banks do have an effect on real interest rate and economic activities. That model is confusing and, in a sense, that model discredited the macroeconomics profession in the 1990s and going towards the 2000s. It was perceived that macroeconomists’ analysis was not firmly based in data.

In the data, it looks like central banks have an effect on things. All the way back to the Depression to the crisis in the early 1990s, with the unification of Germany and so on, there are lots of episodes which reminds people that central banks have a big effect on the economy. The only way to understand that is a model which recognizes the role of aggregate demand in determining the output.

Q: One of the problems with DSGE is that it is quite difficult to use it to communicate with the general public.

It sometimes resulted in certain “political inconvenience”, to put it mildly. Should we make some simpler macroeconomics models for the policy-making?

C: I have an answer for that question, but I have to set the background for it a little bit. From my point of view, and my point of view is heavily influenced by going to places like the International Monetary Fund (IMF) and various central banks around the world. The purpose of thinking about macroeconomics is to provide input into policymaking decision. Ultimately, the purpose is to provide input into the decision made by the central bank governors.

The central bank governors, of course, are political appointees and they are not necessarily experts in central banking. That is to say, whatever information and advice provided, they have to be done in ordinary language. That’s an absolute requirement.

I also think that it is actually a good thing that forcing advisers to translate things into an ordinary and simple language. It is an important task because the ultimate criteria for policy advice are, “Does it make sense when you say it to a normal person?”. So, at the very top, the model must be extremely simple. No equations are allowed. No stochastic stuff allowed. It has to be in the ordinary language.

In order to arrive at that final output, however, you have to go through various steps. That’s why I think of the bottom and the top. At the top, I have in mind the upper floors where the policymakers are; then at the basement, it is where the Ph.D. Economists working on DSGE models lives. What you need is that people working hard at all levels and they all complement each other. They are all necessary, none of them could operate without the others.

Let me use an example of a policy question. Let say the economy is not doing very well and the governors contemplating a cut in the exchange rate. So, a very simple question, if we cut the exchange rate, were we going to stimulate the economy?

Economists understand that it has different types of effects on the economy. One of which is that it makes domestic goods cheaper and makes foreigners buy more of them. That increases aggregate demand in the economy and possibly expand the economy.

But there are many other considerations to think about. First of all, most world trade is invoiced in US dollar. As a consequence, it is very likely that the prices at which international trade is occurring are fixed in dollar terms. So that if you change the exchange rate, you may not have a very big effect on trade at all.

Secondly, a lot of people may have borrowed in foreign currency. If you depreciate the exchange rate, you make them worse off because they have to get more domestic currency in order to pay off the foreign currency. To the extent there are a lot of those people, you are going to hurt demand of your country.

So, number one, if prices are all invoiced in dollars and that really matters, then demand channels are not going to be very strong. Number two, to the extent that people are borrowed abroad, there is another impact on the demand channel that goes into the opposite direction. Both the good market side and the financial side are themselves very complicated things. It is very sophisticated to think about it, especially if you worry about the invoicing of prices.

The way economists think about things precisely is through equations. So now, to think about the joint operation of the financial system and the goods market, you are going to need a pretty fancy model. You don’t even know, as I have said earlier, that if you cut the exchange rate, does the IS curve shift to the right? Does it stimulate demand? Does the IS curve shift to the left? Does it hurt demand? You don’t know that until you have taken all these pieces of the economy, see how they work together, how important the different parts are and which one “wins”.

When you have to then travel back up the elevator upstairs to talk to the governors, the governor doesn’t want to hear about the details that you have to think about. The governor is going to want to know two things only: One, what is your conclusion? Does it stimulate or hurt demand by depreciating the exchange rate? Two, the governor would probably also want to know did you run this conclusion through all the test that you have conferences where you brought experts from around the world? Do you have Ph.D. level people fighting it out in the basement about what’s right and what’s wrong? And is this a conclusion that he can feel some confidence in?

I think the basic message that we learn since 2008 is that the world is a lot more complicated than we thought. That means we need more complicated models, not simpler models. At the very bottom, we going to be much more sophisticated. When a central bank hires a macroeconomist, that macroeconomist has to have expertise in financial economics, in addition to the usual stuff.

Do we still need simple models to translate these terms that the governors understand? Absolutely. Are those models important? Yes, they are absolutely vital because you can get lost in the equations. Translating things into simple intuitive terms ensure that you didn’t get lost and you still grasp the big picture.

Further watching:

Shadow Banking – Why the financial crisis happened?

Q: In our previous interview with Prof Atif Mian, he mentioned that macroeconomists traditionally look at the impact of debt and leverage through the corporate debt side, but seldom on the household credits side. My questions is, in your opinion, which side should researchers take when they are modeling the economy?

C: This is a huge question, and I think that it is important that I give a little bit of background before I answer. The background question is “What happened in the financial crisis?” It has something to do with finance. No question about it. But there is a continuous debate about what the issue was. My sense is that there is an emerging consensus and it is not quite the same as Mian and Sufi’s.

The consensus is that, what happened in 2008, what policy makers did not know about, what surprised them, or why is that no one forecasted the recession was that the financial explosion came from a part of the financial sector that no-one really knew it was there — the shadow banking system.

It was understood that there was a shadow banking system, but it was not understood that it was almost as big as the commercial banking system, or some people argued it was even bigger. The other thing that wasn’t understood about was that it was so vulnerable to runs. The shadow banking system was providing funds primarily for the real estate sector. That system is vulnerable to runs, sort of like the ones you saw in the Great Depression, where I think ten thousands of banks were destroyed in the US in a very short period of time, as everybody ran on the banks. Similarly, everyone ran on the shadow banking system. That, I think in the end, is what brought down, first of all, the rest of the financial system, and secondly, the whole economy.

That suggests a very different view about how you should work to insulate the economy from this kind of shock happening again. In particular, the financial authority needs to be sure that they know exactly who and what is doing the financial intermediation in the economy, and those groups are properly regulated. The problem with finance is that it has a fundamental vulnerability in it. The problem is that it involves borrowing short and lending long. Like the classic bank issues demand deposit, people are allowed to come back and get their money at any time; but then they lend the money out for a long period of time, so the bank actually doesn’t have the money to give right away. You have the same thing going on in the shadow banking system.

So, in my view, it is not that there weren’t other problems like “too big to fail”. There are other problems in the regulation of the banking system which should be addressed and are important. But they are not the problems that actually brought the system down. The system could have survived just fine had it not been the shadow banking system. In fact, the commercial banking system had acted as a shock absorber. When the shadow banking system went bad, the commercial banking system expanded and absorbed part of the blow. It’s actually part of the good picture in the economy.

Now, there is another idea that somehow people borrow too much and that borrowing restriction should be tightened up. I think all these are probably true. But I think the main danger, the main financial instability, is the shadow banking system and the fact that we shall be keeping an eye on that. There is the Financial Stability Broad, which is put together by the G20 and headed by Mark Carney. It identified the big source of instabilities in the world economy is a growing shadow banking system.

Gertler and Kiyotaki have written now three papers, there is an AER [Banking, Liquidity, and Bank Runs in an Infinite Horizon Economy], a paper for a Handbook of Monetary Economics [Financial Intermediation and Credit Policy in Business Cycle Analysis], and now they have another paper being made [Wholesale Banking and Bank Runs in Macroeconomic Modelling of Financial Crises, coauthored with Andrea Prestipino] . This paper exactly captures the idea that the crisis was triggered by an implosion in the shadow banking system. So, these ideas I am describing to you now is an idea that is being made very precisely by those guys.

An idea like the one I described, while we can chat about it, to make it really really precise, you do need to write it down in mathematical terms. The reason why it is easy for me to talk about it is that I have taught the Gertler and Kiyotaki stuff to graduate students. You know, in order to be able to get stuff into simple language that makes sense, I think you have to go through the process of working out the so-called the DSGE model to make sure all the ideas hang together and make sense.

In fact, there are four heroes in this. Number one, there was Gary Gorton, who first noticed the bank run across the world, then Bernanke brought the attention to the Congress. In 2010, Bernanke testified in front of the congressional committee for an inquiry looking into the causes of the Financial Crisis, he laid out this hypothesis that there was an implosion of the financial system. Then, the people who really seriously thinking about it at the detailed level are Gertler and Kiyotaki. Those are the four heroes of this view which I think is emerging as the conventional view about the crisis.

What was the financial aspect of it and why didn’t we see it? Why no one forecasted it? Well, the answer is that it came from this thing that no one saw.How do you avoid this in the future? Keep your eyes open! But it is not the matter of don’t work with DSGE models. “Don’t work with DSGE models” to me translates into “Stop thinking carefully about economics!” That is not a good option for dealing with the crisis. The crisis said: “Think more, keep your eyes open. Look at the data.” That the big lesson from the crisis. We see the shadow banking system, but we didn’t see its size and its vulnerability to run.

Understanding the Great Recession

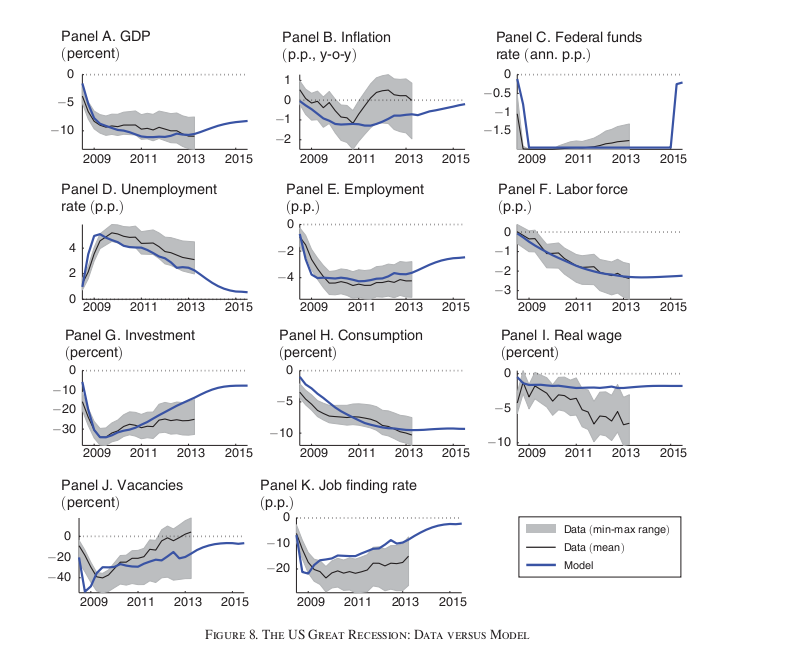

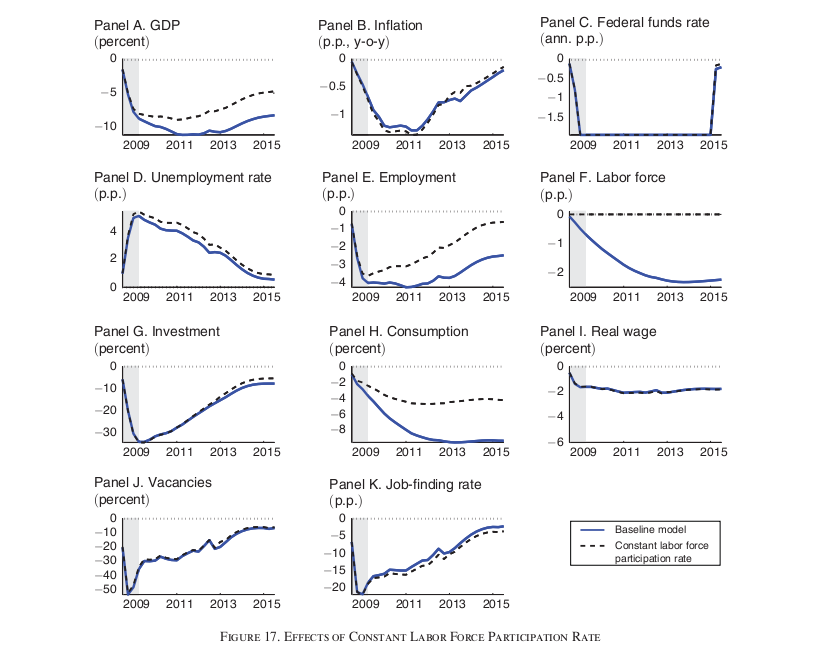

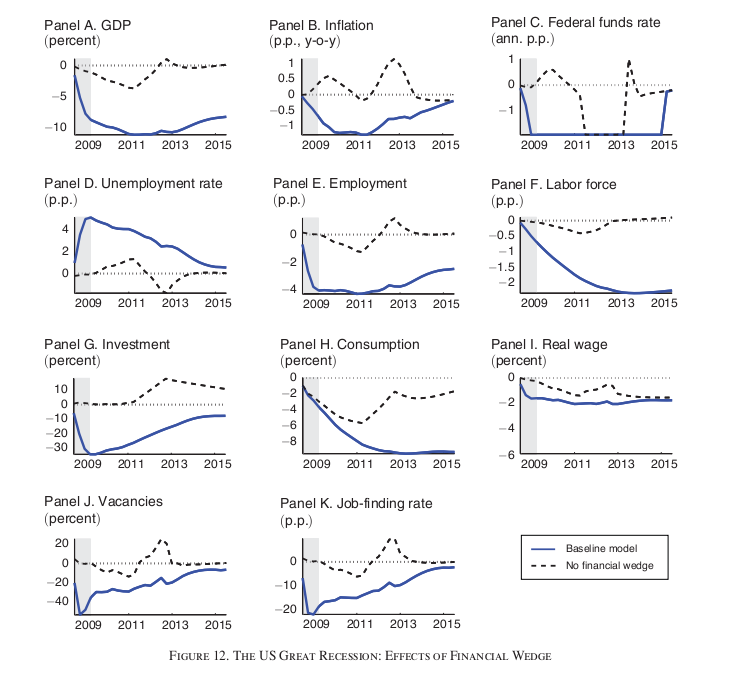

Q: In your recent research “Understanding the Great Recession”, your models show that the fall in labor participation rate is an important factor in explaining the depth of the Recession. In that model, the fall in the participation rate is induced by the financial wedge. What is the financial wedge and why would it lead to lower participation rate?

C: First of all, the fall in labor force participation rate in the model is captured by just simply the souring of the labor market. The labor force participation rate in the model represents the decision by the households to send people out to work in the labor market. The labor market looks like a really bad place during the Great Recession and in the model, it looks really bad so people who had a choice chose not to go. That’s the story about the labor force participation rate in the model.

So, there is the thing that called the financial wedge or the intertemporal wedge in the model. The first one operates on the firms’ ability to get funding to finance their ongoing operation. Firms are a lot like households, they have expenditures that they have to make all the time but their receipts don’t come in all the time. University is the classic example. We get receipts four times a year, but we have to spend money every single month, or actually almost every day. As a consequence, in order to do business, businesses have to go in and out of financial markets to smooth this imbalance in receipts and expenditures. That is done through the short-term commercial paper market, largely. They will borrow for four days, for seven days, stuff like that.

That market kind of collapsed during the crisis. In our model, the collapse of that market is increasing the cost of doing business. It also helps to prevent what would otherwise have been a very big drop in inflation. There are other people who explored the data much more carefully and built a much more precise model about that particular phenomenon. They found that firms that have greatest difficulties with financing their operations have higher prices than other firms that have easier access to finance. That’s one kind of financial wedge that play the role preventing inflation from falling as much. It would have fallen more if that hasn’t been present, according to our analysis.

There is also another financial wedge that is sometimes referred as the intertemporal wedge. That has to do with the more classic part of banking. Most of us, when we think about banking, we don’t think about the banks’ daily, weekly, monthly needs to bridge the imbalance between when money comes in and when the money goes out. They call that working capital requirement. The more classic thing is that firms need long-term funding in order to build an investment project and stuff like that.

When something goes wrong with the banking system, one way to model it is that the system acts like a tax. The savers try to put money in the banks and get money back for those investments. But then because of the various problem in the banking system, they don’t get much money back. That look like a tax. That’s why another word for tax in public finance is a wedge.

Anyway, my thinking now has been evolving and I am not sure that would happen. I mean I think what had happened can in principle be captured by that wedge, but the wedge is so “reduced form” that it is hard to interpret.

I think the collapse of the shadow banking system, while in some technical sense can probably be captured by a wedge like that, it is so different that it’s probably best to just model it. Gertler and Kiyotaki are showing us how to do that. Gertler and Kiyotaki are doing the works that need to be done in the basement if you don’t mind continuing that metaphor from before. In the basement, all the equations, all the PhD economists, all the technical nerdy types are all living in the basement. Then you go upstairs and you eventually encounter the Olivier Blanchard, who understand what is going on in the basement by they also understand how to turn things into common sense. They are vital. Without them, the people in the basement would just say crazy things. Then the Blanchards communicate with the higher ups. So, the Gertler and Kiyotaki stuff is really basement work.

So, my own thinking has evolved. What I am trying to figure out a way to make really precise, based on data.

You probably hear of the book, “The Big Short”. The alternative view about the crisis and Sufi and Mian played an important role in describing the view, was that the existing banking system was just rotten. Then in “The Big Short”, there was this one artistic guy who notices that actually these whole things were really bad and he shorted the whole system. That view is very different from the one I was describing. It is very different.

The view I was describing doesn’t focus on the problem in the loans and the leverage restrictions, and all that stuff. No doubt those were problems, but those are problems of all time. I believe that those problems were not enough to crash the system. You needed the collapse in the shadow banking system to crash the system. To really document that, that takes a lot of careful thinking and that is what I am trying to do. But it is very hard because once the system crashes, then all the debts are bad.

If the system crashes, people are going to stop paying their mortgages. They are going to look real bad. They are really bad bet afterwards. You can’t just look and see that lots of people went bankrupt or fail to pay their mortgages and conclude that, therefore, all the mortgages should not have been made in the first place. It could be that the collapse of the banking system because of the shadow banking system was the fundamental cause.

There is a very famous movie in the US called “It’s a Wonderful Life”. In that movie you can kind of see how a bank run can crash a town and all the borrowers in the town, like the one who borrows to renovate the grocery store, that loan may go bad because there was a bank run that causes the economic activity in the town to stop. But then, you wouldn’t have look at that loan and see that they didn’t pay and conclude that that was a bad idea in the first place. The problem was really the vulnerability to bank runs. It was not the loan per se. Wisely, we solve that problem by focusing on the bank runs and providing Federal Deposit Insurance.

We have to be very careful in looking at the crisis, not to infer from the fact that people stop paying their loans, not to infer from that observation to the conclusion that, “Oh, the banking system made bad loans and we have to make sure they cut back their loans severely in the future.” That maybe the wrong thing to do.

Q: Do you agree that macroeconomists haven’t paid enough attentions to the dynamics of the labor market conditions and the participation rate in their models?

C: For me personally, I have invested a lot. I have an Econometrica Paper came out last summer on modeling the labor market [

Unemployment and Business Cycles] . I do think that it is very important. It is very natural for us to think about that. Labor economists have been working for years understanding the labor force. Integrating what they’ve learned into the macroeconomic model is certainly possible.

At the same time, I totally agree with Blanchard that we need lots of models. I think we need models for different kinds of things. We need the high-level models, the three-equation model that sort of summarize the stuff, and we also need the “low-level” models that are very complicated… But then at the “low-level”, we also need models that emphasize different things. For example, in the case of the labor market, in normal time it just seems like the labor force participation rate is really pretty stable and not a big deal. It could be that in normal time, you can say “I am not going to model that.” Since 2008, in 2009 particularly, the labor participation rate suddenly collapsed. At the same time, the recession occurred. Now, there seems to be part of business cycle recession so I think it deserves a lot of focus.

I do believe that there is some complicated judgment you have to make on what it is that you focus on, even in the really complicated models. Models can be infinitely complicated, then you have to somehow draw a line on how complicated it is. Maybe for some purposes, you really want to emphasize on the labor market, for other purposes you might want to avoid it. In the case of the European Central Bank, for example, sometimes you may want to think about a closed economy and not worry about trade with the rest of the world. At other times, you may want to think about that.

I personally think that thinking about the labor market is very important. Part of the reason why we are interested in the business cycle in the first place is precisely that of the variation in unemployment and employment. But it adds a degree of complexity to a model, and maybe for some purposes, it is fine not to think about that. It depends on the question you are asking, it depends on the country you are living in, it depends on the time that you are living in and so on.

Right now, the fall in the labor force participation of people we normally think of as working all the time, like white working-age males between 25-54 years old, that is a puzzling phenomenon. I think we do need to understand that.

Political Economy and Economics

Q: Working on this project, I have been thinking what we could add to mainstream macro models. Maybe we should add certain political economy factors in macro models? In recent years, We can see that political conflicts in Washington can, in fact, be a major factor that makes economic policy less effective than we have expected. Do you think we should consider incorporating political economy in the models?

C: It’s interesting that you’ve raised this question. I am chairman of the economics department and one of the things that I think about is: “Are we doing a good job in undergraduate education?” One thing that is bothering me is precisely the question that you are raising. Somehow the political economy has been pulled out of the economics, and there are many things that can’t be understood without bringing in the political economy. For example, US policies on globalization make no sense unless you understand the political economy. The outcome of the election last November, that’s going to have a big economic impact. Obviously, that is political economy.

In the case of undergraduate education, I am trying to figure out how to make courses integrate political economy with normal economics, to think about things like globalization, inequality, energy policy, global warming, etc.

I am saying all of this as a way to tell you that I completely agree with your puzzlement. “Hey, why isn’t political economy part of the picture?” By the way, in the 19 century, it was. Somebody pull the political economy out of the economics. I am not sure why. But I do think that this is an important thing. In growth theory, for example, political economy is very important. Actually, there is a very good paper by Jose-Victor Rios-Rull and Per Krusell on the AER [

On the Size of U.S. Government: Political Economy in the Neoclassical Growth Model] many years ago, they tried to explain why it is that sometimes for long period of time societies are more open to new ideas, and then for a long period of time the same society is less open to new ideas. They have a beautiful political economy model, again a DSGE model, for thinking about that. I do think that we need to integrate those kinds of things.

Although people have written down models which integrate political economy and economics, that is at a much lower level of development than, for example, the integration of financial sector into macro models. But I agree with you, this is a very important thing and it is very strange that it hasn’t been done very much up until now. It’s a mistake.

[…] our discussion on post-2008 Macroeconomics developments and the importance of DSGE models in part I of the interview, we asked Prof. Christiano about one of his recent and important research paper […]