Last Updated:

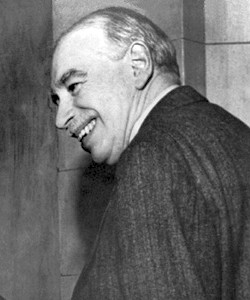

In this episode of “Where is the General Theory of the 21st Century?”, we talk to Professor Dani Rodrik, the Ford Foundation Professor of International Political Economy at Harvard’s John F. Kennedy School of Government, and leading economist on research covers globalization, economic growth and development, and political economy.

Introduction

“Where is the General Theory of the 21st Century?” is an interview series that explore the evolution of macroeconomics academia since the Great Recession.

Do we have some revolutionary changes in the macroeconomics after 2008, just like we had had the “Keynesian Revolution” after the Great Recession? Why haven’t economists come up with a new General Theory after the Great Recession? Our in-depth interviews with influential economists will provide answers to these questions.

In this interview, we talk to Prof. Rodrik about his excellent book on economic methods – “Economics Rules”.

Rodrik tells us that good economists think in terms of models, and there are major differences between models and theory. He also comments on macroeconomists’ quest on finding the “one true model” on the business cycle, and his preferred approach. We also spend some time talking about a major research project Rodrik is working on – research on Premature Deindustrialization.

(This interview took place in July 2017. The publication was delayed due to some reasons. My apology to all of you and especially Prof. Rodrik. The interview is sightly edited, all mistakes are mine.)

–On Economics Rules–

Q: EconReporter R: Dani Rodrik

Q: I love your book “Economics Rules”. May I ask why would you write a book about economics methodology? What is the motivation?

R: I am not a methodologist, and I certainly have only a casual knowledge of philosophy of science. However, I felt that there was a need to explain how good economics work is done to non-economists and, perhaps, paradoxically, to economists.

I had two audiences, both economists, and non-economist. I hope to present a picture of economics to non-economists so that they could, overcome some of the usual misconceptions of what economics is about. But I also hope to reach economists and convince them that the way that economics progress and the way that “good economics” is done are actually different. In other words, the actual practice is different from the apparent philosophy that they have about what kind of science economics is.

So, I wanted to explain to economists that part of the reason they cannot get their points across in the interdisciplinary environment is that they have the wrong view of what economics methodology is really like.

Q: In my opinion, one of the most important insights of your book is how to differentiate “model” from “theory.” Can you briefly tell our readers what the differences between the two are?

R: Models are the building blocks of economics, and I think they are critical in building theories. I try to stay away from the notion of “theory” in much of the book and talk about models. Then, there is one chapter in particular where I talked about what a theory is.

There are at least three different senses in which we use the term “theory” in economics and they all related to models in one way or another. But I think they are different.

A “grand theory” of how a capitalist system works, or how a market economy works, or to explain value and distribution, or to explain business cycle; those kinds of grand theories, I think, have generally been unsuccessful.

What we are much better at are conditional explanations. That is what models are – to build a causal explanation of what the impact of X, Y or Z would be on some variables of interest. Those tend to be more conditional and context-specific explanatory theories.

There is also an intermediate domain where we also apply the word “theory.” It is when we are trying to explain something after the fact. What did we have the Global Financial Crisis? Why is the Euro Zone unstable? Why has inequality risen in the world? These kinds of “theories” are really ways of combining different models that we already have to explain an outcome in a given historical period, or a given region of the world.

So, I think there are at least three different kinds of “theories”: the grand theory that is the universal and timeless theory; the specific, conditional causal explanations; and, the explanations of some particular historical episodes.

–On Macroeconomics and the “One true Model”–

Q: You have mentioned in your book that even Keynes’s General Theory is not a grand theory according to the above definition. May I ask if you think the case is that economics, given its nature as a social science, is not suitable in aiming to generate grand theories?

R: I do think that trying to come up with a “general theory,” say, of business cycles or employment, is not just a fool’s errand in the sense that it is not feasible; I think it also gets us astray. Because what happens is, instead of entertaining a variety of models that might be applicable at different times, we tend to fixate on a particular model that does well for a while; then, when the nature of the underlying realities change, and we need to shift the focus to another model, we are caught unprepared.

This is in some ways the history of macroeconomics. We discarded the Keynesian Model in the 1970s when we have a series of shocks on the supply side, and the Keynesian models did not seem to do a very good job explaining the simultaneous rise in inflation and unemployment. We built new models that were much more careful about expectations and its formation, which were in advance over the Keynesian Model in certain dimension; but it was also a regress in other dimensions because it downgraded the role of animal spirit, investor psychology, multiple equilibria and the demand side.

Then, when we find ourselves in the 2008 financial crisis, where we had demand-led recession and unemployment. All our models were sort of the neo-classical varieties, and they are not particularly helpful.

I still see this tendency among macroeconomists to develop the “one true model.” I think this is an unhelpful way of thinking about macroeconomics.

We need models with all the intertemporal bells and whistles, and in some kinds of policy analyses, those would be extremely important. In some other types of applications, ISLM would work just as well. Instead of trying to come up with ‘the model” – the grand unifying model – we need to carry in our mind a collection of models. Depending on the context, the nature of shocks, and which causal mechanism seem to be much more important, we try to do a better job of figuring out how to switch from one model to the next.

Q: You have mentioned the diagnostic approach in your book. Do you agree that in fields other macroeconomics, economists are more acceptive to the “diagnostic approach” which incorporates a set of models, instead of pursuing the “one true model”?

R: I think in some parts of the profession, the tendency to search for “the model” is relatively less strong.

In general, the more explicitly empirical and explicitly microeconomic the field is, it has less urges for the universal models. In labor economics and development economics, in particular, where the institutional details of the application highly matter; and the empirical tools of randomization or well-identified models have become very common.

In these areas, labor and development, I think there are much greater willingness to entertain multiplicity of models, and not be looking for the single model. I think it is a question of degree other than kind. There is a general tendency to think that the most recent model has been the most relevant ones. However, it is still true that macro probably is where I see the desire for “what is the right model” most prominently displayed.

Maybe that is because in some sense macroeconomics has failed us. The latest generation of macroeconomics thinking had very little to say about the possibility of, say, the global financial crisis and how to react to it. I think there is a greater sense of crisis in macroeconomics that macro has failed after a period of self-congratulation.

Just before the great financial crisis, macroeconomics has been in a very self-congratulatory mood. Macroeconomists think that the business cycle has been conquered; they think they understood the basics of it, and have a good idea of how fiscal and monetary policy ought to be used, and so forth. So perhaps, the disappointment is the greatest in macro.

I think the reaction has been the wrong one. The problem was not that the neo-classical model and all the dynamic optimization frameworks were completely worthless. It was just that we were applying the wrong model. We should have gotten a little bit away from Lucas and Surgent, and gone back toward Keynes or the New Keynesian models, or some other models with financial frictions.

I think what distinguishes a good economist from a pure ideologue is that a good economist can navigate between different mental frameworks and different models and knows that he has to be flexible. The framework he chooses is driven by the circumstances, not from prior notions of what a good model is.

Q: Some macroeconomists I have talked to would counter your arguments, saying that it would create many ad hoc theories.

For example, in development economics, the use of experiments possibly generates many ad hoc results that can’t be generalized. What do you think there could be a problem that if there are too many ad hoc theories, we can be able to choose among them?

R: No, I think what we are lacking is the way to systemically thinking about how to use the different models that we have. How do we distinguish between the models that have a chance of being useful, and those are not going to be useful, so we can navigate among the models that we have.

Obviously, if we have thousands and thousands of models, that is not a practical solution. However, I think the kind of craft, or the art, of economics, is the ways that we use the models that are the ones that proved handy; therefore we use them more, without necessarily discarding those that are “useless.”

The notion of ad hoc is very misleading in this kind of context because every model is ad hoc, in the sense that every model is a mix of a massive number of simplifying assumptions.

What is more ad hoc? To assume a representative agent that lives infinitely? Or to assume that a consumption function where individuals consume a fixed fraction of their income? I can imagine circumstances that the first assumption is more out of place than the second one. When you are thinking about issues of dynamic about future policy changes, we may want to use a model with forward-looking individuals; assuming representative individual with a very long horizon may not be a bad approximation under certain circumstances. It might be an appropriate assumption.

However, in other cases, when you have different groups of consumers that access very different types of financial markets and consumption possibilities, where distribution matters, heterogeneity matters, I think the representative agent assumption can be misleading.

So, I would never want to say that one is the right specification and the other one is ad hoc. I think that is just misleading terminology.

— Pluralism in Economics —

Q: Let talk about pluralism in Economics. Do you think that there is enough pluralism in economics as a whole?

R: If you define economics the way that I do, which is also the definition that Keynes gave… Let me paraphrase it; he said: “Economics is the science of thinking in terms of models, combined with the art of choosing the relevant ones.” What distinguishes us from our other social scientists is that we work by building models, we think in terms of models. That is the way we work.

There is much pluralism within that definition, in the sense that people are free to arrive at any policy conclusion provided that they follow the methodology rules of economics – which is to think in terms of models. There is pluralism in that sense.

There is no pluralism in the sense of acceptance of assault on the methodology. It is much harder to get your viewpoints across if you are doing sort of “literary economics,” which is to say basically work in a mode that is not thinking in terms of models. There is a certain amount of opposition to that; but I do not necessarily think that is inappropriate. Every discipline has its own methodological rules, and that is what gives it its discipline. It does not necessarily mean that I do not benefit from works in those other methodological traditions, but when I learn and think in those terms, I find it helpful to go back again and think in terms of models because that is when I think I can understand something.

To give you an example, for some years now, I have been interested in the constructivist tradition in social science, which says that many of the things we take as “facts” about the real world are actually “social constructs” – products of our own imaginations. They became facts because we believe them and imagine them.

The way that I have just stated to you, most economists would react to it by saying: “This is not what I do. It does not make any sense to me.” However, I thought that how we think about economic policy, development, globalization, and so on, could be enhanced by adding a constructivist perspective.

So, I started to think about how to model constructivism in economics. I do not do it to appear like an economist. I do it because I think it actually helps my thinking. Furthermore, one advantage is that I ended up convincing myself, and I hope some other economists too, that there is in fact not a huge gap between the rational choice world of the economist where interests are very well defined, and the constructivist world where interests are constructed socially.

In fact, you could think about these two worlds, which have many things that are diametrically opposed to each other, if you write down an appropriate model where there is some role for the construction of interest. Because people’s sense of identity, interests, and how the world works are in part the results of choices that we made in investing, advertising or persuasion, those two worlds can meet. I think we can enrich our understanding of the social world in that way.

I think the way in which Economics can become plural is when we have some basic insights from other fields, and then we start to think, “how does this work if I start to model it.” I think that is the strong point about economics that it forces you to be very, very clear about what your starting point is, what the casual channels are and exactly how you from particular assumptions to a specific result.

— On Premature De-industrialization —

Q: What is Premature Deindustrialization? What do you mean by premature?

R: I think it is premature in the sense that the onset of the deindustrialization at the level of income, and level of industrialization, which are much lower than that has been historically the case in countries that have eventually become wealthy.

It is premature in the context of historical comparison. Britain, Germany or the United States, which are in the first wave of industrialization; Japan, South Korea, and Taiwan which are the second or third waves. When we take those countries as our benchmarks of comparison, we see that today countries experience the onset of de-industrialization at a much lower level of income, and without having gone through a proper experience of industrialization.

Q: One of the problems facing developing countries is that they have to rely on service industries to support their growth. Why is the service-led growth is less beneficial to developing countries in general?

R: There are some critical differences between manufacturing and services that explains why manufacturing has been the escalator industry for convergence. Very few services share those properties.

What are they? First, manufacturing is tradable, that means that domestic demand and productivity in the rest of the economy do not constrain the market size faced by producers. If you are good at producing a few manufacturing products, you can scale up because you have the world market. There are of course some tradable services as well. IT, business services, finance, etc. But the problem with those tradable services that are highly productive is that they tend to be much more skill-intensive than manufacturing historically has been.

So manufacturing has been able to absorb a lot of low-skill labors, so you can turn a farmer or somebody in the informal sector into a manufacturing worker on the production line and increase his/her productivity three-fold, four-fold without a massive investment in training and education.

The service sectors that I have just cited, IT, finance, etc., really require highly skilled professionals. Therefore, they can’t absorb the production factor that low-income countries that are most abundant – low-skilled labor.

The services that do absorb unskilled labor are typically not tradable, so they have the problem that they cannot expand and scale-up very rapidly. I think that is the conundrum.

Q: The role of technology in your framework is kind of interesting. The origin of the problem is that tech in developed countries replaced the need for manufacturing in low-income countries. But may I ask if there is a case that technology can help the low-income countries to solve the conundrum they are facing?

R: There are indeed ways in which developing countries benefit from these technologies. First, to the extent that they are importers of products that are subject to the technological advances, they benefit from it. One of the most significant sources of gain for these countries has been the access to mobile telephony. The cell phone has generated consumer surplus in developing countries in a very substantial way. That’s a gain.

Secondly, new technology has enabled developing countries to develop niche products, for example in agribusiness, like in soybean, avocado, etc. I think you find much success in developing countries in agribusiness by using high technology in agribusiness to service markets elsewhere.

But in the end, ultimately the question is where will the productive jobs come from. Many of these new, more technology-intensive activities in developing countries, whether in services or agribusiness, are not generating many jobs. So we still have the question that, as people moving out of agriculture, moving into urban areas, what kind of jobs can they get?

In the early era, if the government did their job right, they would be promoting manufacturing and industrialization. Today it is happening to a very limiting extent that people flooding into the urban area are going into informal services that have very low productivity. That what I worry about. It is not that developing countries do not benefit from technology, either as the consumer or as the producer of niche products. But the kind of mass employment in high productivity activities, that’s where I worry that developing countries are being shut out of.

Q: Will premature deindustrialization widen global inequality?

R: I do think that there was a very rapid growth we have had in the last couple of decades, not just in China, also in India, Sub Saharan Africa, and Latin America. But I don’t see that being sustainable.

I do think that global inequality will continue to fall, in part because the rich countries are going to be growing less rapidly as well. I do expect developing world will grow more quickly than the advance countries. So, I do think that convergence will continue to some extent, but at a much lower pace.

— Straight Talk on Trade —

Q: You have a new book “Straight Talk on Trade” recently. What is the motivation for writing this new book?

R: I think we need a narrative about globalization that is both more evidence-based and also has the potential of displacing the kind of populist narrative which obviously has increased appeal in recent years. I think the populist narrative is damaging in many ways, in particular to liberal democratic norms.

My objective with this new book is the present kind of an alternative narrative about how we can have a healthy globalization that doesn’t undermine domestic economic policy space and does not undermine the practice of democracy and provide an antidote to mindless populism.

Independent Economics Journalism

Stay ahead of the curve — follow EconReporter for in-depth coverage on economics & markets.