Last Updated:

Federal Reserve’s Pre-2008 Corridor System

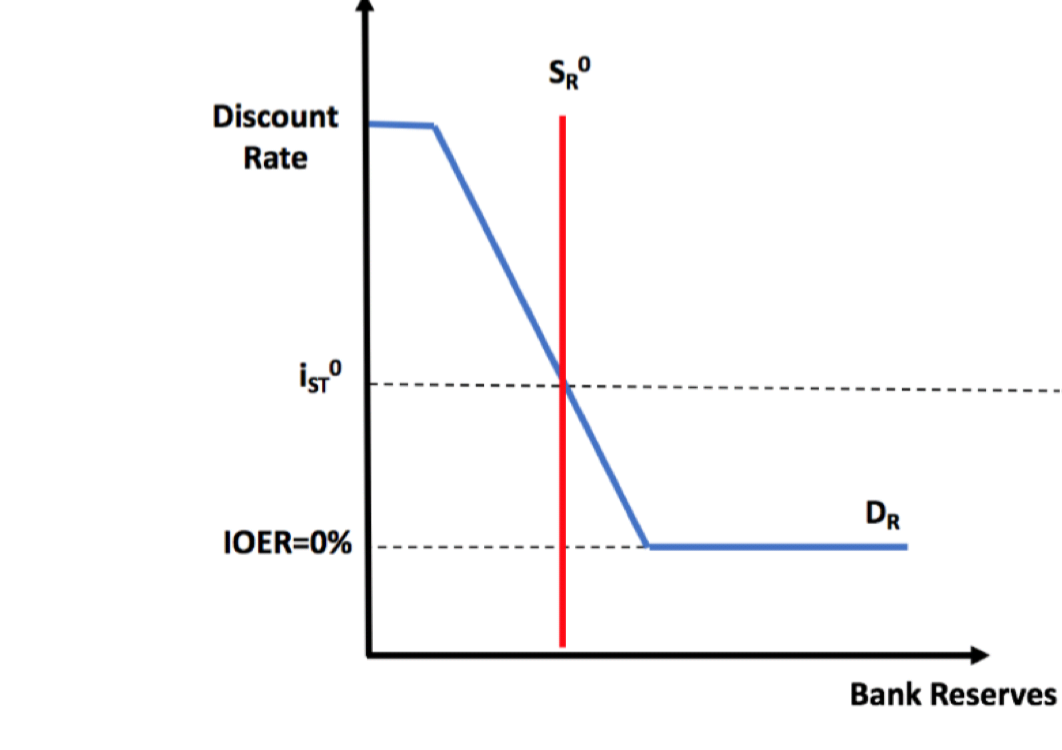

Before 2008 the interest rate policy system is a so-called “corridor system”, where the discount rate served as the corridor ceiling and the zero lower bound (ZLB) was the floor.

In this system, the demand curve of the bank reserve market is downward sloping with respect to the interbank interest rate. Note that the demand for reserve is perfectly elastic when the interbank borrowing rate (the Fed Fund rate) is at or above the discount rate, or at or below the ZLB, that means the demand for reserve vanishes when the interbank rate is outside the bond of these two rates (discount rate and ZLB).

Here is the graphical illustration of the reserve market:

The supply of reserve is controlled by the Fed, and it is the intersection of the supply and demand curve of reserve that determines the level of interbank interest rate.

Under the corridor system, the Fed would put the reserve supply at the level which the reserve demand curve is downward sloping, and the Fed adjusts the reserve supply daily to keep the interbank rate at the FOMC target level.

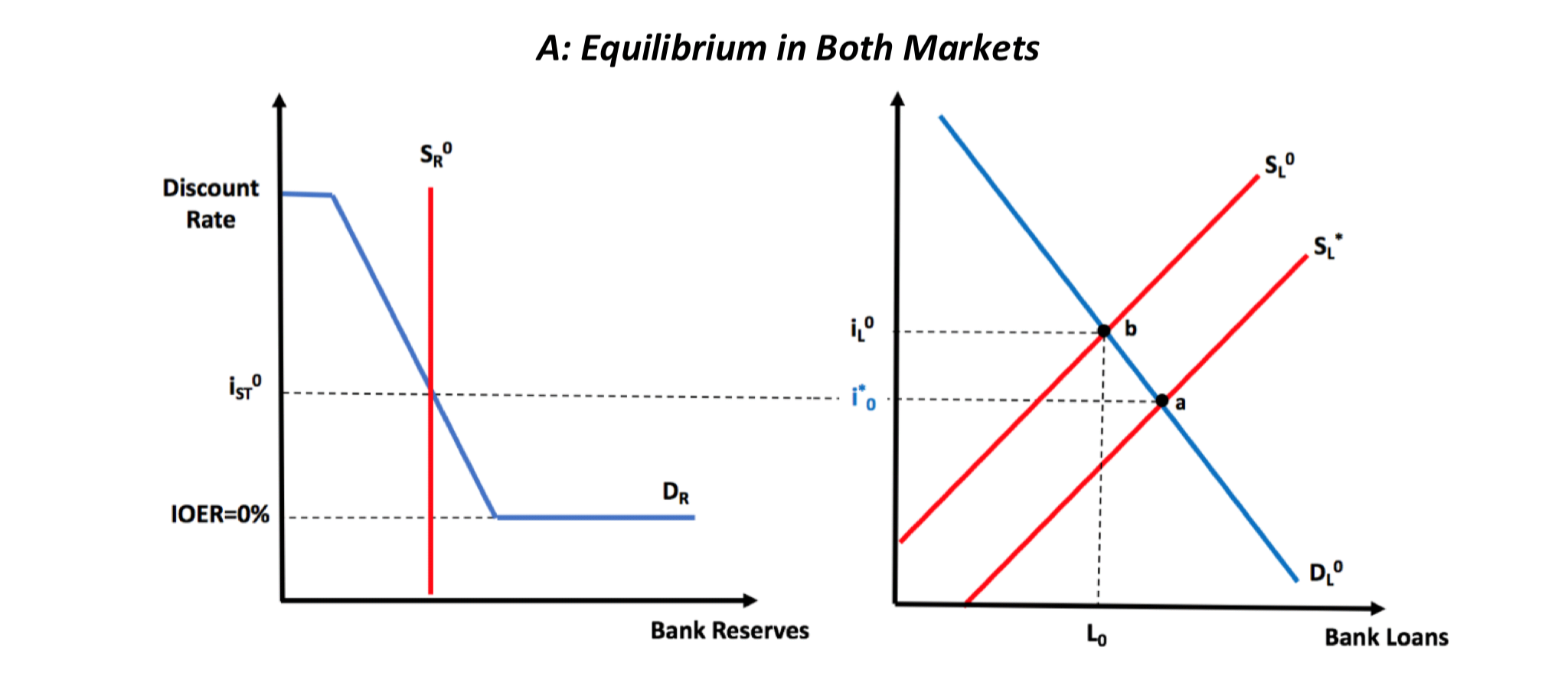

In theory, the equilibrium interbank rate should be equal to the equilibrium risk-free rate in the market for loan. If the risk-free rate is higher then the interbank rate, banks would have the incentive to extend more loans, this would increase the demand for reserve, as banks need to meet a higher reserve requirement when the loans in their book increased. Higher demand for reserve would push the interbank rate higher and eventually, equate the risk-free rate in the market for loans.

Federal Reserve’s Post-crisis Floor System

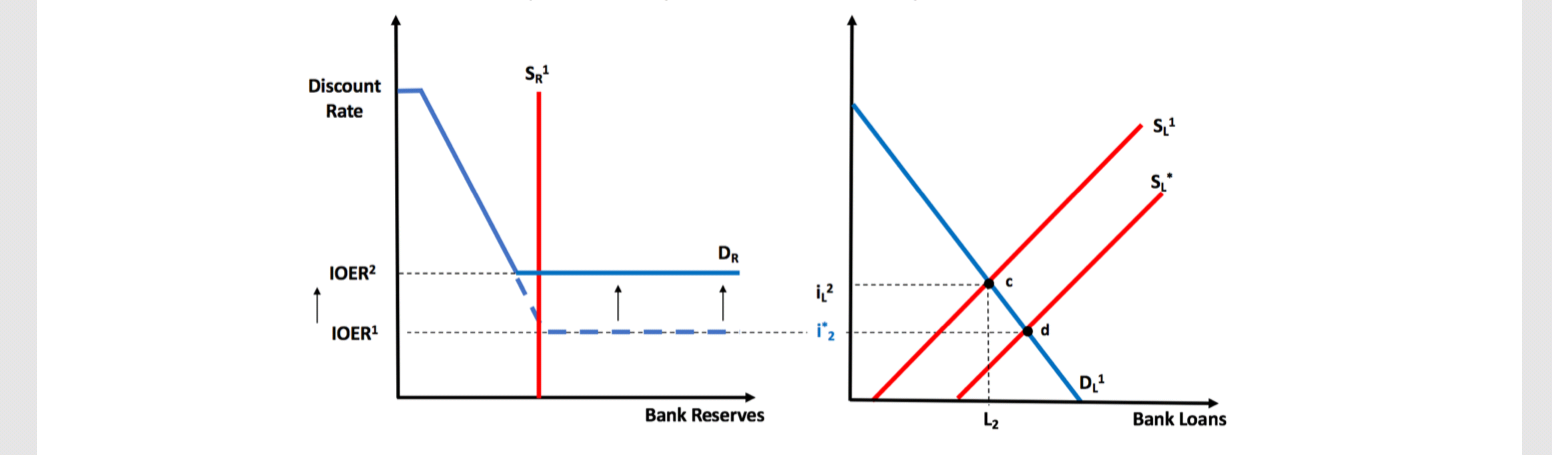

In October 2008, the Fed started to pay interest on excess reserves (IOER) to the banks and it is no longer zero. At the start, the IOER was at around the level of 75 bp, but soon it came down alongside the Fed’s rapid cut of Fed Fund rate. From 2009 on, IOER is stuck at 0.25 ppt till 2016.

Under the old corridor system, IOER is zero and served as the corridor floor. Yet, ever since the Fed started paying IOER, IOER is constantly higher than the effective Fed Fund rate (EFFR). That is, EFFR no longer stays in the corridor.

By setting IOER above the EFFR, the Fed essentially eliminated the cost of holding reserves for the banks. Remember in the old system, the banks earn nothing from holding excess reserves, so they have to forgo the interest income that can be earned from loaning out the reserve in the interbank market. Now the banks have the incentive to hold much more reserves.

Graphically, the supply and demand now intersect at the bottom flat part of the demand curve. The interbank rate is set by the risk-free rate of the loan market, and the interbank rate is lower than the IOER.

Because of the 2008 financial crisis, the demand for loans greatly reduced, this brings down the demand for reserve also. On the other hand, in November 2008 the Fed started the first quantitative easing (QE), which started buying mortgage-backed securities (MBS) and long-term treasuries from the bank and paid the bank with reserve in exchange. Hence, the supply of reserve increased substantially.

With both the increase in supply and fall in demand for reserve, the equilibrium interbank rate is pushed firmly below IOER.

According to David Beckworth, Research Fellow at the Mercatus Center and author of the insightful research “The Great Divorce: The Fed’s Move to a Floor System and Its Implications for Bank Portfolios” which this article is based on, the Fed intended to keep the IOER above the EFFR, so to ensure that demand and supply of reserve don’t intersect on the downward doping part of the demand curve, and it is the IOER, instead of the supply of reserve, that drives the interest rate policy.

In 2014, the Fed introduced the overnight reserve repurchase agreements (ONRRP) which allow money market participants to lend money to the Fed and earn interest income that is essentially risk-free. The ONRRP became the hard floor for the risk-free rate in the interbank market and the loan market. This is the Floor system that the Fed is using to set the interest rate policy since then.

Reference

The Great Divorce: The Fed’s Move to a Floor System and Its Implications for Bank Portfolios

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡