Monthly Archives: June 2024

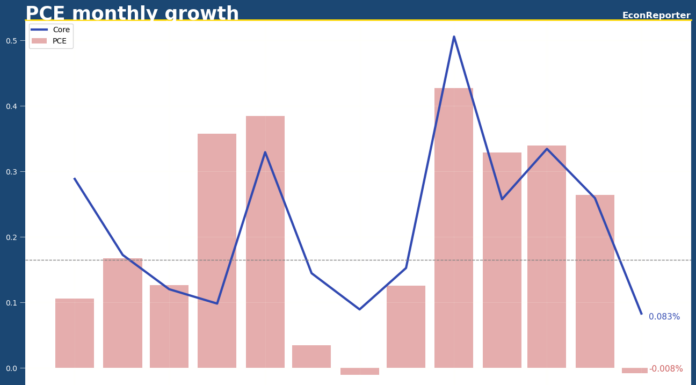

US PCE price index shows zero monthly inflation in May

US PCE price index showed 0% monthly inflation in May, bolstering market narrative that consumption sentiment has weakened in Q2 and helped easing inflationary pressure in the US economy.

US large banks pass Fed’s stress test with credit card, commercial loans projected to generate more losses

The Federal Reserve revealed US large banks passed the 2024 banking system stress test.

Canada inflation rebounds to 2.9% in May

CPI inflation in Canada rebounded to 2.9% YoY and 0.31% MoM in May 2024

BoE holds rate at 5.25% with ‘some’ officials signal eagerness to cut

Bank of England held its policy interest rate at 5.25% with a 7-2 vote amongst officials at its Monetary Policy Committee.

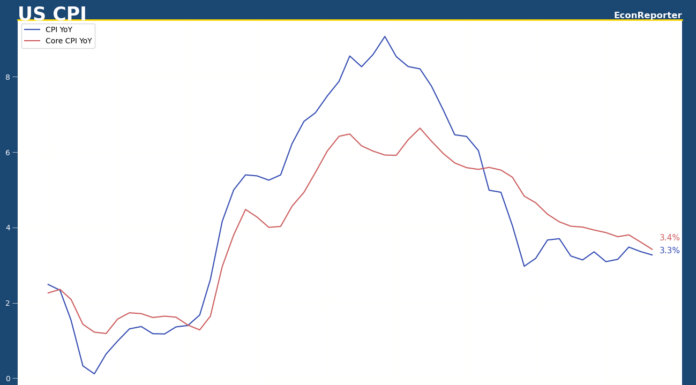

US CPI shows zero inflation in May

US CPI grew 0% in May as the yearly growth rate dropped to 3.27%; core inflation, which stripped out food and energy prices, rose 0.2% and the yearly rate decreased to 3.42%

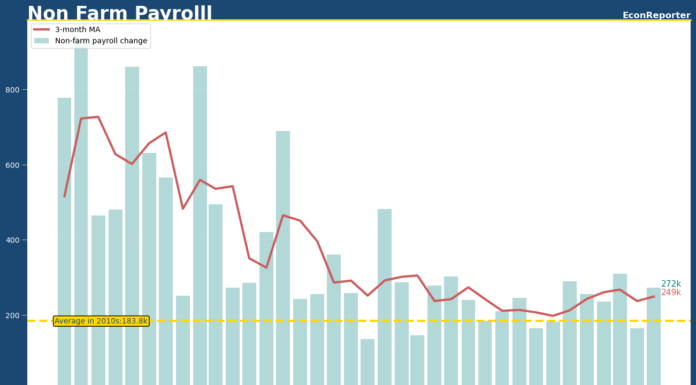

US gains 272,000 jobs in May, blows past expectations

US gained 272,000 nonfarm employment in May blew past market expectations of an 185,000 increase. Meanwhile, unemployment rate rose to 4%, which is the highest level since November 2021.

Bank of Canada cuts rate by 0.25 ppts to 4.75%

The Bank of Canada lowered its target for overnight rate by 0.25 ppts to 4.75%, making it one of the advanced economy central banks to cut rates before Federal Reserve does.