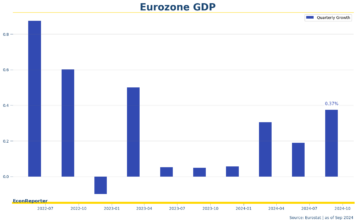

Eurozone inflation drops to 6.1% in May, lower than expected

Annual consumer prices in the Eurozone rose by 6.1% YoY in May, down from 7% in April.

UK house prices continue to fall in May, Nationwide reports

UK average property prices were 3.4% lower compared to the previous year, accelerating the annual fall of 2.7% in April.

UK CPI inflation eases to 8.7% but food inflation still close to 20%

The headline CPI figure slowed down to 8.7% in April, from 10.1% in March, while core inflation accelerated to 6.8%, from 6.2%

US PCE inflation slows further in March with looming recession concern

US PCE price index decelerated further in March with the year over year rate dropped to merely 4.2%, down from 5.1% in February.

UK inflation remains above 10% as food prices continues rapid rise

The UK CPI rose 10.1% in the year to March, still remain in double digits even though analysts expected the annual rate to fall to 9.8%

US CPI decelerates further in March to close 2 year low

Consumer price index grew for March 5% over the past year, reaching the lowest level since May 2021. Nonetheless, Core CPI recorded a 5.6% increase, up from 5.5% in February.

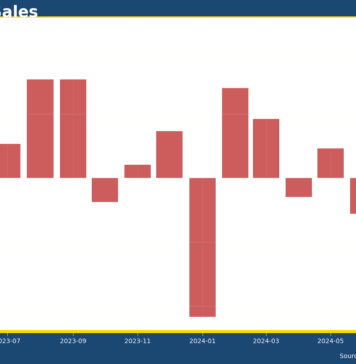

Resilient US job market continues easing trend

Non-farm payroll booked an increase of 236,000 in March, a further deceleration from February's 326,000, which was revised upward from the preliminary figure of 311,000, according to the Bureau of Labor Statistics' establishment survey.

US inflation eases further in February as energy prices drop, PCE index shows

Inflation in the US showed further signs of easing as the yearly growth of core PCE price index slowed to 4.6% in February, while the headline number increased by 5%.

Fed-preferred PCE price index accelerated in January

Core PCE inflation rose 4.7% in January YoY, beating expectation of 4.4% increase. The Fed-preferred price index rose 0.6% MoM compared to the market expectation of 0.5%.