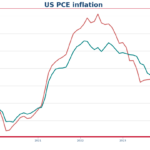

US CPI down to 2.9% in July as disinflation continues

US headline CPI down to 2.9% in July, lowest since March 2021

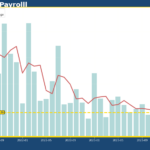

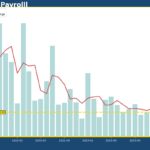

US April Jobs Report – Unemployment rate rises back to 3.9% as Nonfarm Payroll...

Nonfarm payroll increased 175,000 in April, a significant reduction from 315,000 in March and fell short of the market expectation of 243,000. Meanwhile, US unemployment rebounded to 3.9%

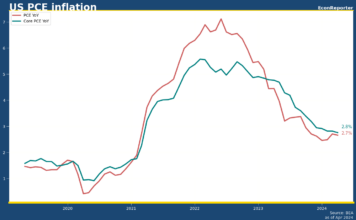

US PCE inflation drops to 2.5% as disinflationary trend continues

Inflation in the US cooled off further to 2.5% over the year to the end of June, according to the latest reading of US Bureau of Economic Analysis's PCE price index.

UK retail sales rebounds 3.4% in Jan after dismal Christmas figures

UK retail volume rose 3.4% MoM in January, after it dropped by 3.3% in December

US gains 272,000 jobs in May, blows past expectations

US gained 272,000 nonfarm employment in May blew past market expectations of an 185,000 increase. Meanwhile, unemployment rate rose to 4%, which is the highest level since November 2021.

Canada inflation drops back to 2.7% in June

Annual inflation rate in Canada eased back to less than 2.7% in June after a upshot in the previous month, according to Statistics Canada's CPI report.

US gains 339,000 jobs while unemployment rate rises to 3.7%

Employers in the US added 339,000 jobs in May, but at the same time 440,000 more people reported they were unemployed

Canada unemployment rate rises to 5.8% as labor force continues to grow

Statistic Canada on Friday reported that Canada's unemployment rate rose to 5.8%,, reaching the highest since the start of 2022.

UK inflation holds at 4% in January

CPI: 4.0% YoY (Dec: 4.0%); Core CPI: 5.1% YoY (Dec: 5.1%)

US PCE price index shows zero monthly inflation in May

US PCE price index showed 0% monthly inflation in May, bolstering market narrative that consumption sentiment has weakened in Q2 and helped easing inflationary pressure in the US economy.