UK CPI inflation eases to 8.7% but food inflation still close to 20%

The headline CPI figure slowed down to 8.7% in April, from 10.1% in March, while core inflation accelerated to 6.8%, from 6.2%

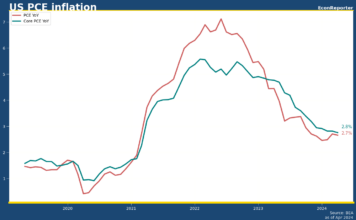

Fed-preferred PCE price index accelerated in January

Core PCE inflation rose 4.7% in January YoY, beating expectation of 4.4% increase. The Fed-preferred price index rose 0.6% MoM compared to the market expectation of 0.5%.

UK house prices continue to fall in May, Nationwide reports

UK average property prices were 3.4% lower compared to the previous year, accelerating the annual fall of 2.7% in April.

UK retail sales drops 1.2% in June due to poor weather, election uncertainty

Monthly growth rate of UK retail sales volume fell 1.2% in June, after a 2.9% increase in the previous month.

UK inflation holds at 4% in January

CPI: 4.0% YoY (Dec: 4.0%); Core CPI: 5.1% YoY (Dec: 5.1%)

Canada inflation slows further to 2.5% in July

Inflation in Canada decreased to 2.53% at an annual basis in July according to Statistics Canada's latest report

BoE holds rate at 5.25% with ‘some’ officials signal eagerness to cut

Bank of England held its policy interest rate at 5.25% with a 7-2 vote amongst officials at its Monetary Policy Committee.

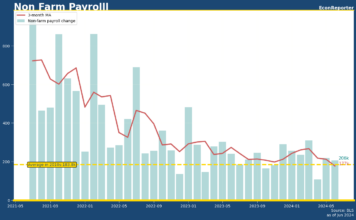

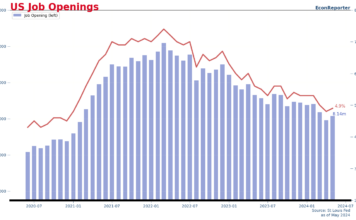

Resilient US job market continues easing trend

Non-farm payroll booked an increase of 236,000 in March, a further deceleration from February's 326,000, which was revised upward from the preliminary figure of 311,000, according to the Bureau of Labor Statistics' establishment survey.

UK retail sales rebounds 3.4% in Jan after dismal Christmas figures

UK retail volume rose 3.4% MoM in January, after it dropped by 3.3% in December

US GDP grows at 2.8% in Q2 as consumer spending remains strong

US GDP grew at a 2.8% annualized rate in Q2, supported by acceleration in consumer spending, increase in nonresidential fixed investment as well as an upturn in private inventory investment