Last Updated:

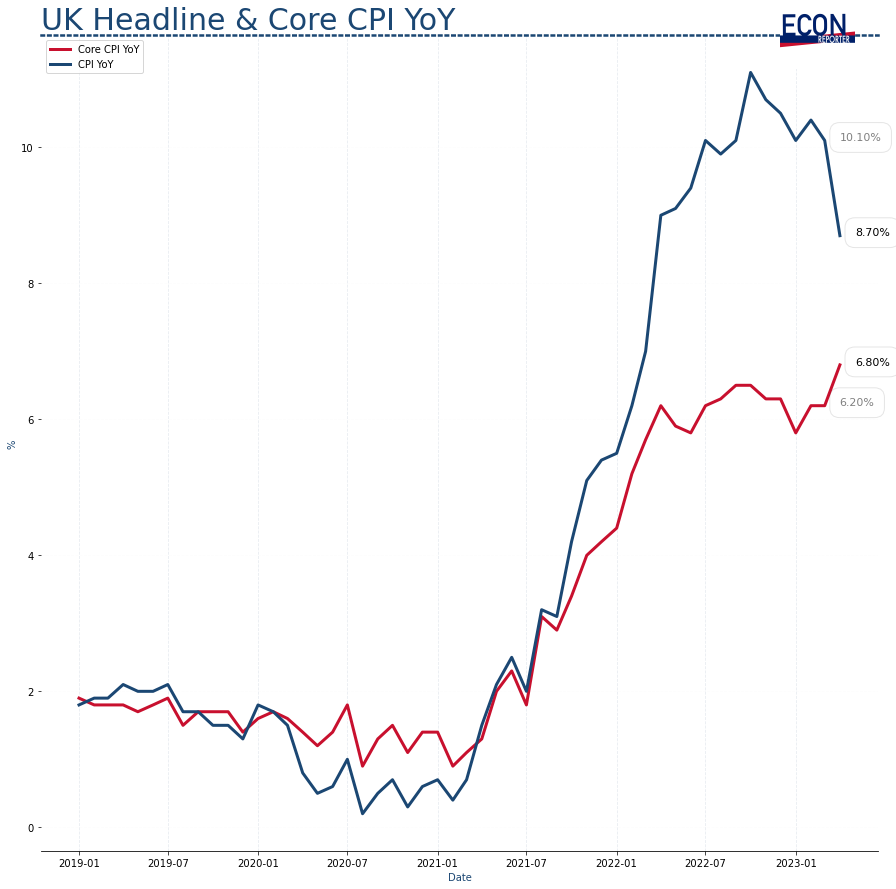

CPI rose 8.7% for the year ended April in the UK, first time the annual increase back to single digit since August last year, according to the latest release from the country’s Office for National Statistics (ONS).

While the headline figure slowed down from 10.1% in March, core inflation accelerated to 6.8%, from 6.2% in March, indicating the stickiness of the general price level increase in the UK.

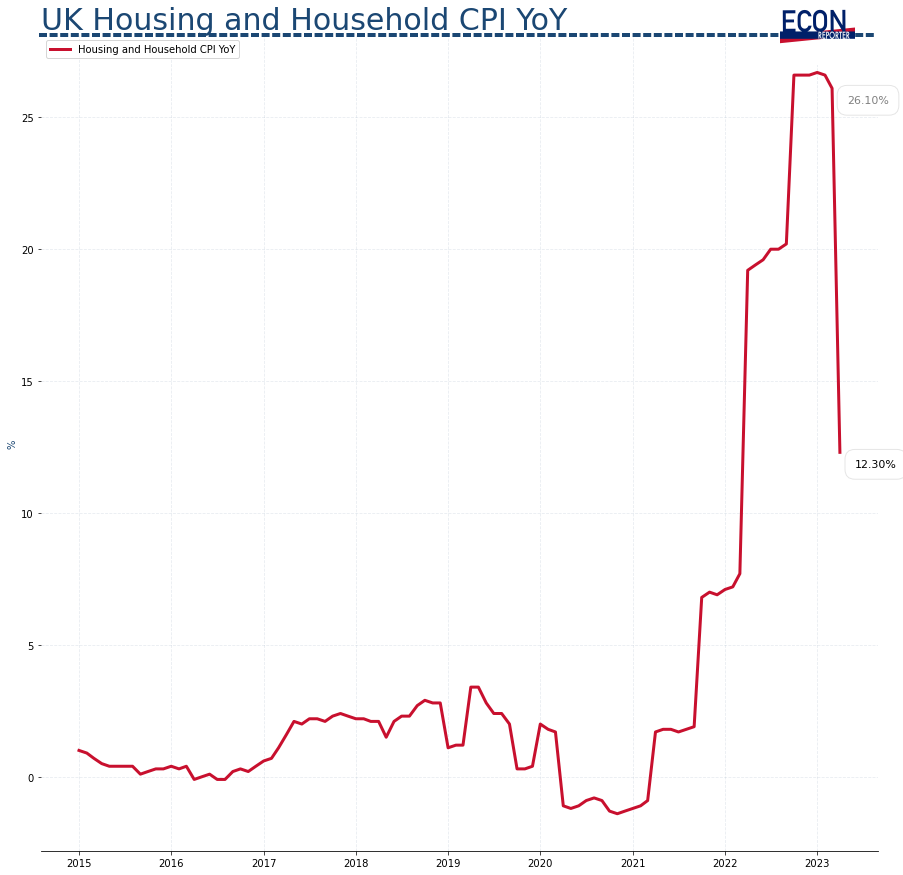

Housing and fuel cost — 12.3%

The slowdown in headline CPI is largely a result of a “merely” 12.3% annual increase in CPI for housing, water, electricity, gas and other fuels, compared to 26.1% in March. ONS, however, explained that the “fall is largely because of the upward contribution from the higher April 2022 Office of Gas and Electricity Markets (Ofgem) energy cap dropping out of the annual estimates.”

The Ofgem energy price cap, which limits the maximum energy suppliers can charge customers on each unit of electricity and gas, rose by 54% in April 2022 due to the rise in global gas prices back then. The energy cost for a typical household was increased from GBP 1,277 to GBP 1,971 per year for that quarter.

The cap was subsequently raised to GBP 3,280 in the quarter starting April this year, though what a typical customer pays was limited to only GBP 2,500 as a result of the government’s Energy Price Guarantee. The good news was that, on Thursday, Ofgem announced that the price cap starting from July will be lowered to GBP 2,074, an effective GBP 426 reduction from the price in the current quarter, so we can expect a further slowdown in the household energy cost in the UK.

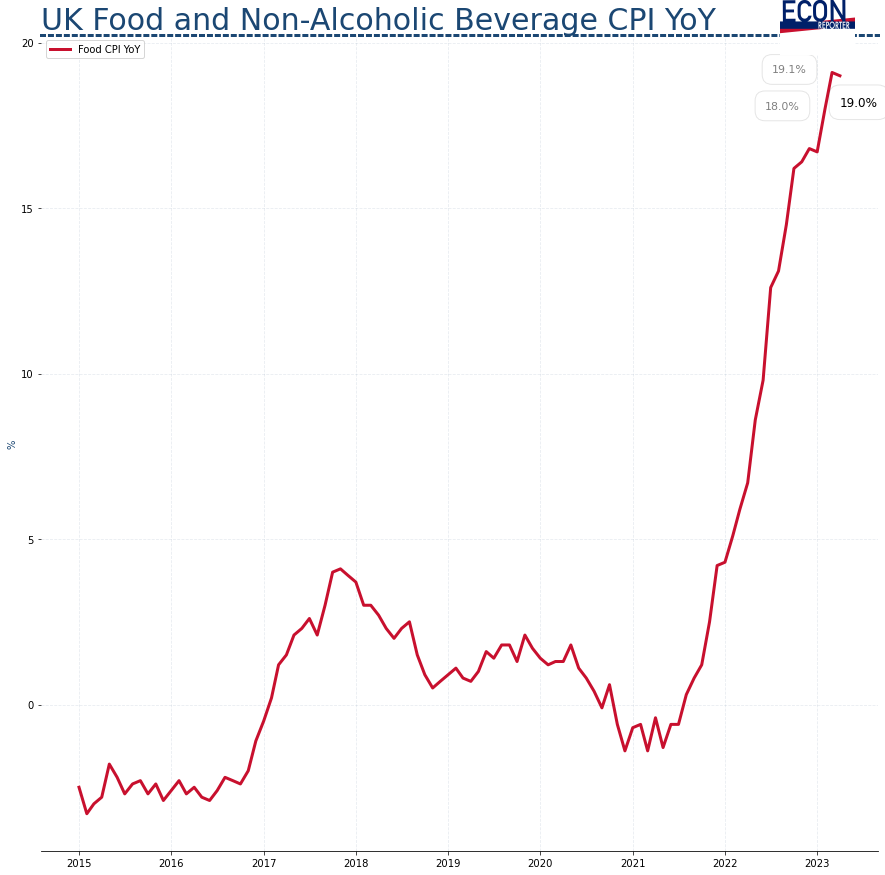

Food inflation — 19.1%

Still, one of the most severe cost of living problems facing UK residents is the persistent rise in food prices. CPI for food and non-alcoholic beverage rose 19.1% in the year to April, just a bit lower than the 19.2% record high we saw in March.

Bank of England may need to step up

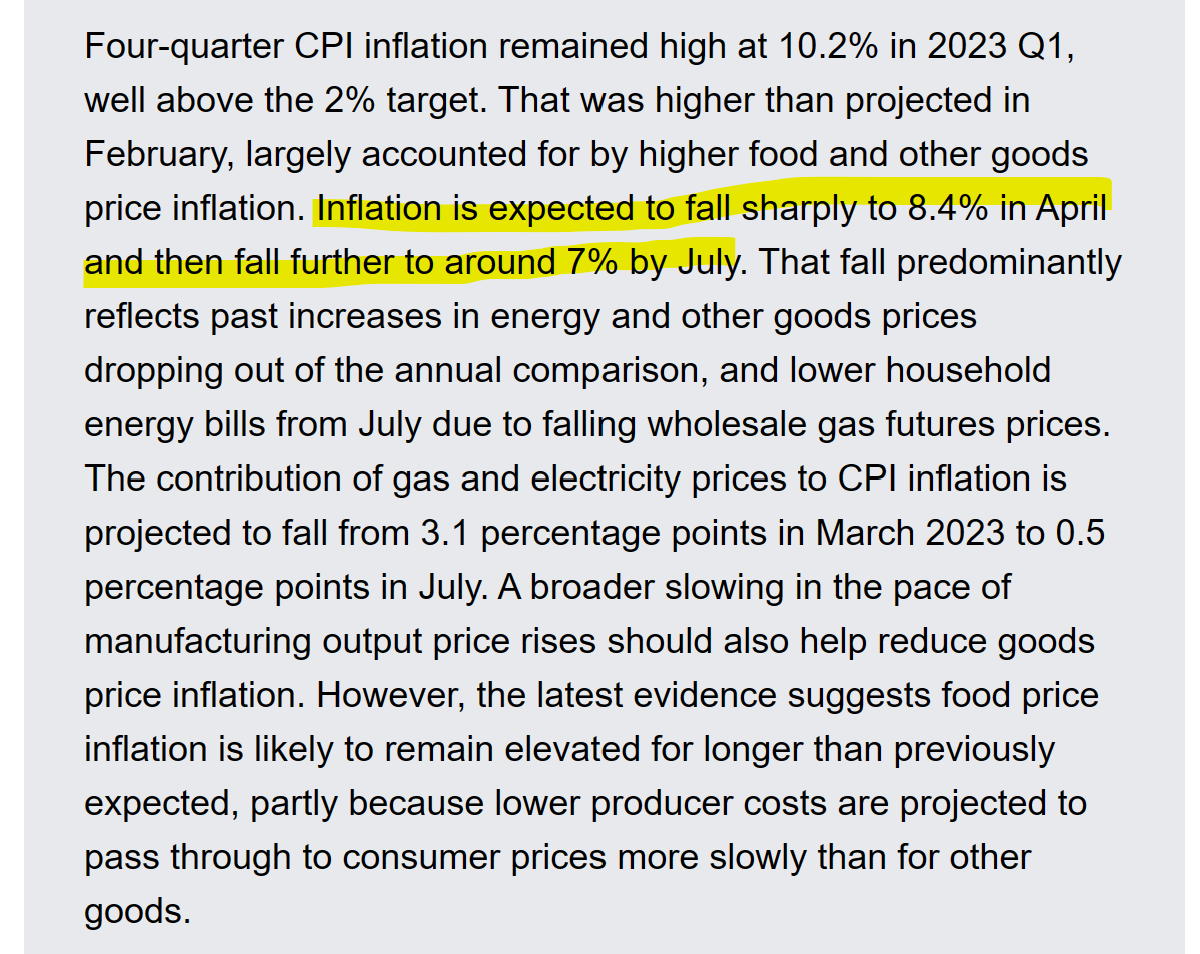

Elevated food prices have been a “surprise” element in the Bank of England’s inflation forecast, as the Bank expected the headline number to drop to 8.4% in April.

The Bank’s Governor Andrew Bailey on Tuesday told a House of Commons Treasury select committee that market contacts had informed BoE in February that food inflation had likely peaked, but the information turned out to be incorrect as bad weather in other parts of the world affected crops such as sugar. Also, food producers had locked in higher costs with some hedging arrangements, another factor that the BoE had missed.

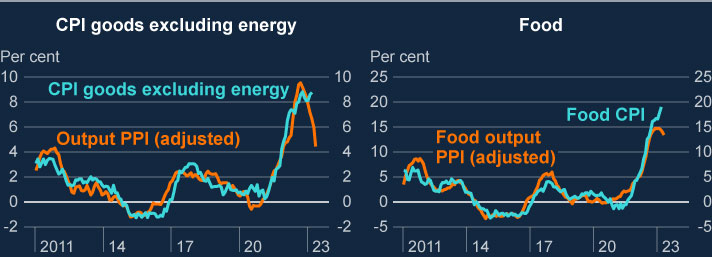

BoE, in its latest Monetary Policy Report, was still optimistic that food inflation will come down in the near future and bring down the general inflation, citing the fall in PPI for food products, though the current CPI figure still has yet to reflect that.

Analyst’s comments

“Assuming the most recent month-on-month increases in output prices were to continue through the remainder of this year, it implies that food inflation should be back to the 6% area or below by Christmas.

In practice, we doubt the deceleration will be that aggressive, but there are nevertheless good reasons to think that food will be contributing less to overall inflation by the end of the year.” — James Smith from ING

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡