Last week, Bank of England’s Deputy Governor for Monetary Policy Ben Broadbent gave an insightful speech about debt dynamics.

An important point Broadbent has illustrated is that a high absolute level of debt is not the most worrying sign of economic slowdown. It is the growth rate of debt that we should heed.

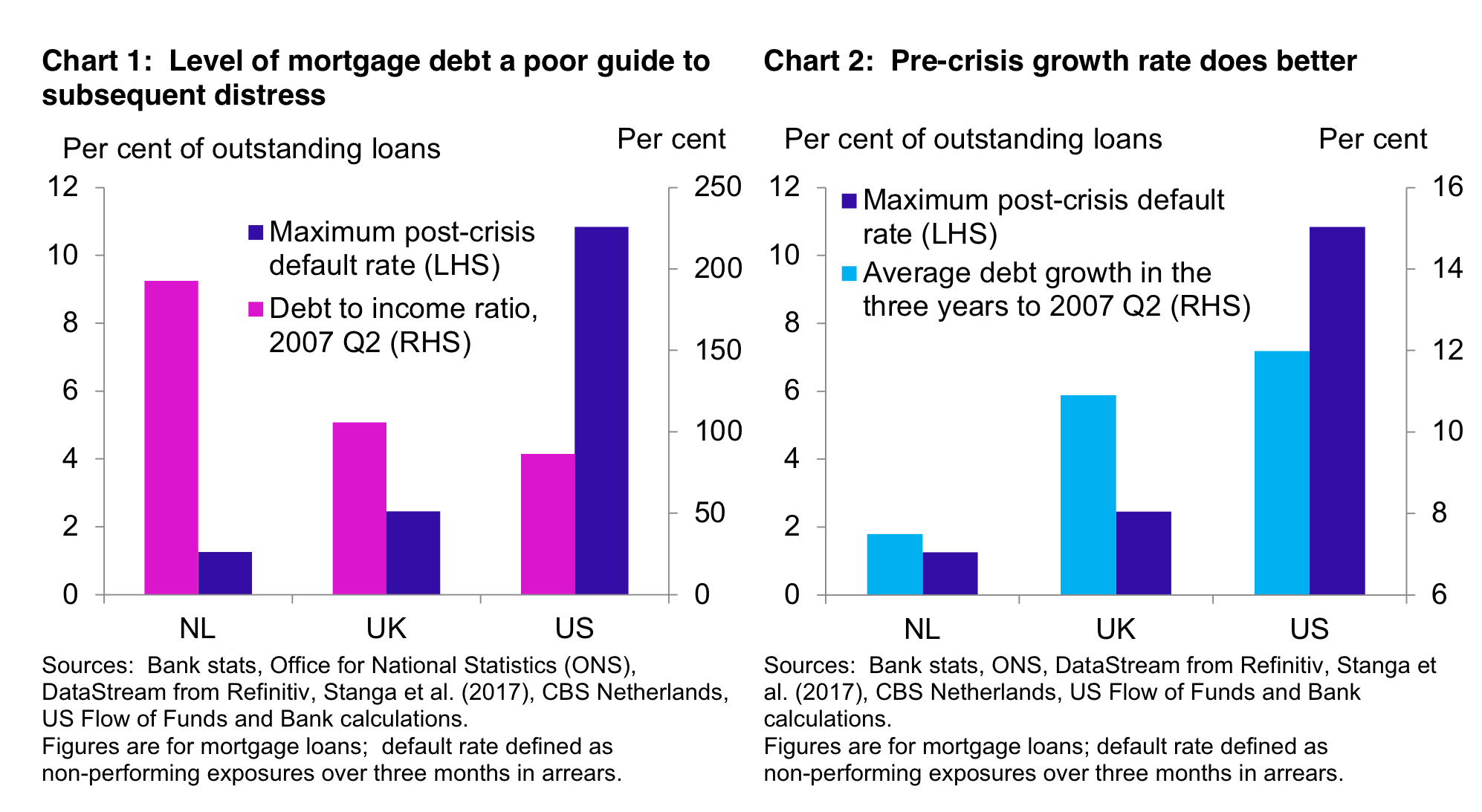

Before the 2008 financial crisis, the level of mortgage debt, compared to income was near 200% in Netherlands, but less than 100% in the US. Nonetheless, it is the US that ended up experiencing the most mortgage defaults.

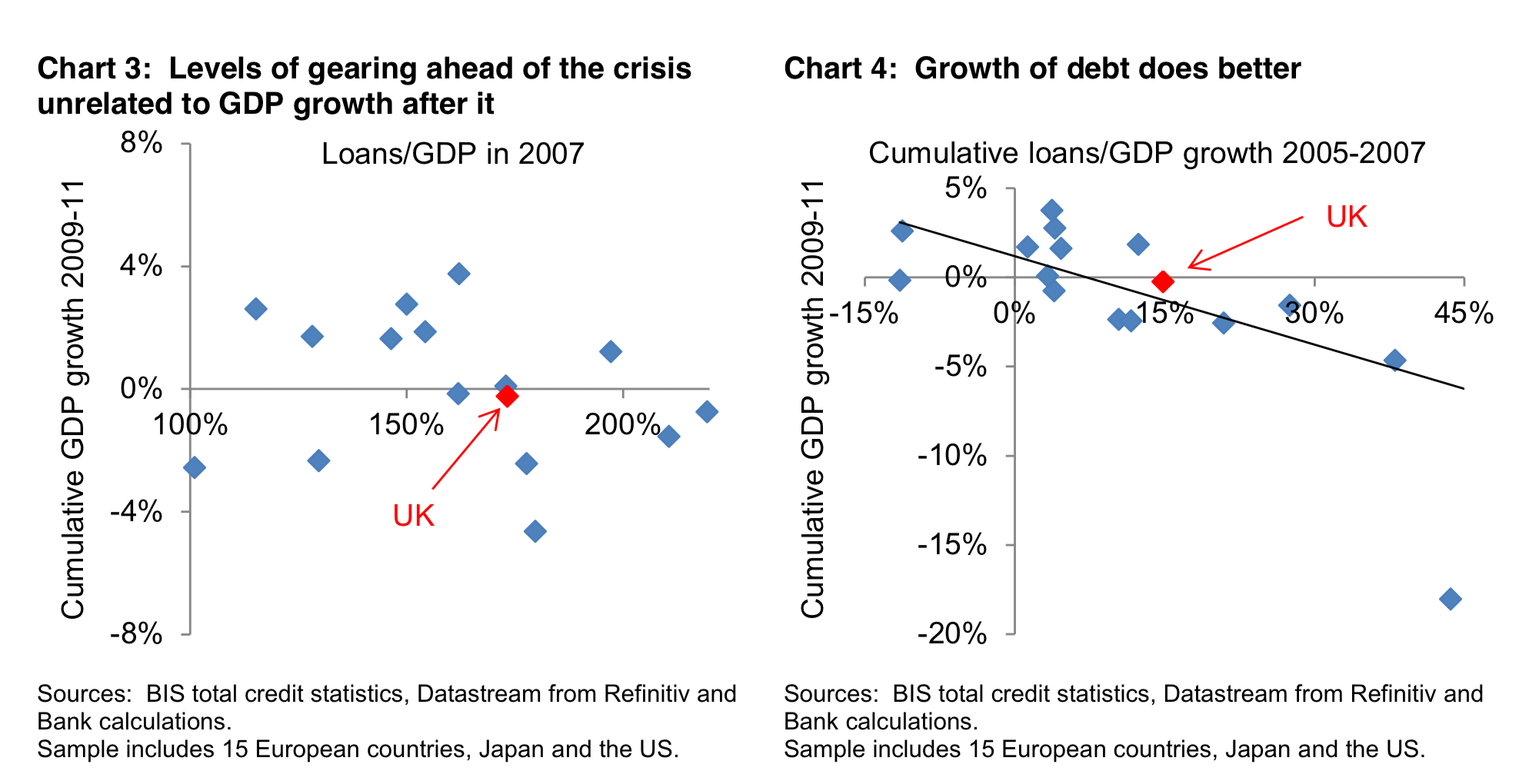

If we look at the average debt growth for these countries before the crisis, we can see that the default rate actually correlated with it. The figure below, using the loans to GDP ratio of various countries in 2007, and the loan to GDP growth between 2005-2007, it shows the same picture. There is a negative correlation between economic growth and loan growth.

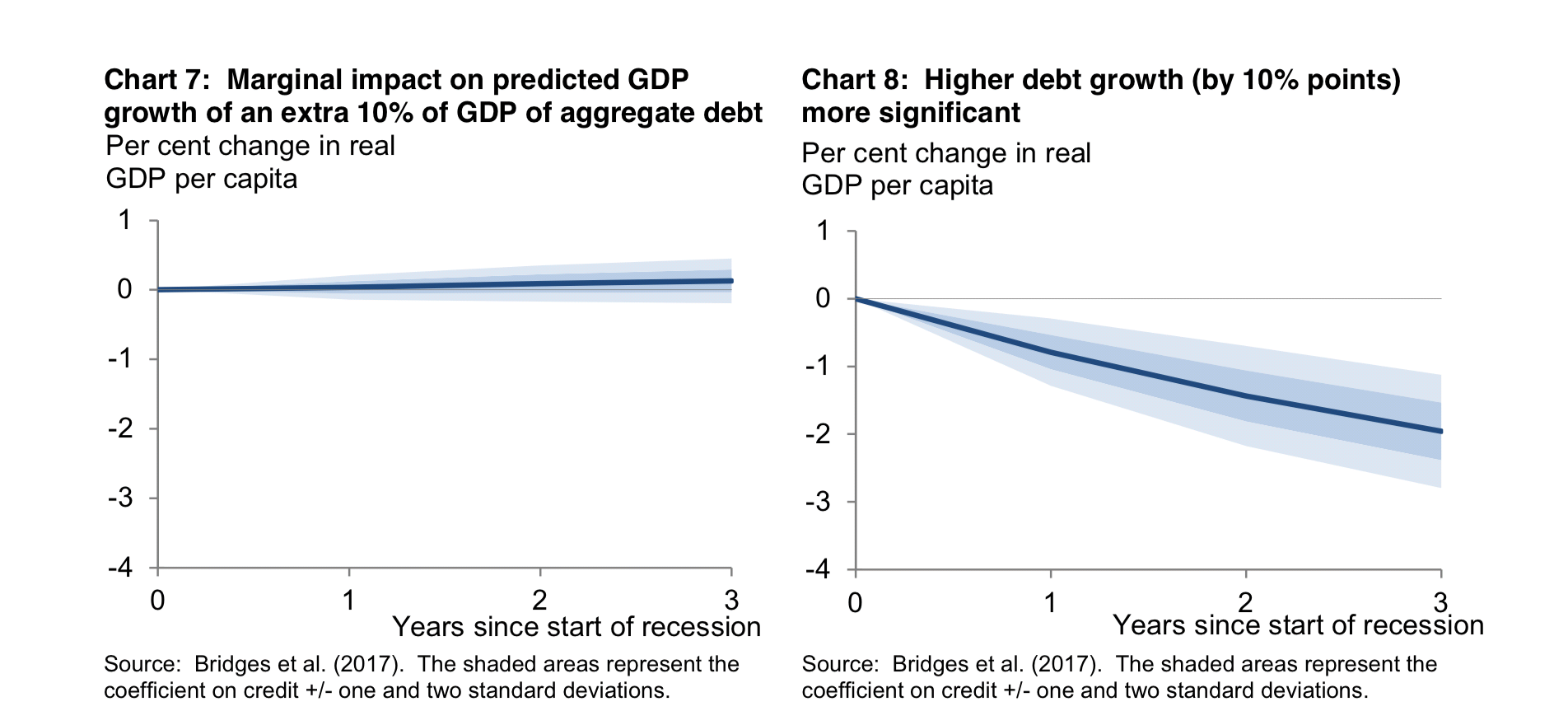

Citing a 2017 BoE working paper, Broadbent illustrated that this relationship hold even if we look at a sample of longer history.

For an extra 10% growth of Debt to GDP ratio, the impact on GDP grow is, on average, near zero; but if there is a acceleration of debt growth of 10%, it predicts a 2% fall in GDP.

Broadbent suggested that there may be country-specific factors that make the same level of debt more affordable and less risky in some places than in others, or even at different points in time. There are also structural factors that affect measured debt but probably have less significance for households’ financial risk. These are the possible reasons that why the level of debt is not informative about the future economic performance.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡