Last Updated:

The Saturated Level of Reserves, or efficient level of reserves, is the point in which the opportunity cost for banks to hold reserves disappears, and the banks became indifferent towards holding more reserves. The reserve demand curve beyond this point becomes close to horizontal.

The Federal Reserve is currently operating its interest rate framework with the supply of reserves well beyond the saturated level.

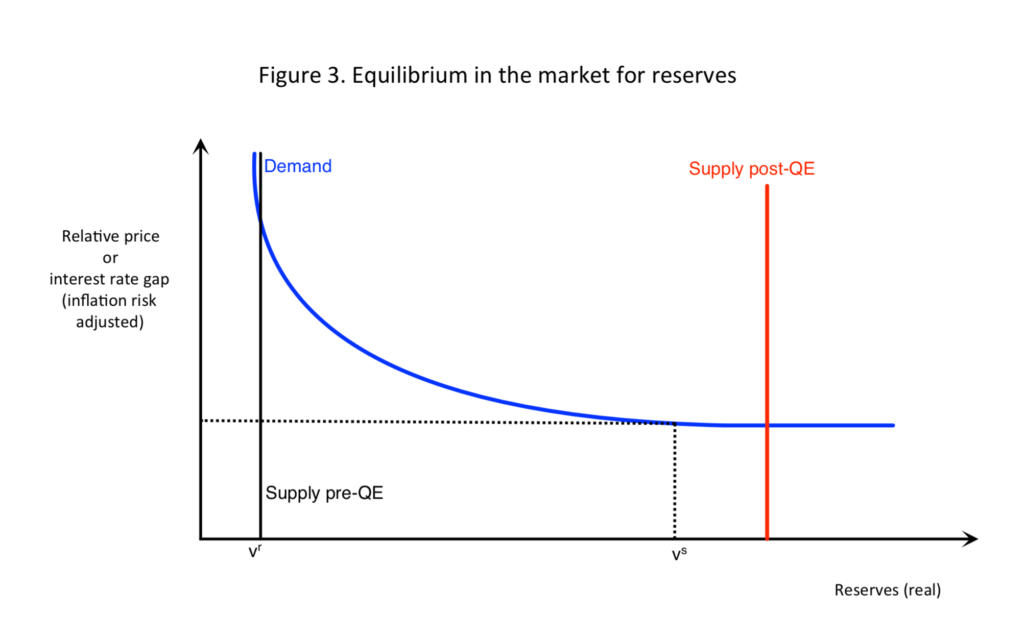

The above figure portrays the market for reserves.

The blue line is the demand curve of reserves, which portrays the inverse relationship between the quantity demanded of reserves and the opportunity cost of holding reserves.

The demand for reserves starts as a vertical line at the level v^r. This is the pre-QE level of reserve supply, where banks mostly hold reserves at the level required by the central banks, i.e. the level of excess is essentially zero.

Please note that the downward slope of the demand curve also reflects the service that reserves may provide in the form of liquidity. The scarcity of liquidity leads to a premium being priced into the reserve, which is essentially the real price of reserves. The smaller the premium is, the larger the demand for reserves.

Nonetheless, there is some point at which banks have all the liquidity they want, and this is v^s in the figure. From this point onwards, the opportunity cost of holding reserves (i.e. the liquidity premium) disappears and banks are indifferent towards holding more reserves.

The demand curve beyond this point becomes close to horizontal and the reserves market is said to be saturated. This is where most advanced economies are in after rounds of QE injections.

That point right in the middle of the downward sloping and horizontal reserve demand curve, or v^s, is the so-called saturated level of reserve in the reserves market.

If the central bank decides to keep the beyond the saturated level, it will can’t control the interest rate in the reserves market by changing the supply of reserves, as the banks are indifferent in holding more or less of them. The price they are willing to pay/receive for an extra unit of reserve is zero.

In this ample reserves system, the central bank has to control the interest rate by altering the cost of holding reserves directly. One example is to impose an interest rate on excess reserves (IOER), which becomes the minimum price a bank has to receive before selling a unit of reserve, and the central bank can control the interest rate through it.

References: “Funding Quantitative Easing to Target Inflation” by Ricardo Reis

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡