The Federal Reserve is expected to cut its benchmark interest rate by 25 basis points this week. This has been the baseline market assumption since Chairman Jerome Powell’s speech at Jackson Hole, in which he proclaimed, “the shifting balance of risks may warrant adjusting our policy stance.”

The question is, how many dissenting votes will Powell face in this meeting?

Waller & Bowman

In the last FOMC (Federal Open Market Committee) meeting, there were two dissenting votes from governors Chris Waller and Michelle Bowman, both of whom had advocated for a rate cut. The FOMC is now expected to grant their wish. Will they continue to dissent?

In a speech late last month, Waller explicitly stated he would only support a quarter-point rate cut at this meeting, making it unlikely he will dissent. Bowman’s situation is more difficult to predict, as her last speech on the economic situation was in early August, where she merely reiterated the expectation of three rate cuts this year. We are inclined to believe she will be in step with Waller and won’t specifically ask for a half-point cut.

Stephen Miran

One notable point for this meeting is that the chairman of the White House Council of Economic Advisers (CEA), Stephen Miran, was confirmed by the Senate as a Fed Governor on Monday, just in time to join the meeting on Tuesday. There’s a good chance he will cast a dissenting vote.

Since his nomination as a Federal Reserve governor, Miran has noticeably avoided speaking about Fed matters in public forums outside of Congress. However, a Wall Street Journal profile of Miran published on Monday included this quote:

“I’m never going to claim to be the smartest person in the room,” he said. “I’m happy to be the most annoying person in the room.”

This makes it clear his purpose in joining the Fed is to “stir things up”—or, in his own words, to counter the problem of the Fed’s “groupthink”. If we use Treasury Secretary Scott Bessent’s views to represent the White House’s thinking, Miran will likely dissent against the 25 basis-point cut, instead arguing for a 50 basis-point reduction.

It’s also worth noting that as Miran was confirmed on Monday and the meeting starts on Tuesday morning, it’s unlikely he would have had any assistance from the Fed Board staff for his Summary of Economic Projections submission in this meeting. Hence, the Dot Plot we will get after this meeting features a dot that is produced without any input from Fed researchers—a truly rare occurrence.

What About The ‘No Cut’ Side?

An interesting question is whether we will also get a dissenting vote from the “no cut” side.

The basic expectation is that no dissenting votes will be cast against a rate cut, as the Fed is still a consensus-driven institution. The remaining governors and Fed bank presidents should still want to avoid dissenting unnecessarily.

But, just for the sake of discussion, I think Chicago Fed President Austan Goolsbee is one committee member who might cast a dissenting vote. This is because Goolsbee has mentioned in a Bloomberg interview that he sees rising services inflation as a clear problem.

“The last inflation report that came in, where you saw services inflation — which is probably not driven by the tariffs — really start shooting up,” he said. “It’s a dangerous data point, I’m hoping that that’s bit of a blip.”

He made the comment after the July CPI data was released, at the time hoping it was just a “blip.” So, was it a blip?

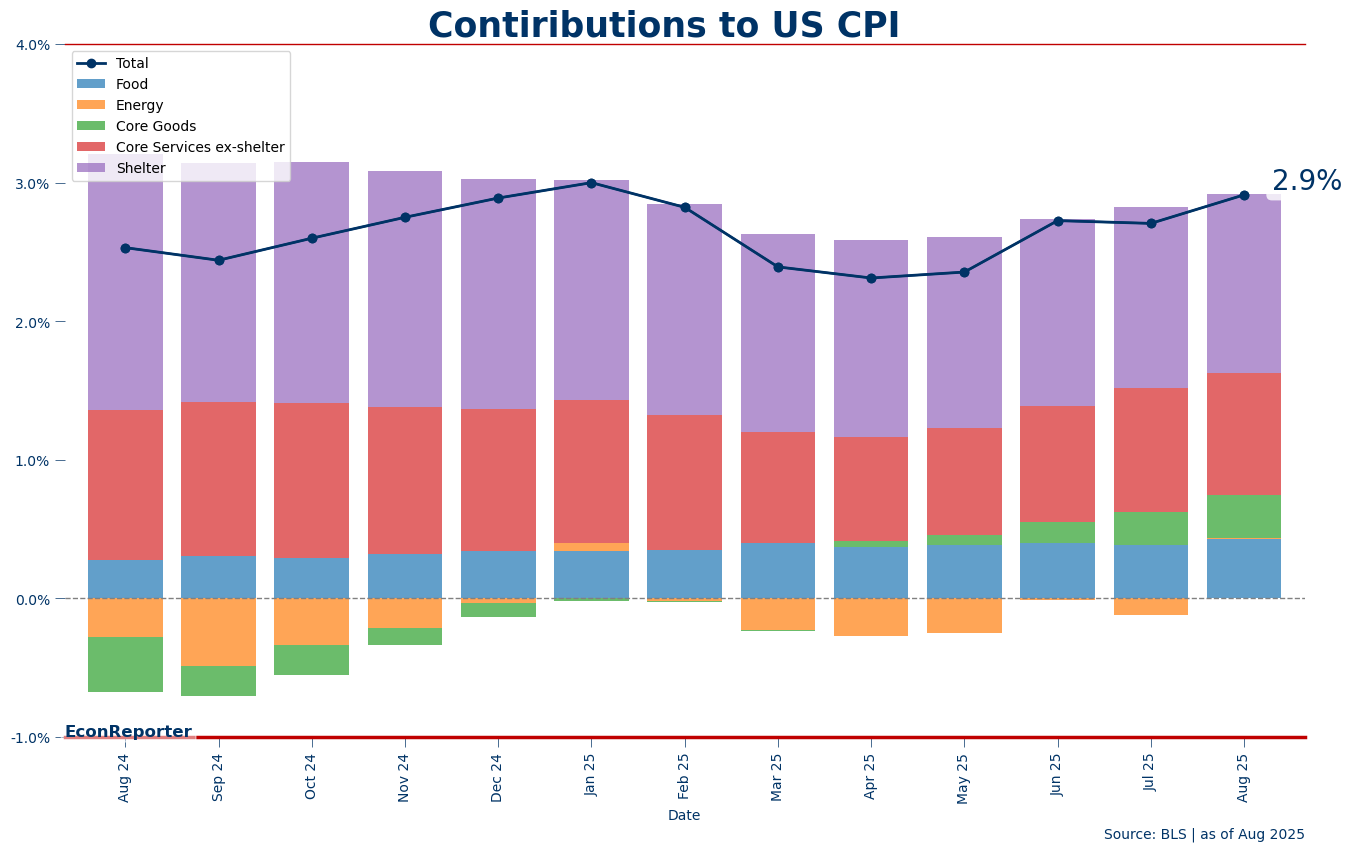

As shown in the chart below, which illustrates the contribution of five major categories to CPI, the contribution of super-core services (services excluding housing and energy, shown in red) did decrease slightly in August, but only from 0.894 percentage points to 0.88 percentage points. This is the first time its contribution decreased since April (it was only 0.752 percentage points that month).

While it’s still lower compared to August of last year (1.083 percentage points), there was a significant difference back then: the contribution of core goods inflation (green) was negative. Now, however, the green bar is positive.

If services inflation continues to rise and the contribution of goods inflation doesn’t turn negative, it’s difficult to see the inflation rate returning to 2%.

While we can assume goods inflation is a result of tariffs and will be a one-off event, we can’t be entirely sure whether the recent rebound in services inflation is a consequence of tariffs or if it’s a result of something more fundamental. Goolsbee, for example, said in the quote above that it “is probably not driven by the tariffs.”

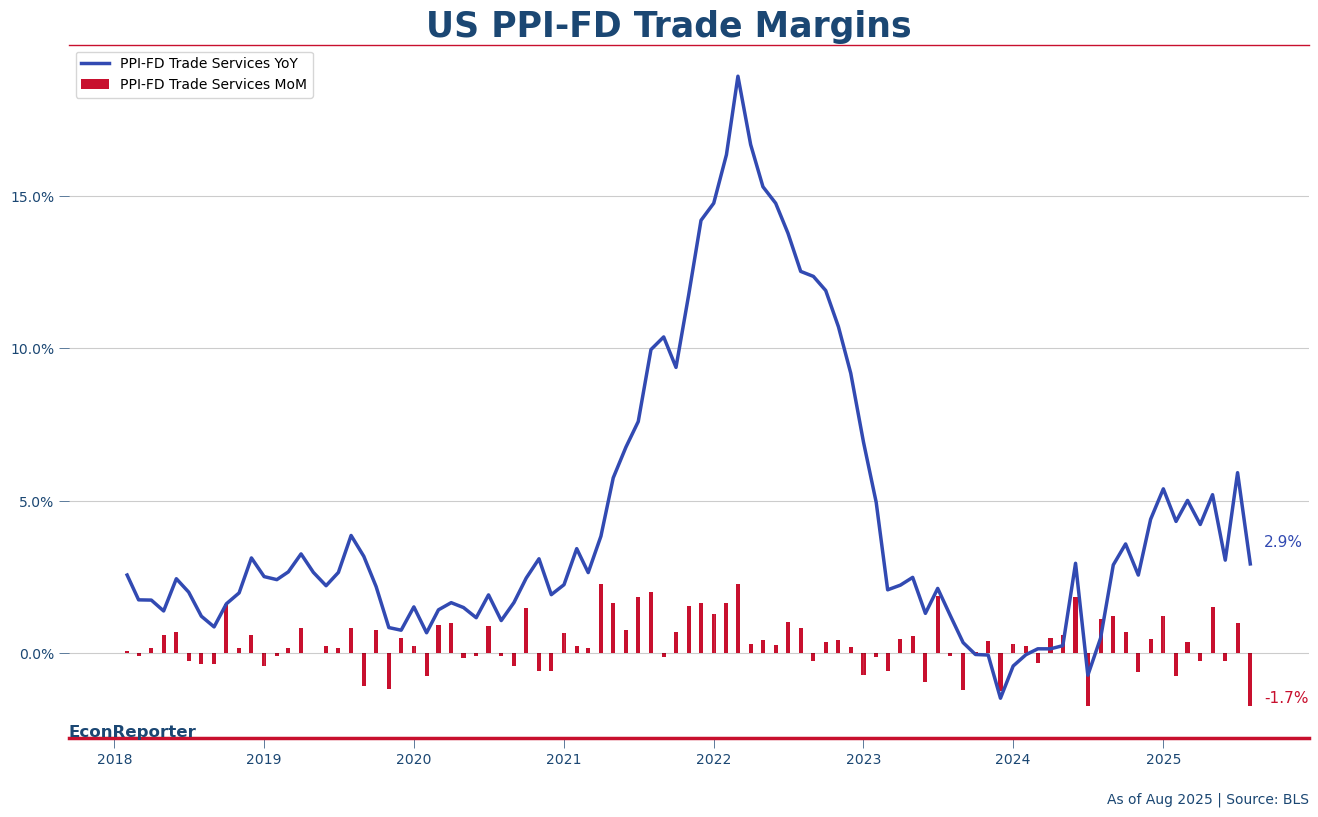

Another concerning figure comes from the August PPI data. In August, the input costs faced by final demand services producers, as illustrated by the Intermediate Demand Stage-4 Service PPI, have clearly rebounded in the last two months. This obviously shows that service producers are facing higher cost pressure, and they might have to pass them on to consumers, potentially making service inflation in CPI even more sticky.

Are these concerns bad enough to make Goolsbee cast a dissenting vote, though? Again, not likely. But the situation is still concerning and would likely make certain FOMC members hesitant about further rate cuts.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡