Last Updated:

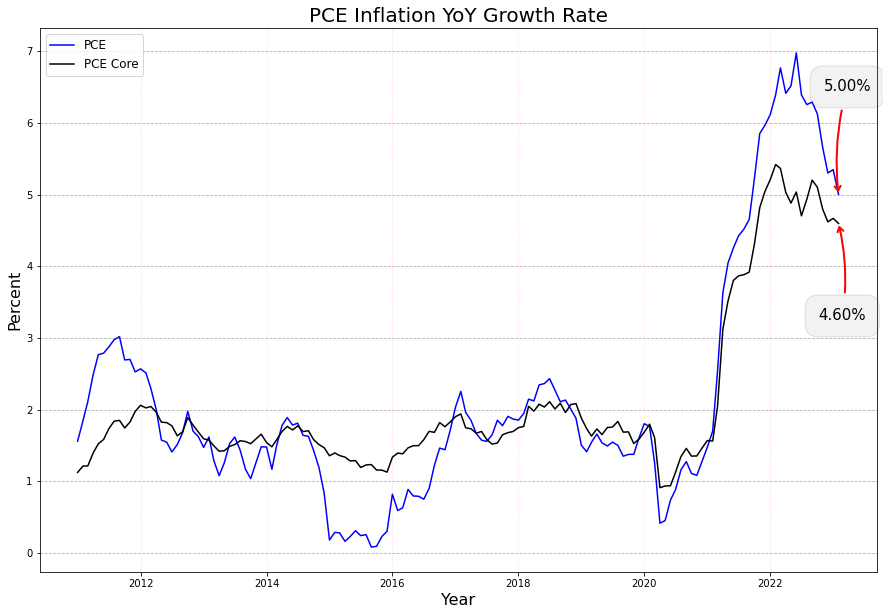

Inflation in the US showed further signs of easing as the yearly growth of core PCE price index slowed to 4.6% in February, while the headline number increased by 5%.

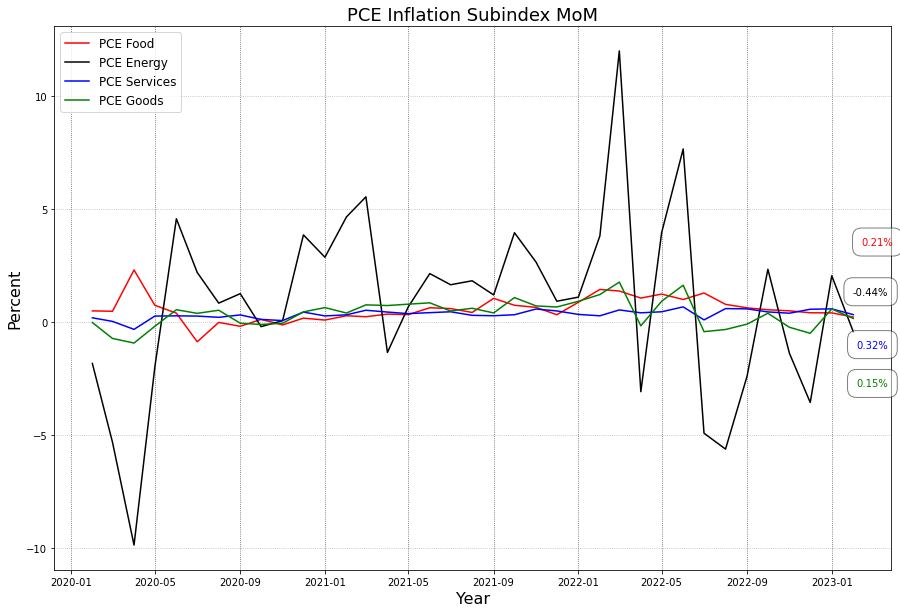

Energy prices showed a 0.44% monthly decrease, while the price levels for goods, services and food all rised at a slower rate than in January.

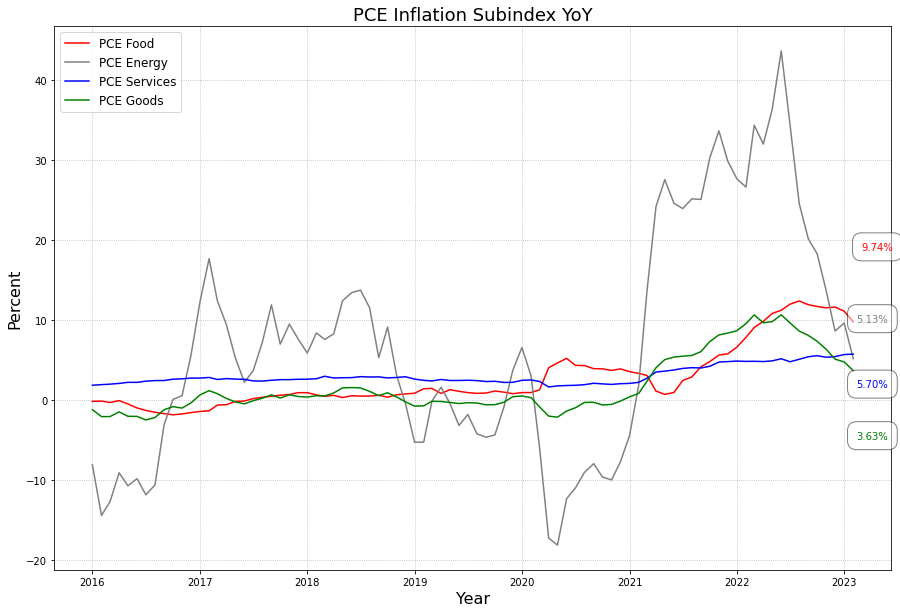

The report also indicates that the year-on-year inflation rate for energy goods and services dropped to 5.1%, lowest since earlier 2021.

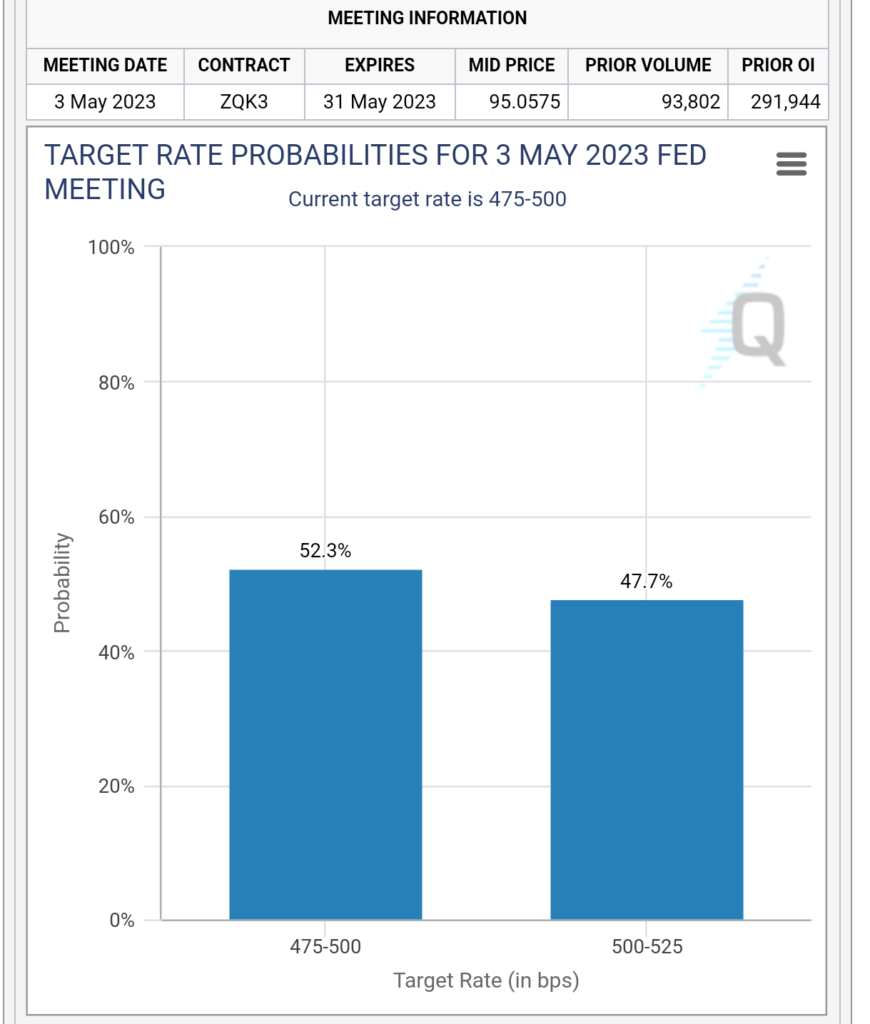

The deceleration of inflation likely takes some pressure to raise rate further off the Fed. The Fed Funds futures pricing indicated that there is a 52.3% chance the central bank will hold its benchmark rate unchanged at its next meeting on May 2-3, according to CME Group’s data.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡