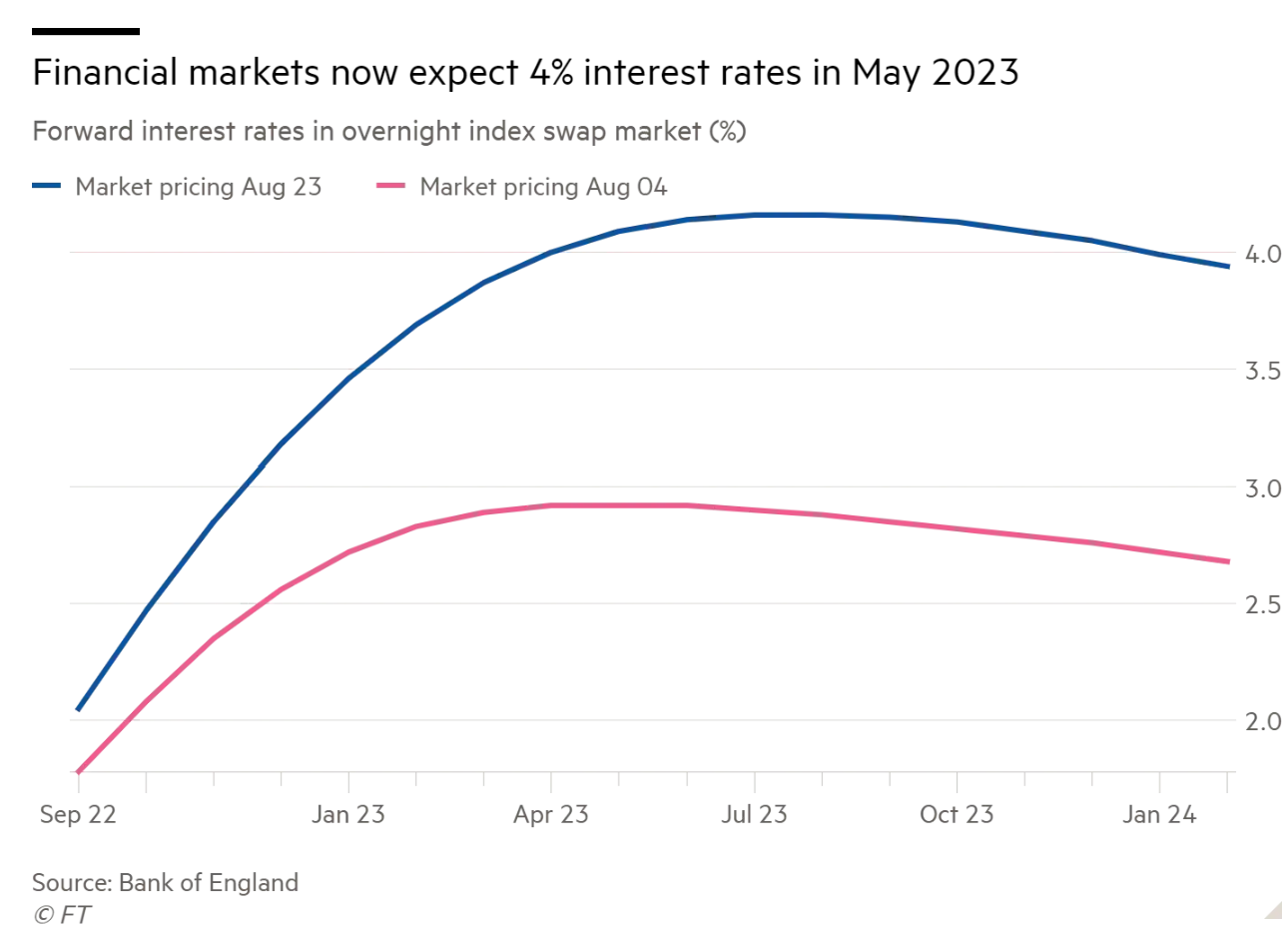

Traders in the overnight index swap market are expecting the UK policy interest rate UK will break 4% by May, more than double the current level of 1.75%. Financial Times reported.

– The market also expects interest rate to reach 2.75% by the central bank’s Nov meeting.

UK Residents are facing a rapidly increase in energy costs. Research firms are forecasting that energy regulator Ofgem will double the annual energy cap, putting even more intense cost of living pressure to households in the country.

– Citi predicted UK inflation rate will rise to 18.6% next year as a result of surging energy bill.

The accelerating rate hike expectation is already impacting the housing and mortgage markets,

Banks are now down-valuing the mortgage they approved, valuing the properties at less than their selling prices, as the banks worry the high inflation will spell the end of the property boom. (Telegraph)