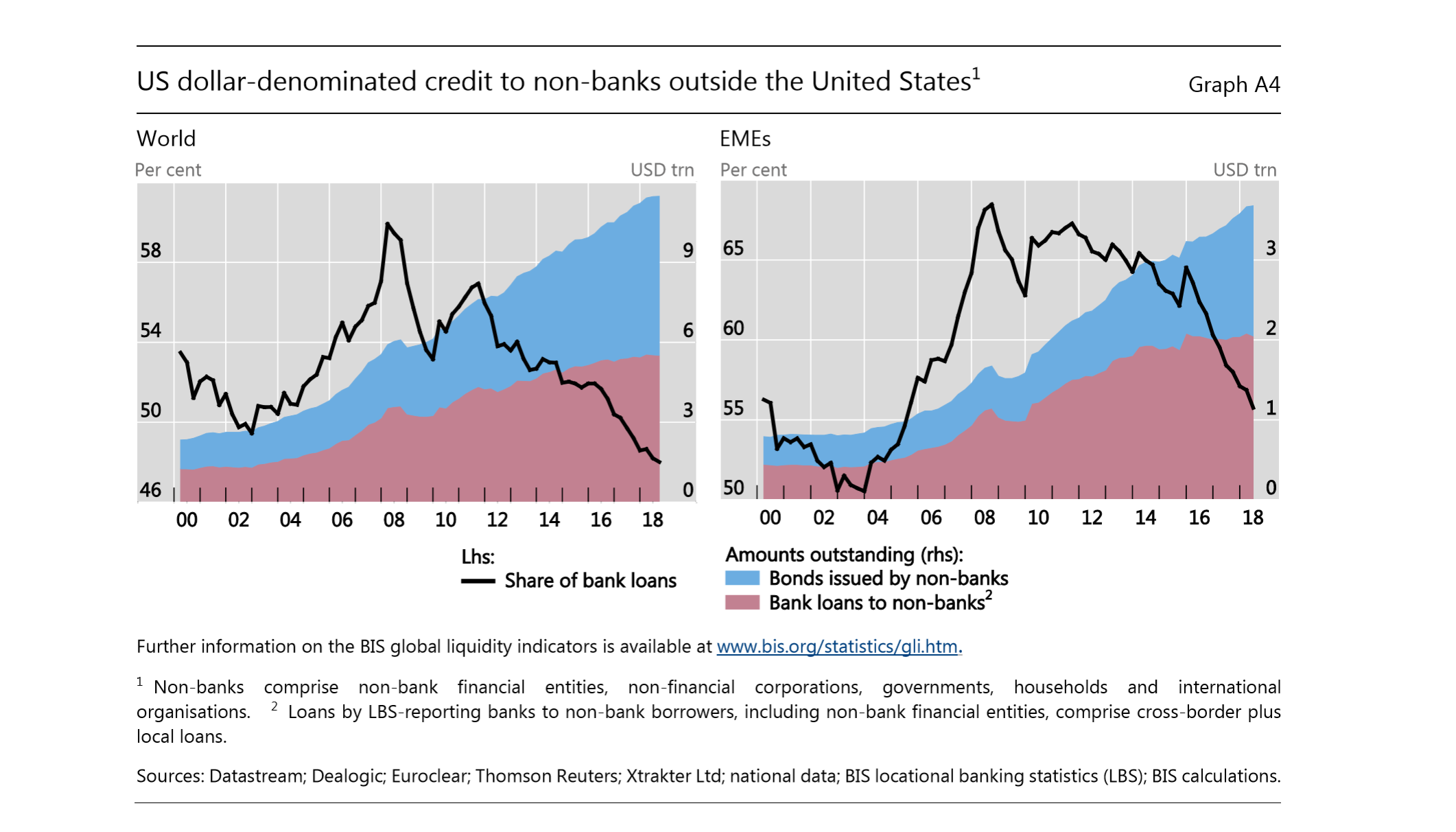

The latest BIS global liquidity indicators showed that the share of Non-bank USD denominated credit continued its rising trend.

As shown in the left panel below, as of September 2018, the share of USD denominated credit from banks to foreign non-banks (the black line) is below 50%, meaning that non-bank USD credits account for more than half of all USD credits to the world (outside the US).

On the right panel, we can see the share of non-bank USD credit to emerging market economies is also rising. Although the share for non-bank credits to EMEs has not yet risen above the 50% mark, the rising trend (as illustrated by the falling black line) continued. The USD credits to EMEs generated by banks hold a 56% share right now.

In a recent working paper “The Non‐Bank Credit Cycle“ by researchers Esti Kemp, René van Stralen, Alexandros Vardoulakis, and Peter Wierts, they showed that non‐bank credit growth, or equivalently the non‐bank credit cycle, can act as a leading indicator for currency crises and, perhaps also for a sovereign debt crisis. You can read more about this paper here.