In a new working paper “The Non‐Bank Credit Cycle“, researchers Esti Kemp, René van Stralen, Alexandros Vardoulakis, and Peter Wierts tried to look into the cyclical properties of non‐bank credit and its relevance for financial stability.

In modern financial systems, the size of non‐bank credit is often as large, or maybe even larger, than bank credit. But compare to bank credit, the sources of nonbank credit are wide-ranging, it can take the form of bond financing, or loans by a diverse group of lenders that include investment funds, non‐bank mortgage providers, foreign lenders or the government.

It is important to note that non‐bank credit is broader than shadow banking, as the latter term (only) includes non‐bank entities with short-term funding and potential financial stability risks related to leverage, liquidity and maturity mismatches and interconnectedness.

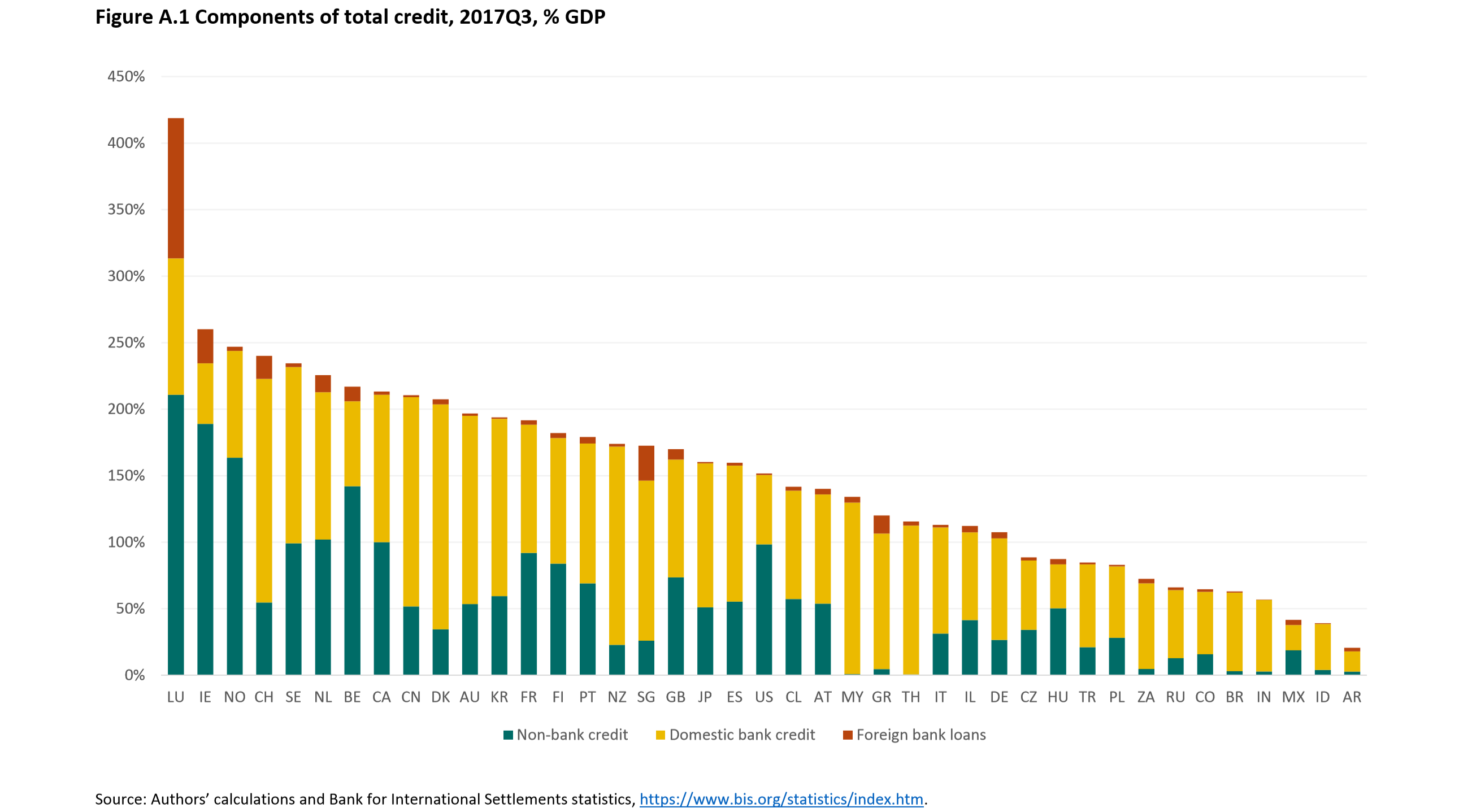

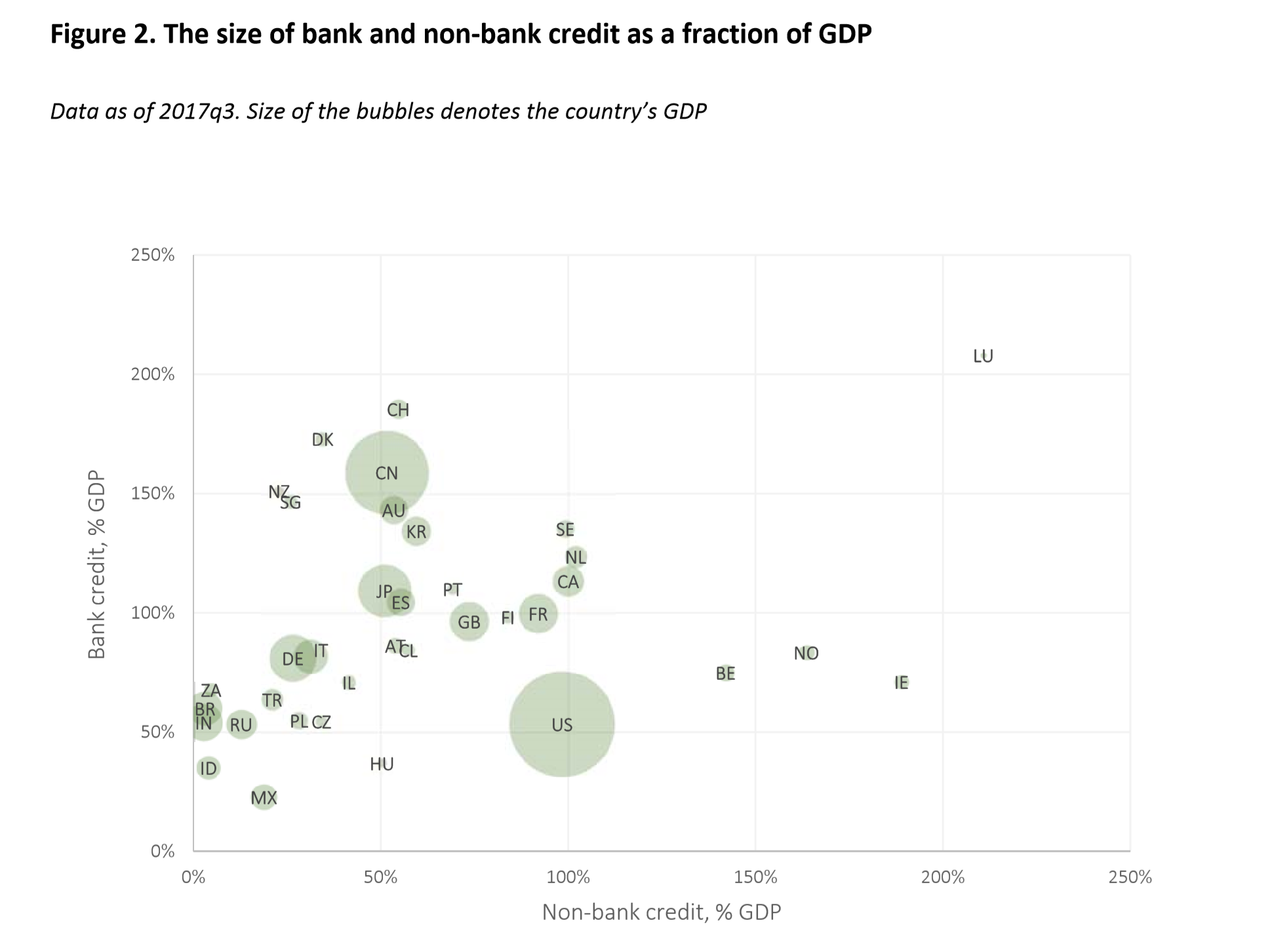

The four authors defined non‐bank credit to private non‐financial sector (PNF) ≈ (All sector credit to PNF – (Domestic) Bank credit to PNF –Non‐resident bank loans to PNF). Here is the relative size of nonbank credit as a percentage of GDP, compared to the size of bank credit as a percentage of GDP:

Many observations are above but relatively close to the 45‐degree line, indicating that bank and non‐bank credit generally are quite similar in size within countries. But some countries lean more towards bank credit (e.g. Denmark, China) and others more towards non‐bank credit (e.g. the US, Ireland). Moreover, Advanced Economies show relatively larger sizes of non‐bank credit than Emerging Market Economies (EMEs).

An important finding of the research is that the cyclical properties of non‐bank credit are heterogeneous across countries and different from those of bank credit.

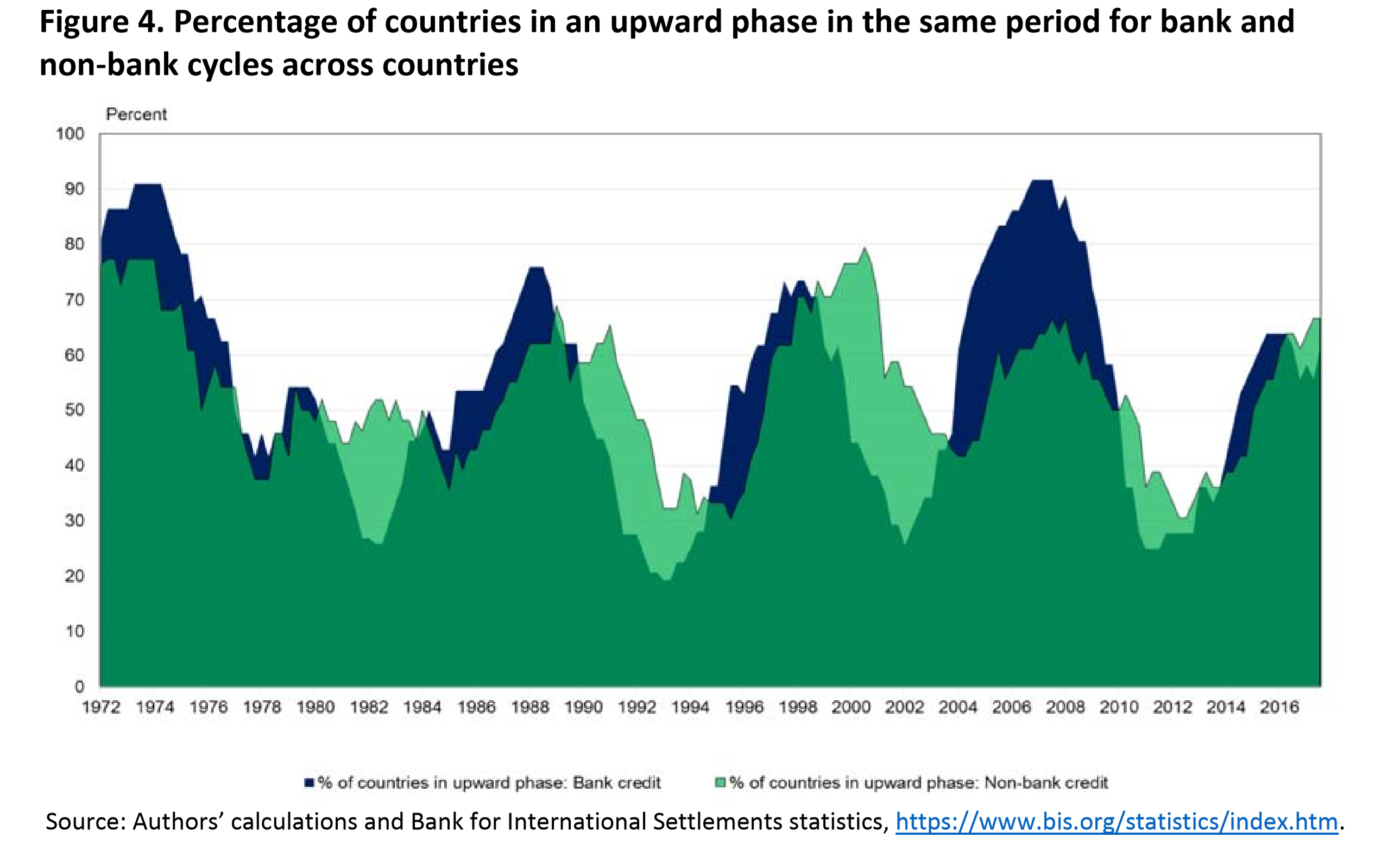

Above graph shows the percentage of countries in an upward cycle in bank credit (blue) and nonbank credit (green).

There several characteristics of the nonbank credit cycle. First, upward phases in several countries at the same time are more common for bank credit than for non‐bank credit.

Also, the peaks of the majority of countries in an upward phase of the bank credit cycle, i.e., 1973, 1987, 1997, 2007, coinciding with global crisis periods – the OPEC oil price shock in 1973, stock market crash 1987, the Asian financial crisis 1997 and the global financial crisis 2007.

Specifically, the correlations in non‐bank credit in EMEs were the highest during the run‐up to the Asian crisis, and in the EU during 1999‐2001 when the run‐up to monetary union encouraged economic convergence. It is also the period for which the highest number of countries, twenty-seven out of thirty-four countries, or 79%, in the research sample experienced an upward cycle in non‐bank credit.

Third, the number of countries experiencing an upward phase in the non‐bank credit cycles generally does not exceed the number of countries experiencing an upward phase in the bank credit cycle, except in 2000.

With some detailed examinations of the data, the four researchers also showed that non‐bank credit growth, or equivalently the non‐bank credit cycle, can act as a leading indicator for currency crises and, perhaps also for a sovereign debt crisis.

On the other hand, bank credit growth is a useful leading indicator for systemic banking crises, while non‐bank credit growth fails to predict such incidences.

One explanation is that non‐bank credit provision – and in particular bond financing – is at times more closely related to movements in international capital flows compared to bank credit supported by deposits in domestic currency.

Non‐financial corporations tend to borrow in foreign currency‐‐included in our non‐bank credit measure‐ when interest rates abroad are relatively lower. A reversal in capital inflows worsens the ability of firms to rollover their debt, while, at the same time, domestic authorities may need to maintain higher interest rates to support the peg. The latter can be harmful to the domestic economy especially if corporations are highly indebted and cannot substitute external for more expensive internal credit.

Overall, the ability to maintain the peg may be curtailed when nonbank credit from abroad is elevated, as it amplified the consequences of adverse shocks that can lead to currency crises.