The rise zombie firms is a macroeconomic problem that the Bank of International Settlement (BIS) researchers has been actively tracking in the last decade. It is an essential component of their Financial Cycle narrative, which states that financial factors like the easiness of credits and financial market sentiment are the significant factors that drive the real economic cycle.

In this narrative, the prevalence of zombies in the corporate sector is the result of easy credit, and global central banks’ low-interest rate policy is one of the major contributors.

In the latest BIS Quarterly Review, researchers Ryan Banerjee and Boris Hofmann consolidated some of the earlier research to illustrate the problem of zombie firms. They argued that the rise of zombies predated the 2008 financial crisis, and has since been dragging down the productivity of the real economy.

The rise of zombie firms: causes and consequences

Part 5 of “International banking and financial market developments” (BIS Quarterly Review), September 2018, by Ryan Banerjee and Boris Hofmann. The rising number of so-called zombie firms, defined as firms that are unable to cover debt servicing costs from current profits over an extended period, has attracted increasing attention in both academic and policy circles.

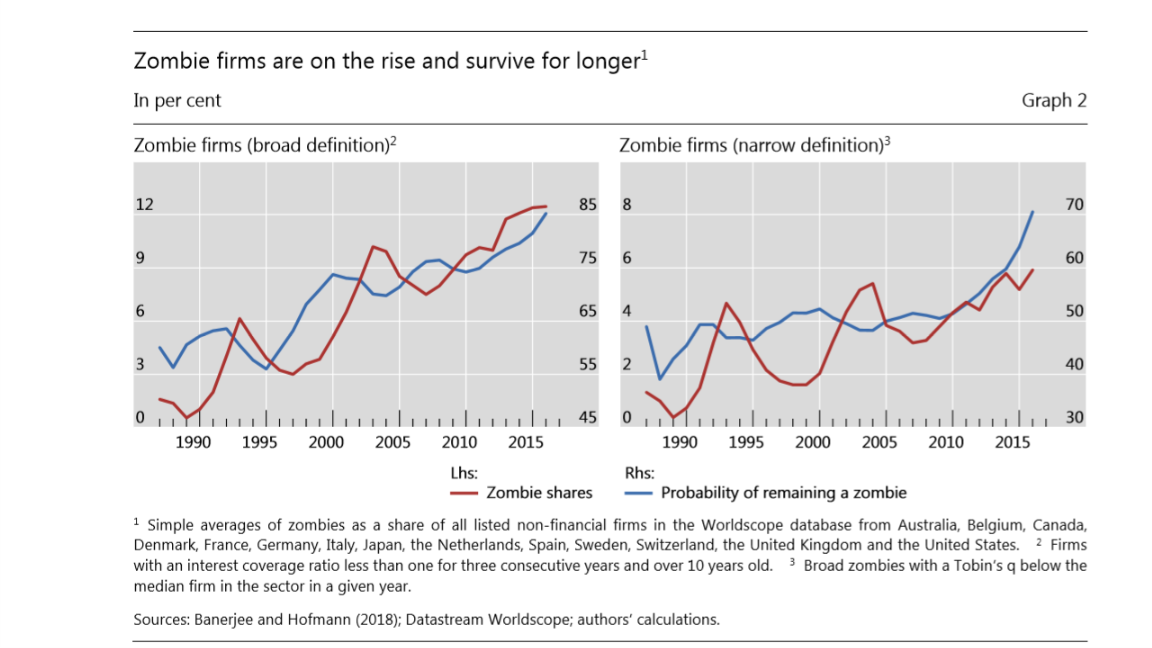

Here is the share of zombie firms among all the non-financial firms in the sampled advanced economies.

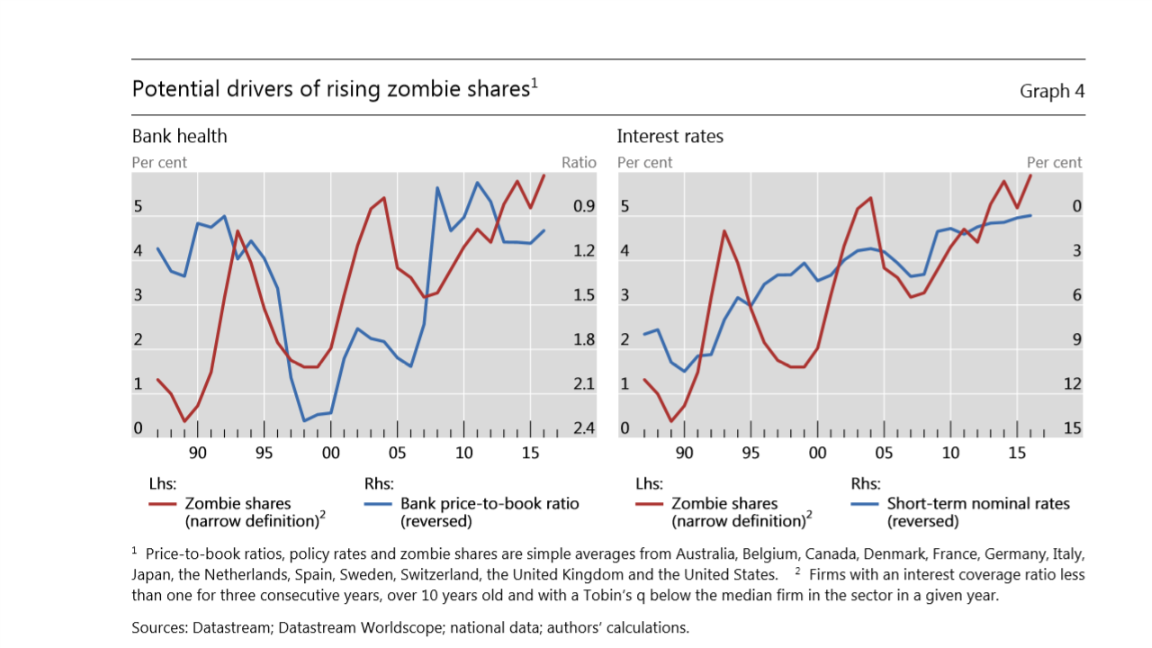

What is the cause for the rise of zombies? There are two common explanations. One is a weak banking system, and another is the low-interest rate environment. A weak bank will have the incentive to keep refinancing the loan to zombie firms, as a way to avoid writing off the bad debt. Low-interest rate, on the other hand, reduces the pressure for the bank to clean up the balance sheet, as the funding cost for bad loans is low, and higher recovery rates can be expected.

As shown in the graph below, there are apparent correlations between the share of zombie firms and bank health (as measured with the price to book ratio of the banks, reversed in the figure), or interest rate (also reversed in the figure).

But as Banerjee and Hofmann further explained in the report, the relationship between interest rate and the zombie share is stronger comparatively. The two authors estimated that ten percentage point decline in nominal interest rates since the mid-1980s might account for around 17% of the rise in the zombie share in advanced economies, assuming an average industry external finance dependency ratio.

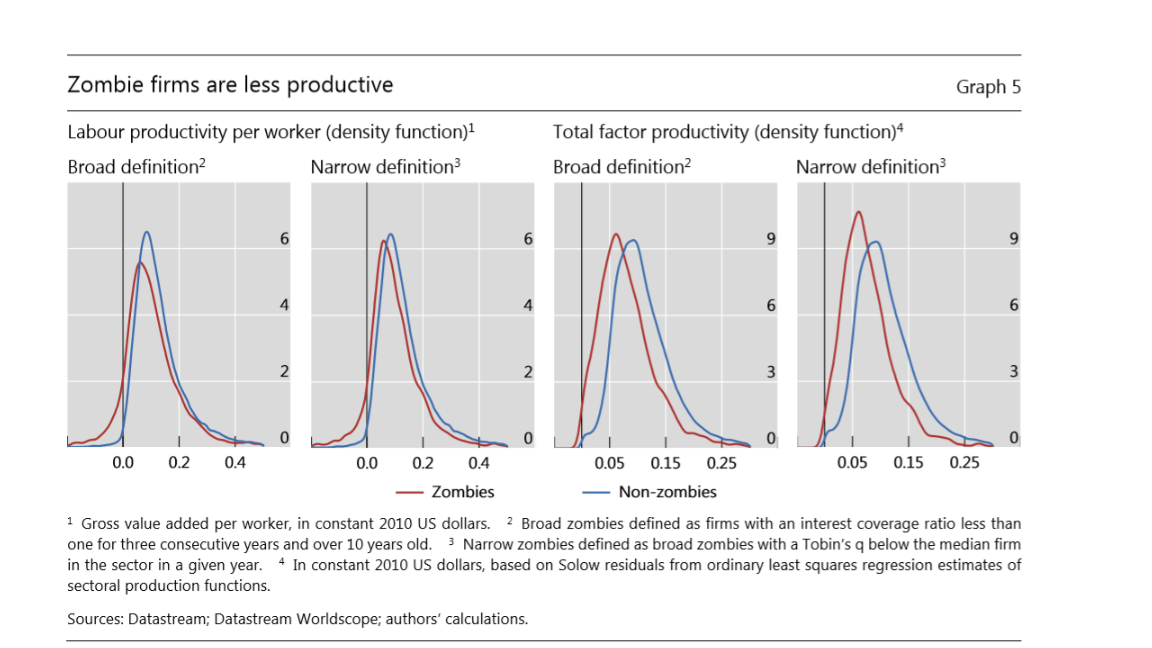

What is the problem of the rise of zombies? It is because the zombies drag down the overall productivity of the economy.

As shown in the figure above, the zombies, in general, have a lower labor productivity per worker, and also lower total factor productivity as compared to regular firms. With a higher share of zombies in the economy, the overall productivity of the real economy is hampered. This could be one of the reasons why the growth in advanced economies in the last decade remain lower than the long-term trend.

Photo Credit: Peter Kudlacz